Crypto News – Ripple’s Chief Legal Officer Challenges SEC’s Use of “Crypto Asset Security” Term

Crypto News – Ripple Labs’ Chief Legal Officer, Stuart Alderoty, has strongly criticized the United States Securities and Exchange Commission (SEC) for its repeated use of the term “crypto asset security,” labeling it as a fabricated phrase with no legal foundation. In a post on X (formerly Twitter) dated September 2, Alderoty argued that the SEC is attempting to mislead judges by employing this term, which is not found in any existing statutes.

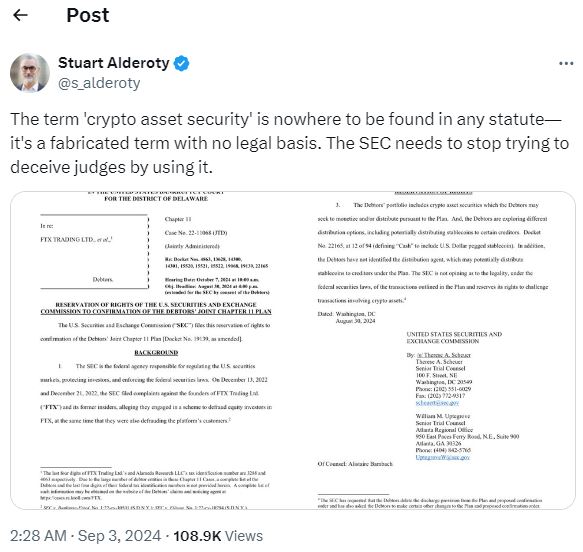

The SEC has recently referred to “crypto asset securities” in its ongoing legal actions, including a warning issued on August 30 against any plans by the defunct crypto exchange FTX to use stablecoins for repaying creditors. The regulator highlighted that its portfolio contains “crypto asset securities,” a term Alderoty contends lacks legal grounding.

Ripple’s Legal Challenge Against the SEC

Alderoty’s comments come in the wake of broader criticism of the SEC’s approach to regulating the crypto industry. In a recent development, the Federal Court for the Northern District of California echoed concerns over the term “crypto asset security” in its legal battle with crypto exchange Kraken, describing the concept as “unclear at best and confusing at worst.”

This sentiment reflects the ongoing tension between the SEC and various stakeholders in the crypto space, who argue that the agency’s use of such terms may be an overreach, potentially leading to misinterpretations of the law.

Historical Precedents: Art Galleries and Unregistered Securities

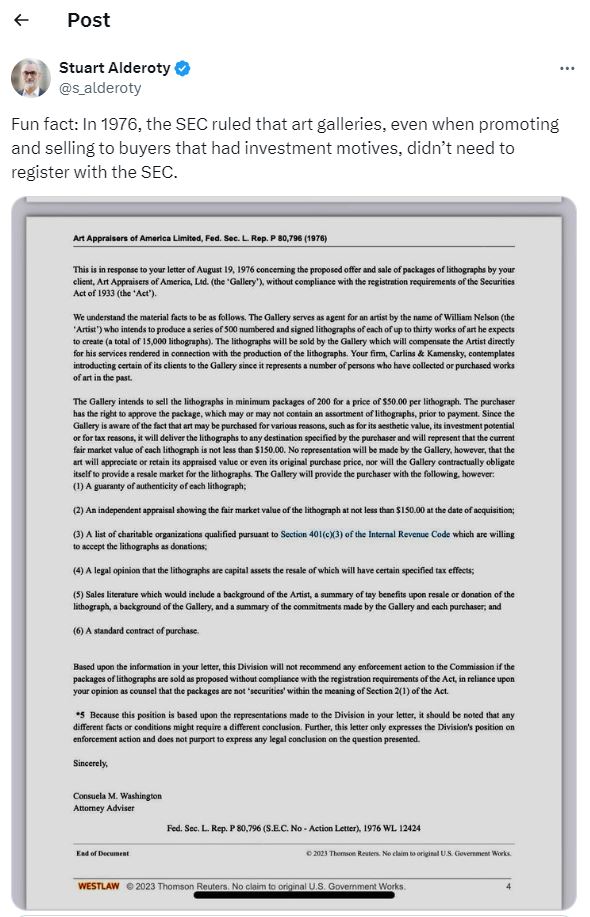

Alderoty also referenced a historical precedent to bolster his argument against the SEC’s current stance. In an August 29 post on X, he criticized the SEC’s recent Wells notice to NFT marketplace OpenSea, which suggests that the tokens sold on the platform could be considered unregistered securities. Alderoty pointed to a case from over 40 years ago where the SEC decided that an art gallery did not need to register with the agency, even if buyers were motivated by investment purposes.

In 1976, the Art Appraisers of America sought clarification from the SEC on behalf of artist William Nelson regarding the sale of lithographs and print drawings. The gallery was concerned that collectors might purchase these artworks as investments, potentially reselling them at a higher value later. However, the SEC ruled that the gallery was not required to register, as long as there were no false declarations made about the sale.

Alderoty highlighted this case to demonstrate the inconsistency in the SEC’s approach, noting that the agency’s stance could change based on “different facts or conditions,” but the historical ruling still sets a significant precedent.

FAQ: Ripple’s Challenge to the SEC’s Use of “Crypto Asset Security”

What is the main argument made by Ripple’s Chief Legal Officer against the SEC?

Ripple’s Chief Legal Officer, Stuart Alderoty, argues that the term “crypto asset security,” frequently used by the SEC, is a fabricated term with no legal basis. He believes the SEC is trying to mislead judges by using this term, which is not found in any statute.

Why does Ripple believe the term “crypto asset security” is problematic?

Ripple believes the term “crypto asset security” is problematic because it lacks a legal definition and is not supported by any existing laws or regulations. They argue that the SEC invented this term to extend its regulatory reach over cryptocurrencies without proper legal grounding.

How has the SEC used the term “crypto asset security” in its actions?

The SEC has used the term “crypto asset security” in various legal actions, including warning against the use of stablecoins by defunct crypto exchange FTX to repay creditors. The SEC claims that these stablecoins and other assets in its portfolio might be considered “crypto asset securities.”

Leave a comment