Ethereum’s Quiet Rally: Institutional Demand Fuels Bullish Q4 Outlook

Despite Ethereum’s decline towards the $4.2k support zone, exchanges continued to withdraw their funds. Buyer domination and a willingness to push to new all-time highs would be demonstrated by a move above $4.7k. According to AMBCrypto, ETH’s $6k threshold was closer than it seemed. Because institutional demand has not decreased, Q4 estimates remain solidly optimistic.

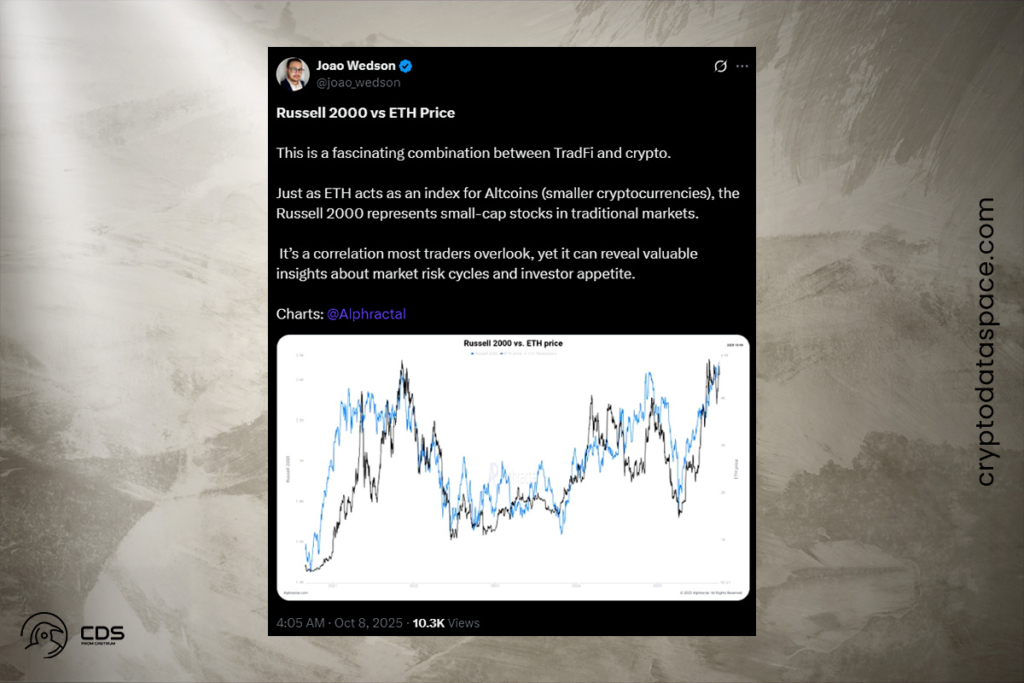

ETH Mirrors the Russell 2000: What This Hidden Correlation Means for Traders

An element that many traders might miss was brought to light by Joao Wedson, the founder and CEO of Alphractal. Wedson emphasized in a post on X the relationship between Ethereum price patterns and the Russell 2000 index. Ethereum generally tends to climb in tandem with the small-cap U.S. stock market index. According to the expert, this intriguing association sheds light on investor risk appetite and market risk cycles. Smaller businesses will find it simpler to finance loans due to rate-cut predictions, which explains the stock price increase. The dollar is weakened as a result.

It’s interesting to note that the U.S. Dollar Index (DXY) has increased since the government shutdown, according to another analyst. This increase in dollar strength was explained by the idea that investors were holding onto their money in anticipation of future events due to uncertainty. The timeless maxim, “When in doubt, zoom out,” holds the secret. The global money supply, which has been increasing in recent years, has expanded further this year, while the DXY has been drifting dramatically lower in 2025. The dollar’s decline can be explained by these macro changes. The outlook for cryptocurrency investors is still positive.

Ethereum’s On-Chain Explosion Could Be the Catalyst for Its Next Rally

On-chain strength, in particular, was a positive aspect for Ethereum investors. From a baseline of 7 million, the internal contract calls—a stand-in for intricate network interactions—have surged to a new, consistent floor above 9.5 million. This resulted from the combination of business adoption, governmental approval, and opening institutional floodgates. This creates a solid bullish basis that is likely to drive Ethereum prices higher when combined with the macroeconomic indicators.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.