Featured News Headlines

Ethereum Signals Altcoin Revival Post-Liquidation

Following one of the most intense liquidation events of 2025, altcoins are showing signs of recovery as capital cautiously flows back into riskier assets. Bitcoin’s dominance has slipped, and Ethereum appears to be setting the tone for a potential altcoin revival.

Market Overview: $19B Wipeout, BTC Dominance Cools

The crypto market experienced its largest liquidation event on record, with over $19 billion in leveraged positions erased within 24 hours, impacting more than 1.6 million traders, according to data from Coinglass. The Total Crypto Market Cap (excluding BTC and ETH) fell sharply but found support near $1 trillion, suggesting that the worst of the drawdown may have passed.

Meanwhile, Bitcoin dominance (BTC.D) has dropped to 60.45%, retracing from the recent spike triggered during the crash. This drop reflects a growing rotation away from Bitcoin and toward altcoins, as traders seek new opportunities amidst reduced volatility.

Ethereum Activity Signals Altcoin Accumulation

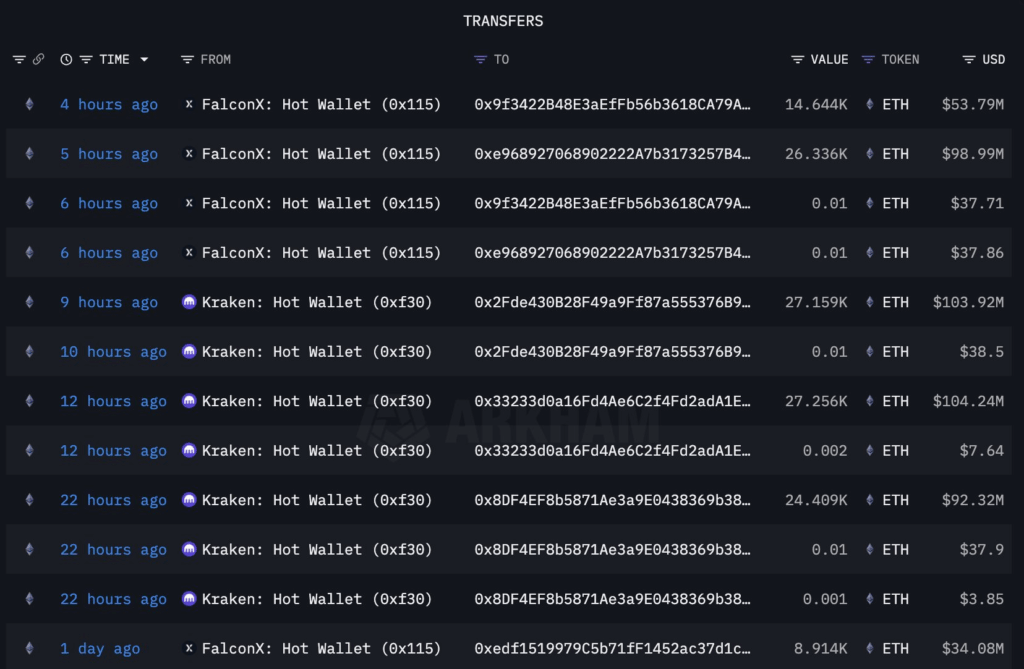

Ethereum is once again acting as the bellwether for altcoin strength. On-chain data shows that six new wallets, likely associated with Bitmine, withdrew 128,000 ETH (worth roughly $480 million) from centralized exchanges FalconX and Kraken in the past 72 hours.

Joao Wedson, CEO of analytics platform Alphractal, commented on the shift:

“We’re seeing a rapid redeployment of capital into altcoins following the Bitcoin flush. Large ETH accumulations suggest growing institutional confidence.”

The Altcoin Season Index currently sits at 47, indicating a neutral stance — not yet in “altseason” territory, but edging closer as investor appetite returns.

Technical Analysis: Momentum Builds Below the Surface

Relative Strength Index (RSI) for ETH has bounced from oversold territory (32) to 45, suggesting early recovery but no full bullish confirmation.

MACD on the 4-hour ETH/USD chart shows a bullish crossover, with histogram momentum shifting upward.

Directional Movement Index (DMI) indicates declining bearish pressure, though ADX remains above 25, showing the recent trend’s strength has not yet fully reversed.

Altcoin-focused metrics are gradually turning positive, albeit with caution still dominating sentiment.

Can Altcoins Sustain a Recovery?

While the broader crypto market remains fragile, early signs of rotation suggest that Ethereum-led inflows could spill over into smaller cap altcoins in the coming week. If Bitcoin dominance continues to soften and liquidity remains stable, a gradual altcoin rebound is likely — especially if macro conditions don’t deliver further shocks.

As Wedson puts it,

“The next 7–10 days will be crucial. If capital rotation continues and BTC.D trends downward, we may see a more aggressive altcoin bounce.”

For now, eyes remain on ETH and key altcoins as traders test the waters post-shakeout.

Comments are closed.