Featured News Headlines

Ondo Finance Faces Short-Term Pressure Despite Rising TVL

Ondo Finance, a blockchain protocol focused on institutional-grade financial products, has come under short-term pressure following the broader market pullback. Over the past 24 hours, its native token ONDO declined by approximately 10%, reflecting the wider downturn across digital assets.

Despite the price retracement, several underlying metrics point to sustained network activity and continued capital engagement.

What Drove the ONDO Decline?

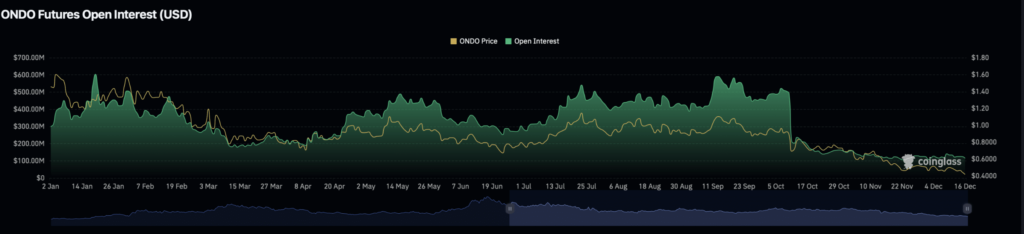

The recent price drop appears to be largely linked to liquidity outflows from the derivatives market. Over the last day, capital withdrawals reduced ONDO’s circulating derivatives balance to around $110 million. Total outflows reached roughly $11 million, with close to $1 million attributed to liquidations.

This movement was accompanied by a sharp increase in trading activity. According to CoinGlass data, ONDO’s 24-hour trading volume surged 46% to $204 million. A combination of rising volume and falling price typically signals strong selling momentum, suggesting that short-term bearish sentiment dominated the market during this period.

Nevertheless, investor participation remains elevated. ONDO’s market capitalization stands at $1.27 billion, while the number of token holders has reached a new all-time high of 174,360, indicating ongoing interest despite recent volatility.

On-Chain Liquidity Continues to Expand

While derivatives liquidity declined, on-chain indicators tell a different story. Ondo Finance’s Total Value Locked (TVL) climbed to a record $1.926 billion as of December 15. Rising TVL is commonly associated with increased long-term capital allocation, as users commit assets to earn yield through protocol mechanisms.

In practical terms, participants are depositing ONDO into liquidity pools, allowing them to generate yield while maintaining exposure to potential future price movements. Supporting this trend, DeFiLlama data shows the protocol generated $2.24 million in fees during December, reflecting higher platform usage and sustained demand for its services.

Binance Activity Signals Growing Engagement

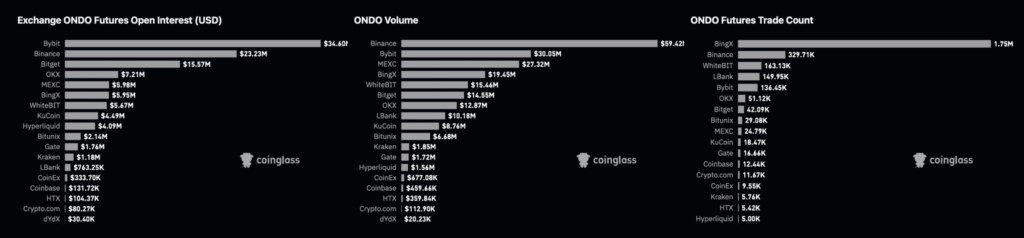

Derivatives traders on Binance are also showing renewed interest. CoinGlass data highlights rising derivatives volume and capital inflows on the exchange. Binance currently accounts for the second-largest share of ONDO’s Open Interest, totaling $22.23 million.

With net volume gradually turning positive, this shift in positioning suggests improving sentiment among active traders, even as broader market uncertainty persists.

Comments are closed.