BTC Price- Why Bitcoin’s Future Looks Bright: Market Insights

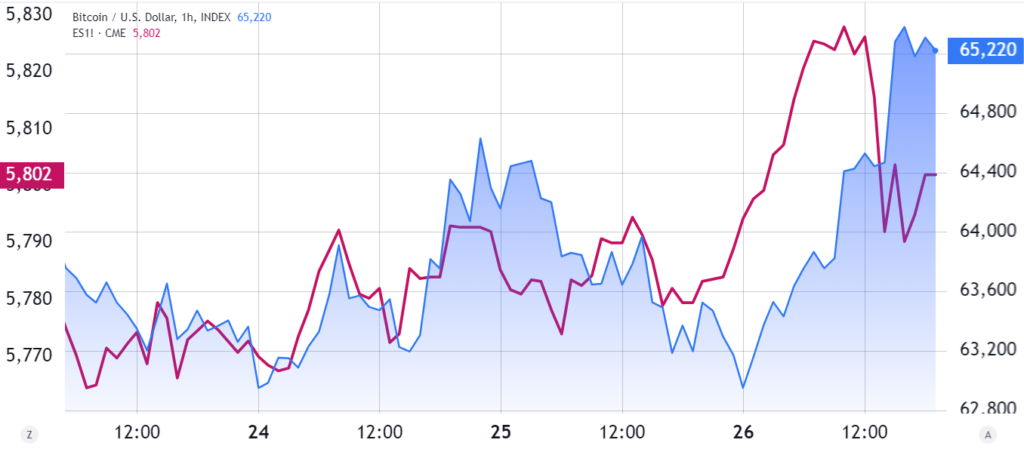

BTC Price– In the early hours of September 26, Bitcoin’s price dipped to $62,705, leading bulls to temporarily lose hope after facing rejection at the $64,000 resistance level for the third time in just four days. However, as the US stock market opened, a positive shift occurred, propelling the S&P 500 index to a new all-time high. This momentum carried over to Bitcoin, which rebounded by over 3%, reclaiming the $65,000 level.

Macroeconomic Trends Bolstering Bitcoin’s Growth

Market analysts believe that Bitcoin’s journey towards $70,000 has been strengthened by favorable macroeconomic conditions. Notably, lowered interest rates in the US and renewed interest from long-term institutional investors have contributed to this bullish outlook. As economic growth indicators become more robust, fears surrounding a stock market bubble have started to dissipate. Additionally, US housing prices have reached an all-time high, further reassuring investors.

According to Michael Matousek, head trader at US Global Investors Inc., AI is still there, but I think people got a little too excited, a little too over-hyped in terms of what we can expect in the near term. This sentiment reflects the excitement in the technology sector, which has been a significant driver of global stock market gains. Several tech companies, including Alibaba, Tesla, Nvidia, Taiwan Semiconductor, and Apple, have achieved gains of over 30% in the last six months.

Bitcoin’s Correlation with Monetary Policy Changes

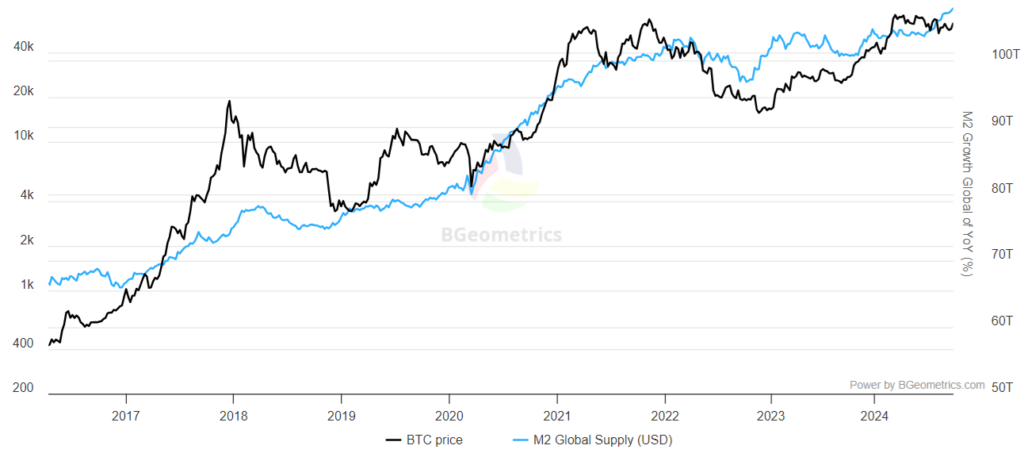

Lyn Alden, an investment researcher and founder of Lyn Alden Investment Strategy, emphasized the correlation between Bitcoin and changes in the global monetary base (M2). Historical data indicates that Bitcoin’s price increased in 83% of instances over a 12-month period when liquidity was added to bank deposits and circulating money. In contrast, gold only followed M2’s direction in 68% of the previous 10 years.

This favorable data for Bitcoin is particularly relevant as governments begin to deploy stimulus measures after an 18-month hiatus. According to the same study, the S&P 500 index also demonstrates an 81% correlation with changes in the monetary base. Thus, rather than being viewed as an uncorrelated asset, Bitcoin may further solidify its position as a hedge against relentless money-printing policies by governments.

Strong Investor Sentiment and Recent Developments

The favorable momentum in the US stock market on September 26 was significantly influenced by Micron, a key player in the artificial intelligence supply chain. The company raised its quarterly revenue guidance from $8.5 billion to $8.9 billion and predicted that demand for chips used in AI data centers would increase fivefold by 2025. This projection reassured investors, particularly those heavily invested in the tech sector.

Adding to the positive sentiment, the third estimate of US gross domestic product growth for the second quarter came in at 3%, supporting expectations of a 2.9% annualized growth rate for the third quarter. Furthermore, China’s newly announced economic stimulus measures led to the largest weekly surge in the CSI 300 stock index in over a decade.

One of the most significant recent developments affecting Bitcoin’s momentum was a $242 million inflow into spot Bitcoin exchange-traded funds (ETFs) over just two days. Initially, there were doubts about institutional demand gaining traction, particularly after BlackRock’s iShares Bitcoin Trust ETF reported only $5 million in inflows since its launch on August 27.

Conclusion: Bitcoin’s Path Towards $70,000

Bitcoin’s rise past the $65,000 mark is fueled by a combination of favorable macroeconomic trends, increasing institutional demand, and renewed strength in the tech sector. The substantial inflows into Bitcoin ETFs indicate a shift in investor sentiment and a reduction in perceived risk. As these dynamics unfold, the stage may be set for a potential Bitcoin rally toward $70,000.

Investors will be watching closely as these factors continue to evolve, and the interplay between Bitcoin and macroeconomic trends may shape the future trajectory of this leading cryptocurrency. With growing institutional interest and a robust tech sector, Bitcoin seems poised for further gains in the coming weeks.

1 Comment