Aave’s Best Revenue Year Overshadowed by Explosive DAO Conflict

Despite having record revenue at the end of the year, Aave’s governance issues took center stage. A disagreement between Aave Labs and the DAO erupted into one of the most divisive votes in the protocol’s history during a calm holiday trading week. Despite having good fundamentals, the conflict shook market confidence and sent AAVE plunging.

Aave DAO Reports $140M Revenue as Governance Rift Deepens

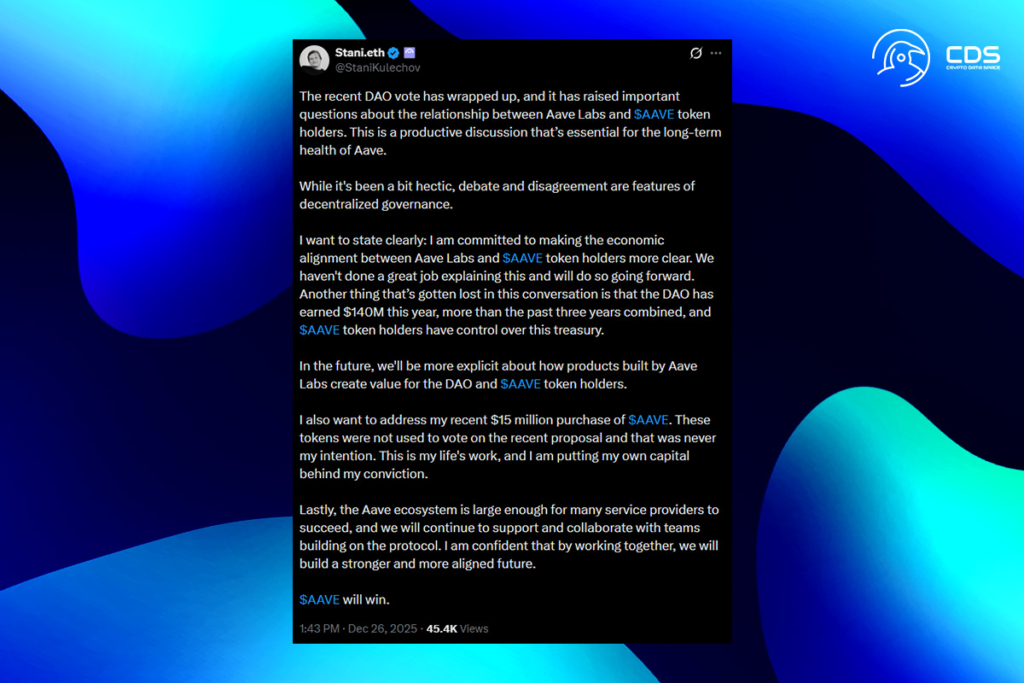

Stani Kulechov, the founder of Aave, disclosed that the DAO‘s income this year was approximately $140 million. That amount is more than the three years’ total revenue. This indicates robust protocol adoption and increasing fee production from a basic standpoint. But after a failed brand control governance initiative, attitudes changed.

I am committed to clarifying the economic interests between Aave Labs and $AAVE token holders. Conceding that our explanations in this regard have not been sufficient, we will strive to improve in the future The DAO has generated $140 million in revenue this year, surpassing the total revenue of the past three years, and $AAVE token holders have control over these funds.

Kulechov

A request to move important brand assets, such as trademarks and domains, from Aave Labs to a DAO-controlled organization was denied by the DAO. While a sizable portion of voters abstained, over half of them rejected the action. The result revealed a sharp disagreement about off-chain control and decentralization.

After Kulechov revealed a $10–15 million AAVE purchase, tensions increased even more. The timing was presented by critics as a power struggle in governance. Kulechov stressed long-term alignment with the ecosystem and denied exploiting the tokens to sway the vote.

AAVE Struggles Near Key Support as Governance Risk Dominates

The uncertainty caused markets to respond swiftly. In just one week, AAVE fell almost 20%, from the high $180s to the mid-$140s. Significant sell programs brought noticeable overhead supply to the chart, liquidity decreased, and volatility increased. Derivatives data indicate that traders are becoming more cautious. As confidence declined, funding rates went negative. Technically speaking, the $140–$142 range is a crucial location to keep an eye on, as previous support levels are now acting as resistance.

The message is obvious to investors. Although governance risk is now factored in, Aave‘s cash flows are still robust. AAVE is expected to trade as a high-beta governance asset until DAO-Labs alignment becomes clear. It will be unable to behave as a pure DeFi growth strategy due to future revenue routing uncertainty.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.