Featured News Headlines

High Liquidation Risk in 3 Altcoins: Are Traders Prepared?

Three altcoins, ZEC, ASTR, and TAO, are about to approach a crucial stage with increased liquidation risks as the second week of December progresses. Traders who are concerned about future deeper drops are becoming tense due to market volatility, dwindling open interest, and deteriorating support levels. Unless there is significant buy-side demand, these assets may be subject to further selling pressure as overall cryptocurrency sentiment becomes more cautious. In order to predict whether there will be a significant breakdown or a stabilization phase, investors are currently keeping a close eye on important technical zones.

ZEC’s Steep Decline Sets the Stage for a Massive Liquidation Event

ZEC has fallen 50% from the record high of $748 established last month. Investors who feel they lost out on previous opportunities are often drawn to such a steep loss. Derivatives traders are encouraged by this trend to anticipate a December recovery. Therefore, the long side’s accumulated liquidation volume has increased. Overconfidence in long positions without stop-loss measures could put traders at serious risk. If ZEC declines toward $295 this week, long traders may have to pay up to $98 million in liquidations.

Aster Faces Short-Side Squeeze as Buyback Program Intensifies

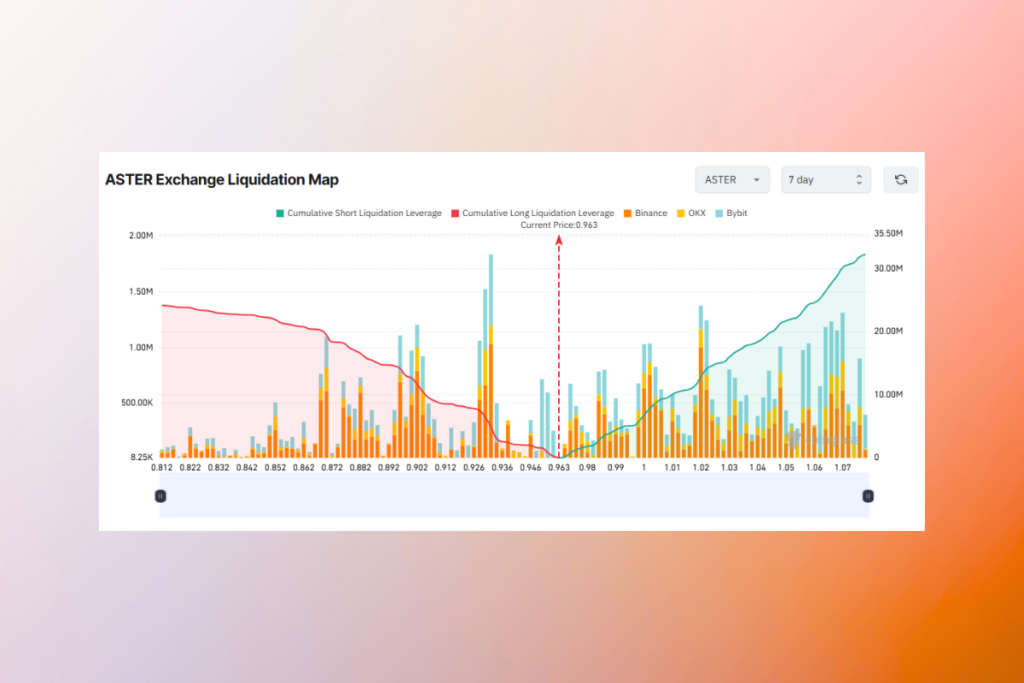

During the September perpetual DEX boom, Aster, a prominent derivatives DEX on BNB Chain, profited from skyrocketing trade activity. But since then, its price has decreased by around 60%. These days, the price varies below $1. According to liquidation maps, short positions have a larger total active liquidation volume than long holdings. Nevertheless, this week could be extremely risky for short sellers.

Aster just revealed that it will begin an accelerated buyback program on December 8, 2025. The daily buyback rate has increased from $3 million to almost $4 million. A price rise this week might be justified by this development. The entire short-side liquidation volume might surpass $32 million if ASTER increases to $1.07.

TAO Halving Nears: Long Traders at High Liquidation Risk

Bittensor’s (TAO) liquidation map reveals a serious imbalance. The amount of liquidations on the long side is significantly more than that on the short side. Long traders might lose about $17 million if TAO falls to $243.50. On the other hand, a spike to $340 might sell off about $5 million in short bets. Before TAO’s initial halving, a lot of traders anticipated price increases. When the overall supply reaches 10.5 million, Bittensor’s first halving will occur around December 14, reducing daily issuance from 7,200 TAO to 3,600.

This reduction in supply will lower emissions to network participants and increase TAO’s scarcity. Bitcoin’s history shows that reduced supply can enhance network value despite smaller rewards, as its network security and market value have strengthened through four successive halvings. Similarly, Bittensor’s first halving marks a key milestone in the network’s maturation as it progresses toward its 21 million token supply cap.

Grayscale

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.