Ethereum news – Impact of $1.86 Billion Bitcoin and Ethereum Options Expiration: Insights from Market Experts

Ethereum news – As the expiration of $1.86 billion in Bitcoin (BTC) and Ethereum (ETH) options looms, the cryptocurrency markets are experiencing intensified volatility. This heightened market activity is largely attributed to recent US Consumer Price Index (CPI) data, which came in lower than expected. Traders are bracing for potential price fluctuations as the expiry date approaches.

Understanding the Impact of Upcoming Options Expiration on Crypto Markets

Bitcoin Options Expiry: Key Figures and Market Sentiment

According to Deribit, approximately $1.4 billion worth of Bitcoin options are set to expire soon. This includes 24,383 contracts, a decrease from last week’s 31,615 contracts. The maximum pain point for these Bitcoin options is set at $59,500. The put-to-call ratio stands at 0.83, indicating a slightly bearish market sentiment. The maximum pain point represents the price level where option holders would experience the most significant financial loss.

- Current Bitcoin Market Overview: Bitcoin’s recent price has fallen to $57,255, down from nearly $60,000 before the CPI data release. This decline reflects the market’s response to the lower-than-expected CPI figures and the approaching expiration of options contracts.

Ethereum Options Expiry: Analysis and Market Outlook

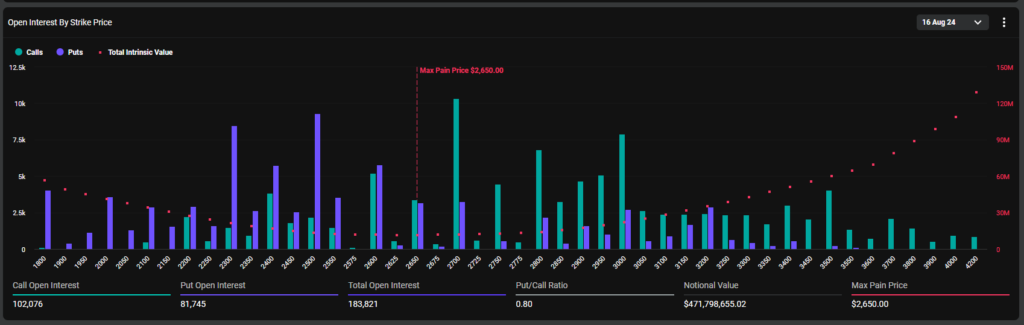

For Ethereum, $471.79 million in options are nearing expiration, involving 183,821 contracts, a drop from last week’s 206,626 contracts. The maximum pain point for Ethereum is set at $2,650, with a put-to-call ratio of 0.80. This suggests a cautious market outlook, with a higher prevalence of purchase options over sales options.

- Ethereum Price Movements: Ethereum has seen a decline from $2,751 to $2,534, currently trading at $2,562. This drop follows the expiration of options and the market’s reaction to the CPI data. The weakness observed in Ethereum’s price also reflects the broader uncertainty in the crypto markets.

What is the Maximum Pain Point and Put-to-Call Ratio?

The maximum pain point is a critical metric in options trading. It denotes the price level at which option holders experience the maximum financial discomfort, often acting as a pivotal point for price movements. The put-to-call ratio measures the relative volume of put options (sales) to call options (purchases). A lower ratio suggests market optimism, while a higher ratio indicates bearish sentiment.

Analysts’ Insights on Market Conditions and Future Predictions

Analysts from Greeks.live have weighed in on the current market conditions. They pointed out that the US July CPI data, which came in lower than anticipated, has set a new low since March 2021. This development has sparked speculation about a potential Federal Reserve rate cut in September, with expectations centered around a 25-basis-point reduction.

- Market Reactions Post-CPI Data: The lower CPI figures have contributed to a decrease in short-term implied volatility (IV), with a skew favoring put options. The market’s response has included a noticeable decline in Bitcoin and Ethereum prices, reflecting traders’ adjustments to the new economic indicators.

Historical Context: Options Expiration and Market Volatility

Historically, the expiration of options contracts often triggers sharp yet temporary price movements. These fluctuations create a period of uncertainty and volatility in the crypto markets as traders anticipate and react to potential changes. However, the market typically stabilizes shortly after these expirations, returning to a more predictable trend.

Looking Ahead: Strategies for Traders and Investors

As the expiration of Bitcoin and Ethereum options approaches, traders and investors should be prepared for potential volatility. Understanding the maximum pain point and put-to-call ratios can provide insights into market sentiment and potential price movements. Monitoring economic indicators like the CPI and their impact on market expectations can also help in making informed trading decisions.

Such declines in implied volatility are relatively rare in the options market, and the predominantly institutional sellers were able to cover a lot of their profits in this round of declines to make up for the hedging losses from the huge volatility over the last month. Now that the term structure is back to a solid structure of far higher and near lower, the market will probably be deposited for a while now, and the profit-to-loss ratio for selling medium-duration options looks better now.

Conclusion: Navigating Crypto Market Volatility

The upcoming expiration of a substantial amount of Bitcoin and Ethereum options is likely to lead to increased market volatility. By staying informed about key metrics and market conditions, traders and investors can better navigate this period of heightened uncertainty. The combination of economic data and options expiration will play a crucial role in shaping the near-term direction of the crypto markets.

Leave a comment