Crypto News – According to CoinShares’ most recent report, cryptocurrency funds at asset managers, including BlackRock, Bitwise, Fidelity, Grayscale, ProShares, and 21Shares, saw an additional $646 million in global inflows last week.

Crypto Investment Products Break Records: Year-to-Date Inflows Top $13.8 Billion

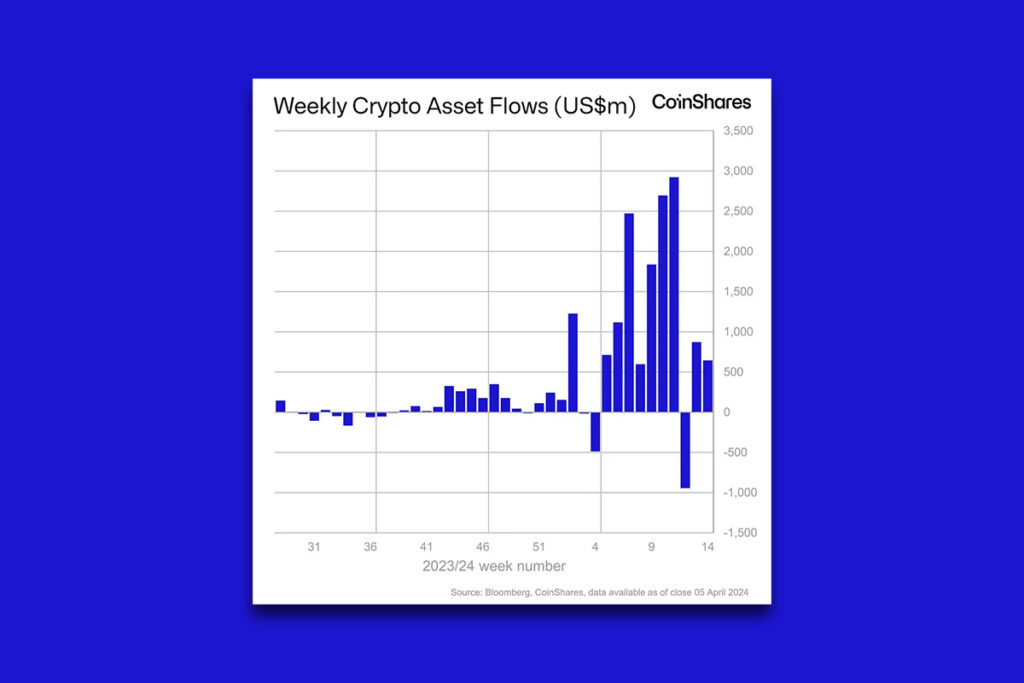

Year-to-date inflows reached their highest-ever level of $13.8 billion, following net inflows of $862 million in the previous week. This surpassed the previous annual record of $10.6 billion in 2021. In the wake of the almost $1 billion in outflows observed for the week ending March 22, it represents a sustained recovery for global cryptocurrency funds. Exchange-traded fund enthusiasm, however, appears to be abating as well, according to James Butterfill.

There are signs that appetite from ETF investors is moderating, not achieving the weekly flow levels seen in early March, while volumes last week declined to $17.4 billion for the week compared to $43 billion in the first week of March,

Butterfill

According to Butterfill, Regional Sentiment is Divided

The focus is still on global bitcoin investment products, which saw $663 million added last week. Short-term bitcoin funds, on the other hand, witnessed $9.5 million in withdrawals for the third week in a row, which suggests some pessimistic investor capitulation, according to Butterfill.

Regional sentiment is still divided, according to Butterfill, despite the fact that U.S.-based funds added $648 million last week along with inflows for goods located in Brazil, Hong Kong, and Germany. Nonetheless, outflows of $27 million and $7.3 million were reported from Switzerland and Canada, respectively.

Leave a comment