The Locked $21 Million Saga: Solana’s Staking Dilemma Unfolds

Crypto News – Have you ever imagined waking up one day to find your digital assets locked away, beyond your reach? That’s precisely the predicament over 31,585 Solana (SOL) users find themselves in, grappling with a staggering $21 million trapped within Lido’s staking protocol. This incident not only throws a spotlight on the inherent risks lurking in the decentralized finance (DeFi) sector but also raises pressing questions about the future of digital asset management.

Lido’s Staking Conundrum: A Tale of Locked Assets and Disrupted Services

Lido, renowned for its significant footprint in the DeFi ecosystem, offers users an innovative way to stake their digital currencies. By depositing their assets, users receive placeholder tokens in return, a move that theoretically enables them to remain fluid across various DeFi platforms. Despite its substantial influence, with over $31 billion in total value locked (TVL) across its services, Lido’s venture into Solana’s territory struggled to keep pace with competitors like Marinade and Jito.

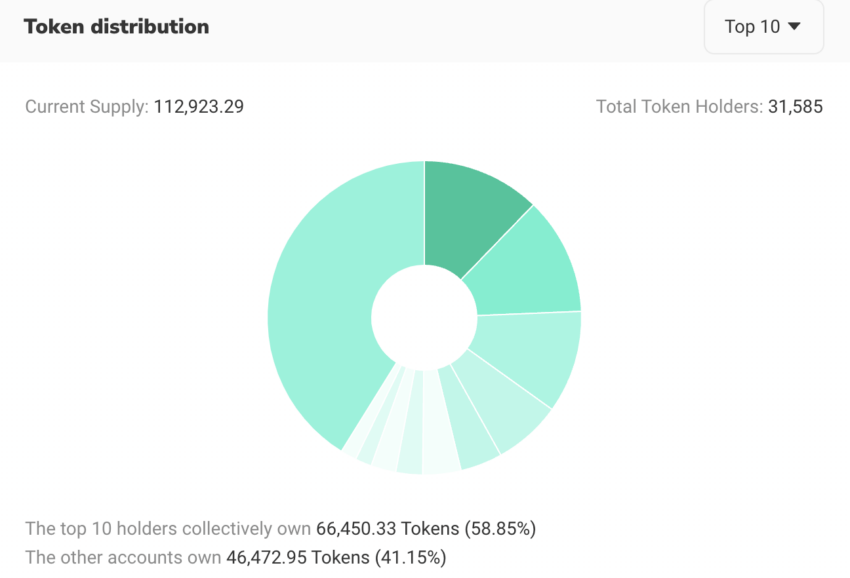

The plot thickened in October when Lido decided to discontinue its Solana service, citing strategic realignments. This decision led to the dismantling of its stSOL and SOL exchange interface. Fast forward to February 4, and Lido formally ended its support, leaving a whopping 112,923.29 SOL—equivalent to about $21 million—frozen in limbo.

The Bug That Bound Billions

Adding to the chaos, a glitch in Lido’s smart contracts surfaced, effectively barricading users from their investments. This hiccup forced users to shift from a user-friendly web interface to a more daunting, code-only interaction with the system. For the less tech-savvy, this transition spelled a nightmare, heightening the risk of errors and effectively stranding many.

Amidst this upheaval, Lido’s community channels have become arenas of frustration and outcry, with stSOL holders voicing their grievances loud and clear. One user lamented the disorder, criticizing the apparent neglect: “The Solana channel of the Lido Discord is a mess. stSOL holders trying to unstake completely lost and abandoned. I know stSOL is depreciated, but I don’t think this is the right way to treat users.”

A Glimmer of Hope Amidst Chaos

Despite Lido’s withdrawal, Solana‘s DeFi scene remains vibrant, with platforms like Marinade Finance and Jito showcasing significant staking volumes. In fact, Solana’s DeFi landscape has been flourishing, now clinching the fourth-largest spot based on TVL, thanks to a notable 61% spike in the last month.

This saga serves as a stark reminder of the volatile and unpredictable nature of the DeFi sector. It underscores the critical need for robust, user-friendly, and secure protocols that safeguard users’ assets against unforeseen glitches and strategic pivots. As the digital asset community continues to navigate these choppy waters, one thing remains clear: transparency, user support, and technical robustness are non-negotiable pillars that must underpin the future of decentralized finance.

Leave a comment