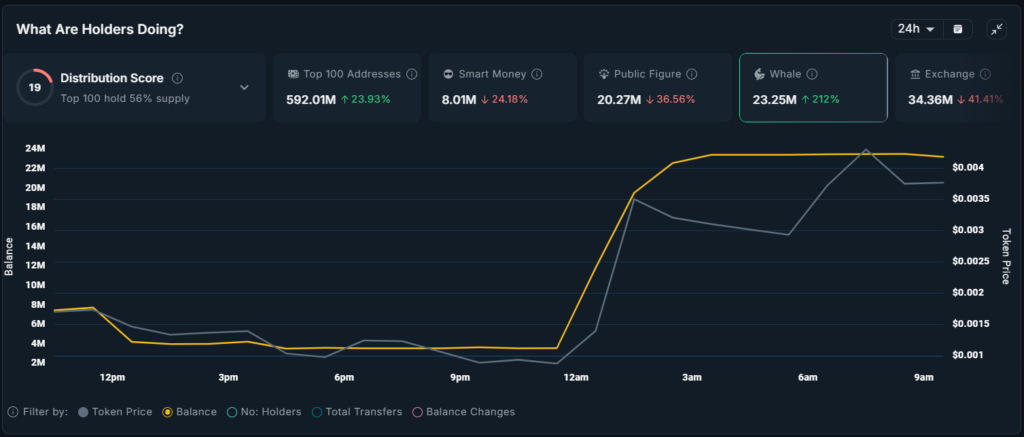

Franklin The Turtle (FRANKLIN)

Franklin The Turtle (TURTLE) has attracted significant whale interest, with major holders acquiring 15.77 million tokens in the last 24 hours. The accumulated supply, valued at over $1.14 million, indicates renewed confidence among large investors despite a broader market downturn. At the time of writing, TURTLE trades at $0.0723, reflecting activity amid a month-long downtrend. Analysts note that rising accumulation could signal an early shift in market sentiment.

Technical indicators are also noteworthy. Bollinger Bands are tightening, which often precedes a spike in volatility. Coupled with ongoing whale purchases, this activity may help TURTLE approach $0.0760, potentially ending its downtrend and paving the way toward $0.0942.

Zora (ZORA)

ZORA has experienced renewed accumulation from whales, with holdings rising from 876,000 to 1.33 million tokens in 24 hours. This surge demonstrates heightened investor confidence as market conditions stabilize. ZORA has increased 18% in the past 48 hours, currently trading at $0.0528 and holding above the $0.0506 support level.

Technical patterns support cautious optimism. The MACD shows an ongoing bullish crossover, suggesting that ZORA could test the $0.0568 resistance and possibly move higher if demand persists. However, analysts caution that a drop below $0.0506 could reverse this momentum, with a potential decline toward $0.0447.

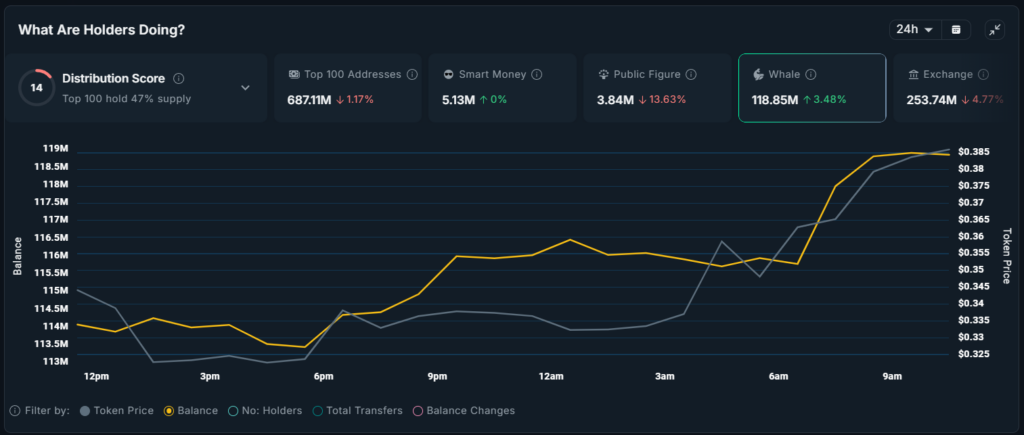

Fartcoin (FARTCOIN)

FARTCOIN whales expanded their holdings by 3.42% in the past day, from 114 million to 118 million tokens. The additional 4 million tokens, valued at over $1.56 million, highlight active participation from large investors during a volatile market period.

Currently trading at $0.392 and below the $0.417 resistance, FARTCOIN has seen a 12% gain today. Technical indicators such as the Parabolic SAR suggest that the upward trend may continue toward $0.470 if current momentum remains. Conversely, weakness or profit-taking could push the price below the $0.358 support level, with a potential drop to $0.320 invalidating the current bullish outlook.

Comments are closed.