Bitcoin Halving: Renewed Expectations and Debates Spark in the Market

On Friday, Bitcoin, the leading cryptocurrency worldwide, underwent its “halving,” an event that occurs roughly every four years, as reported by CoinGecko, a prominent cryptocurrency data and analysis firm.

Following the halving, Bitcoin exhibited relative stability, experiencing a modest 0.47% decline to $63,747.

Enthusiasts of Bitcoin had eagerly anticipated this “halving” – a modification to the cryptocurrency’s foundational technology aimed at reducing the pace of new Bitcoin creation.

The concept of halving was integrated into Bitcoin’s code from its inception by the pseudonymous creator, Satoshi Nakamoto, as a means of slowing down the issuance of new bitcoins.

Chris Gannatti, the Global Head of Research at WisdomTree, an asset management company that markets Bitcoin exchange-traded funds, labeled the halving as “one of the most significant events in the crypto sphere this year.”

For certain crypto enthusiasts, the halving serves to underscore Bitcoin’s value as an increasingly scarce asset. Nakamoto established a finite supply of 21 million Bitcoin tokens. However, skeptics view it merely as a technical adjustment hyped by speculators to inflate the virtual currency’s value.

The halving mechanism reduces the rewards granted to cryptocurrency miners for generating new tokens, thereby raising the cost associated with introducing new bitcoins into circulation.

This event comes on the heels of Bitcoin reaching an all-time high of $73,803.25 in March, following a gradual recovery throughout 2023 from the dramatic plunge experienced in 2022. As of Thursday, the most prominent cryptocurrency was trading at $63,800.

The excitement surrounding the approval of spot Bitcoin exchange-traded funds by the U.S. Securities and Exchange Commission in January, along with expectations of central banks cutting interest rates, has supported Bitcoin and other cryptocurrencies.

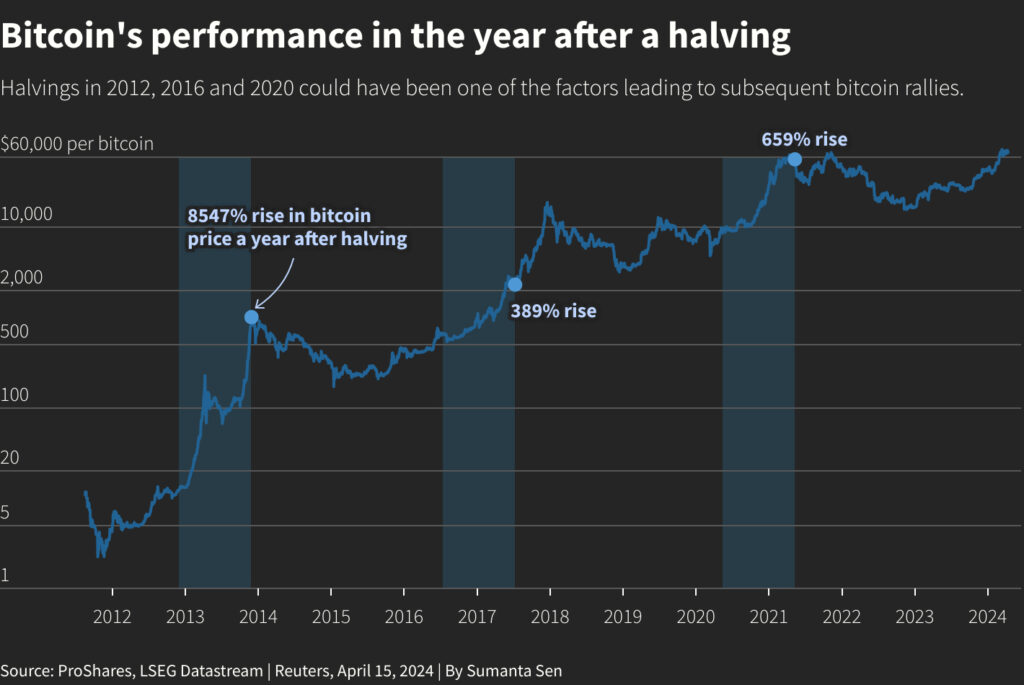

Prior halving events occurred in 2012, 2016, and 2020. Some crypto enthusiasts point to the subsequent price surges as an indicator that Bitcoin’s price will rise following this halving, yet numerous analysts remain skeptical.

JP Morgan analysts, for instance, do not anticipate a post-halving increase in Bitcoin’s price, asserting that it has already been factored in. They foresee a price decline post-halving due to Bitcoin being “overbought” and the subdued venture capital funding within the crypto industry this year.

Financial regulators have consistently cautioned that Bitcoin is a high-risk asset with limited real-world utility, although more regulators are beginning to greenlight Bitcoin-linked trading products.

Andrew O’Neill, a crypto analyst at S&P Global, expressed skepticism regarding the applicability of previous halving events for price predictions. “It’s only one factor among many that can influence price,” he remarked.

Since reaching its record high in March, Bitcoin has grappled with directionality, experiencing a decline over the last two weeks amidst geopolitical tensions and apprehensions that central banks will maintain higher interest rates for an extended period, unsettling global markets.

Leave a comment