VanEck Bitcoin ETF Sees Record Inflows After Fee Suspension; Grayscale Struggles Amidst Outflows

Crypto News – Global investment titan VanEck has achieved unprecedented success with its spot Bitcoin (BTC) exchange-traded fund (ETF), marking an all-time high in inflows following the strategic decision to suspend management fees. Data from BitMEX Research reveals that the VanEck Bitcoin Trust ETF (HODL) attracted a staggering $119 million in fresh capital, setting a new record for the ETF since its inception in January.

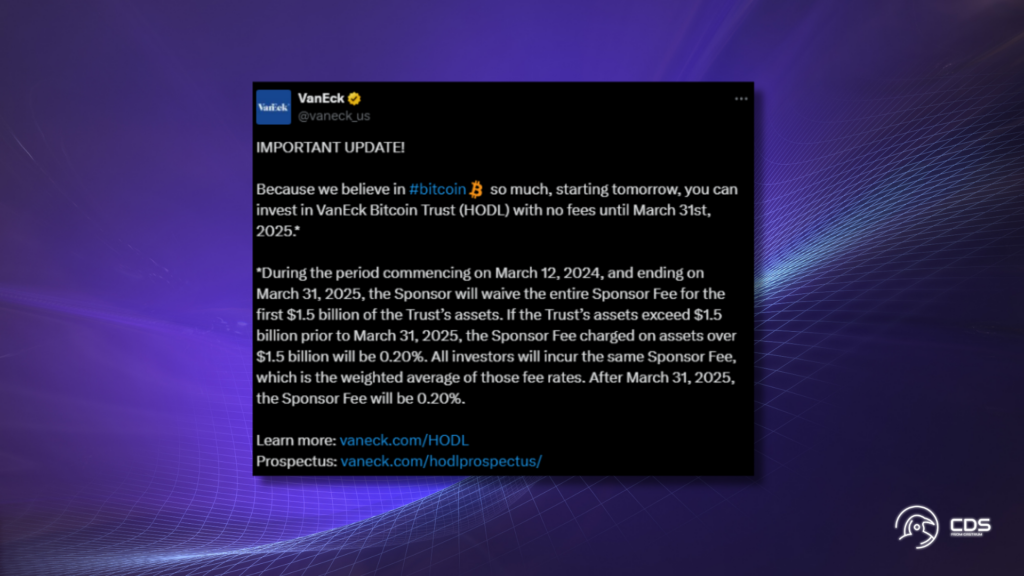

VanEck Record Inflow Came after Suspending Fees

VanEck’s record-breaking influx follows its recent announcement to waive management fees for HODL, effective for up to a year. In a bold move, the ETF issuer cited unwavering confidence in Bitcoin as the driving force behind the fee suspension. Already renowned for its competitive fee structure, VanEck declared an exemption from fees until March 31, 2025, unless the ETF’s assets under management (AUM) surpass $1.5 billion before that date. The monumental $118.8 million influx into HODL represents a remarkable 736% surge from its previous peak of $14.2 million recorded on January 19.

BitMEX data underscores the ascension of VanEck’s HODL as the sixth-largest spot Bitcoin ETF, boasting over 6,000 BTC, equivalent to approximately $441.5 million at current market prices. This positions HODL ahead of rivals such as Invesco’s BTCO and Valkyrie’s BRRR.

Several weeks prior, VanEck had announced a fee reduction for HODL, slashing it from 0.25% to 0.20%. At the time, with total AUM at $187.74 million, the move was anticipated to bolster competitiveness. A company spokesperson emphasized VanEck’s commitment to delivering value and accessibility to investors, underscoring the rationale behind the fee adjustment.

However, speculation abounds regarding the true catalyst behind VanEck‘s fee reduction and subsequent suspension, with some attributing it to subdued inflows. At the time of the fee suspension announcement, VanEck’s AUM stood at $305 million, significantly trailing competitors like BlackRock’s IBIT and Fidelity’s FBTC, both of which had crossed the $1 billion mark. Notably, on the day of VanEck’s record inflows, both IBIT and FBTC registered net inflows of $562.9 million and $215.5 million, respectively.

In contrast, Grayscale Investments’ GBTC ETF continues to grapple with substantial outflows, with BitMEX data indicating a consistent lack of net positive inflows since its January debut. The ETF experienced its largest net outflow of $640.5 million on January 22, followed by another significant outflow of $598.9 million on February 29.

Meanwhile, BlackRock has sought approval from the United States Securities and Exchange Commission (SEC) to incorporate its spot BTC ETF into its “Global Allocation Fund.” With nearly $18 billion in assets under management (AUM) and a year-to-date (YTD) gain of 4.61% as of March 7, the fund represents a formidable player in the market. Additionally, BlackRock has filed with the SEC to disclose its intention for the Strategic Income Opportunities Portfolio to invest in Bitcoin via ETFs, wielding a considerable $36.7 billion in AUM.

In January, the Cboe submitted an application to the SEC seeking authorization to trade options on Bitcoin ETFs. However, the SEC has deferred its decision until April, reflecting the evolving landscape of cryptocurrency investment products.

1 Comment