Chainlink Faces Breakdown Risk: Double Top Pattern Alarms Investors

The price of Chainlink has been sharply declining since the end of August. A bearish double top pattern is almost about to be confirmed by the token. The price of LINK has decreased by 16% from its peak for the month and by over 55% from its peak for the year. Whales have begun dumping large quantities of LINK in the interim. This can lead to more negative outcomes in the future.

Chainlink Price Weakens Amid Falling TVL and Market Risk Aversion

Due to investor fears about US tariffs on important economies, the price of Chainlink has been dropping since August. A generalized sense of risk aversion in cryptocurrency markets has also been exacerbated by the Federal Reserve‘s interest rate stance.

The total value locked in Chainlink-based DeFi apps has decreased to about $545 million at the time of publication, according to additional data from DefiLlama. Compared to late August, when nearly $1.13 billion was recorded, this is less.

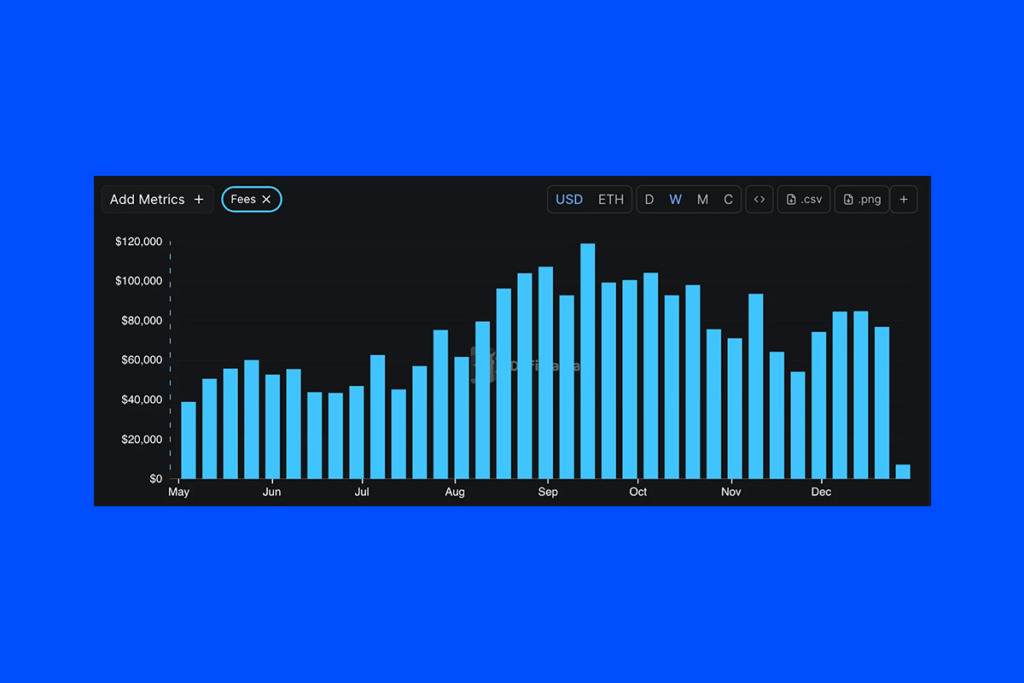

Meanwhile, since September, weekly fees have continuously decreased. A decrease in general usage and demand for Chainlink’s services within the DeFi sector is indicated by declining TVL and a corresponding decline in weekly fees. As a result, investor demand for the asset has been restrained.

Chainlink Weekly Chart Signals More Downside Risk Ahead

The Chainlink price weekly chart also appears to point to further difficulties for the token in the future. It displays the development of a multi-year double top pattern, which has traditionally led to a significant decline in cryptocurrency values. The neckline has developed at $11.08, and the tops seem to have formed at about $28.06.

Additionally, momentum indications have been pointing lower as of this writing. Notably, both the signal line and the MACD line are going lower after crossing below each other. This suggests that the market is still firmly under the thumb of bears. After falling from very overbought levels to about 37.7, LINK‘s RSI has not yet reached the oversold area. This suggests that before any significant reversal can happen, there might be more space for decline.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.