Featured News Headlines

Market Declines Deepen in November

The cryptocurrency market has entered a sharper downturn than many expected for the fourth quarter. After posting a nearly 9% pullback in October, market losses have accelerated this month. Total crypto market capitalization has fallen from roughly $3.6 trillion on November 1 to about $3.19 trillion, a level last seen in early July.

Bitcoin (BTC) has repeatedly slipped below key psychological thresholds throughout November. In the latest trading session, the asset briefly dipped under $97,000, marking its lowest level since May 8, before recovering to $97,426 at the time of writing. Ethereum (ETH) has followed a similar trend, losing 17.2% so far this month and trading near $3,200.

Stablecoin Reserves Rise Despite Broad Sell-Off

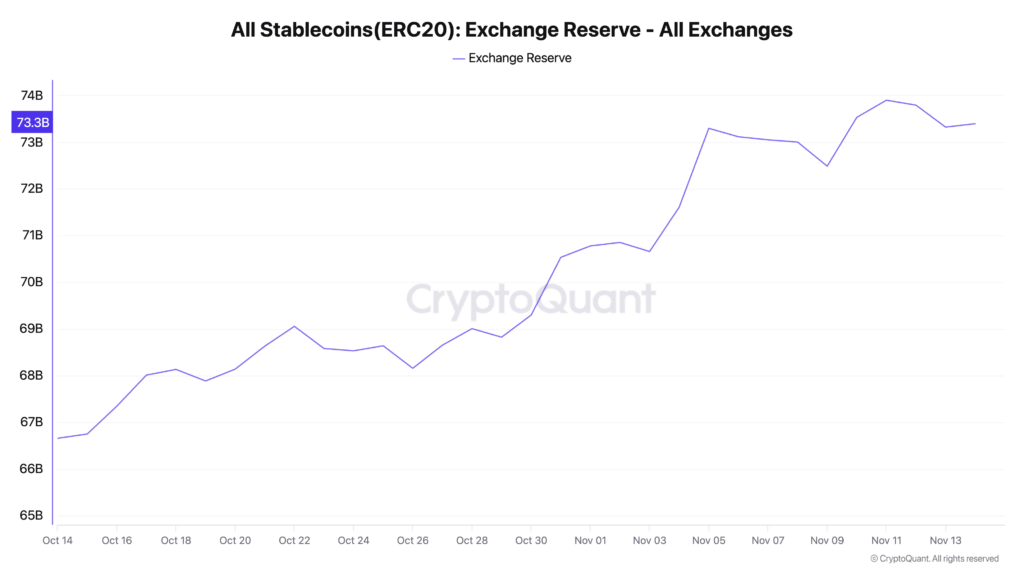

While major assets trend lower, one indicator is moving steadily higher: stablecoin reserves on exchanges. Data from CryptoQuant shows that inflows reached approximately $2.63 billion in November, signaling a notable increase in liquidity parked on trading platforms.

This uptick often suggests that traders are rotating into stablecoins during volatility. However, the significance of the trend becomes clearer when viewed alongside a steep reduction in stablecoin withdrawals.

CryptoQuant analyst Maartunn noted that when Bitcoin was approaching $125,000, withdrawals exceeded 72,000. That pattern has slowed considerably. According to Maartunn, this may indicate that participants are deliberately keeping stablecoins on exchanges, positioning themselves for future opportunities rather than moving funds off-platform.

Analysts Point to a Build-Up of “Dry Powder”

The growing stablecoin supply on exchanges is seen by several analysts as an important market signal. Large amounts of capital waiting on the sidelines—often referred to as “dry powder”—can create conditions for swift buying if sentiment improves.

“Stablecoins are piling into exchanges. This is one of the clearest signals that fresh capital is gearing up to deploy. The last time inflows spiked like this, it marked the start of a major risk-on move across the entire market,” analyst Milk Road commented.

However, sentiment remains cautious. Research firm Swissblock reported that despite rising liquidity, traders are not yet showing strong momentum toward re-entering Bitcoin. The asset continues to test the $97,000–$98,500 support band.

Swissblock added that sidelined capital typically rotates back into Bitcoin only under one of two conditions: a deeper downturn toward $95,000, creating a more favorable entry zone, or a recovery above $100,000, which would signal renewed strength and greater market stability.

Investors Are Pausing, Not Exiting

Although the near-term outlook remains uncertain, the steady accumulation of stablecoins on exchanges suggests that participants are not exiting the crypto ecosystem. Instead, many appear to be waiting for clearer signals—either from price stabilization or from a decisive technical move by Bitcoin.

If market conditions improve or BTC reclaims a key level, the existing reserves of idle liquidity could play a significant role in shaping the next phase of market activity.

Comments are closed.