Ondo Finance’s Latest Acquisition: A Game-Changing Step Toward Blockchain-TradFi Fusion

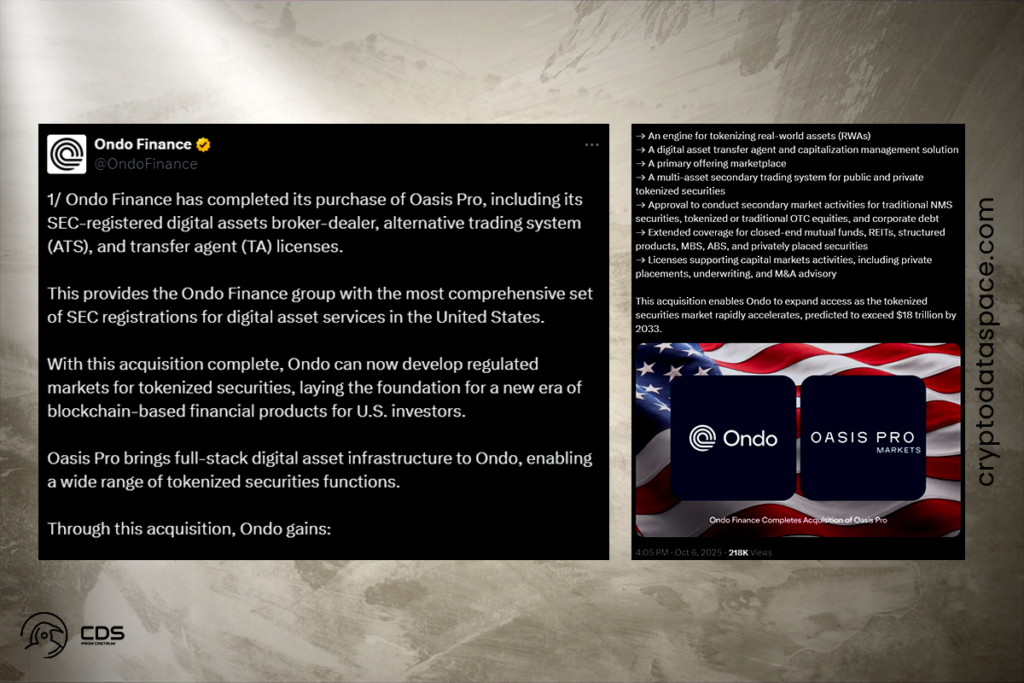

The acquisition of Oasis Pro has been formally finalized by Ondo Finance (ONDO). Included in the transaction are its SEC-approved broker-dealer, Alternative Trading System (ATS), and Transfer Agent (TA) licenses. The purchase is a significant move that enables Ondo to expand its footprint in the regulated digital asset market. It successfully connects blockchain technology with traditional finance (TradFi).

This acquisition enables Ondo to expand access as the tokenized securities market rapidly accelerates, predicted to exceed $18 trillion by 2033,

the announcement

Ondo Finance Sets New DeFi Record with $1.74B in TVL and Growing Institutional Inflows

A DeFi protocol that used to produce RWA tokens, Ondo is currently evolving into an infrastructure player. This development enables it to function lawfully under US financial systems, which is necessary in order to draw in institutional investors to on-chain assets. Most recently, Ondo’s TVL hit a record high of $1.74 billion in the DeFi ecosystem. Revenue and fees came to about $13.7 million for the third quarter.

The tokenized assets of Ondo Global Markets surpassed $300 million, according to a report by BeInCrypto at the same time. Strong inflows into stocks, stablecoins, and tokenized Treasury bonds are reflected in this. This pattern demonstrates the growing demand for on-chain real-world products. Because real interest rates are still high, investors are looking for yield-bearing, reasonably safe alternatives.

Three Critical Factors That Will Decide Ondo Finance’s Next Big Breakout

The SEC licensing, which validates Ondo Finance‘s tokenization model within the U.S. regulatory framework, is the real driver from a fundamental perspective. This opens the door for institutional capital, which has traditionally shunned unregulated DeFi protocols, and lowers compliance risks. However, three crucial factors need to line up for ONDO to have a long-lasting breakout. These include keeping large holdings (whales) stable to avoid sell pressure, guaranteeing ongoing capital inflows into tokenized products, and effectively integrating Oasis Pro’s infrastructure. The rally may be short-lived before reverting to consolidation if these variables deteriorate.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.