From Hype to Doubt: What Happened to PI?

After launching in March with massive anticipation, Pi Network’s (PI) price has plunged more than 90%, falling from a peak of $2.79 to just $0.26. At its height, PI boasted an $18 billion market cap, but over $16 billion has since been wiped out as the price deteriorated amid community unrest and declining confidence.

Broken Promises Fuel Rug Pull Allegations

The sharp decline has reignited “rug pull” accusations that first surfaced in May, when the Pi Network team announced a $100 million venture fund. Critics argue that this fund — allegedly financed by internal revenues and mining — should have been used to develop the ecosystem rather than external ventures.

This led to significant backlash, which halted a brief price recovery and pushed PI below $0.50 again. Although the developers have not publicly addressed all concerns, community frustration continues to mount, especially after more than six years of unmet expectations.

Netflow Positive, But Speculation Falls Sharply

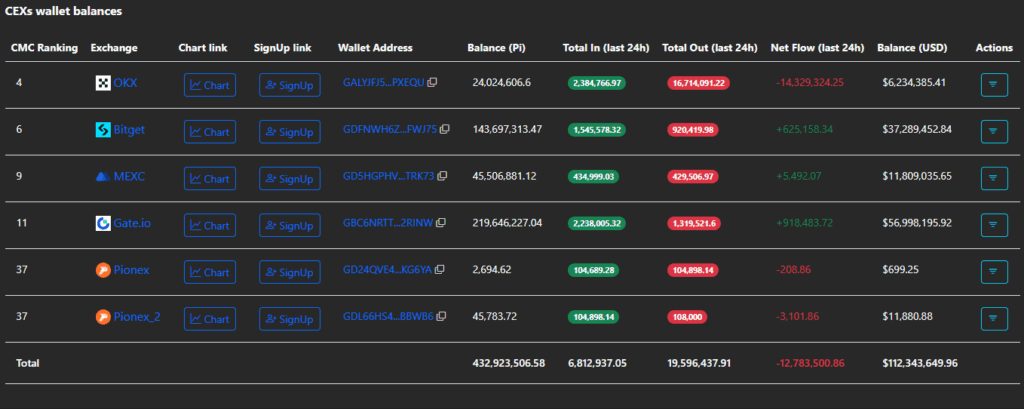

Interestingly, despite the negative sentiment, Pi Scan reported a net exchange outflow of $112.3 million in the past 24 hours. This suggests some users are still accumulating PI, taking advantage of lower prices.

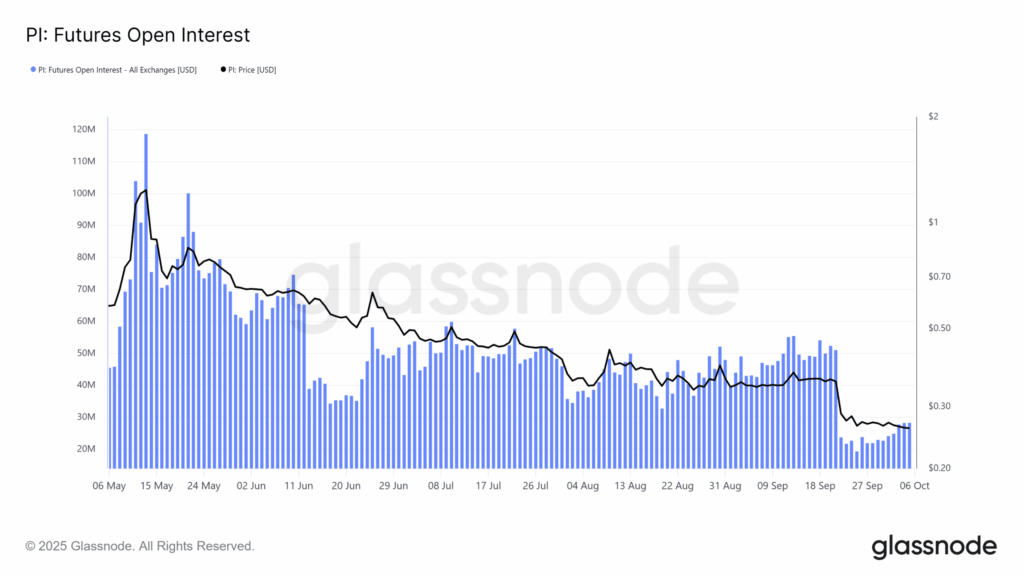

However, speculative interest tells a different story. According to Glassnode, PI’s Open Interest (OI) in the derivatives market has plummeted from $120 million to just $20 million, indicating that traders are losing interest in opening new positions.

The growing circulating supply — up by over 1 billion tokens since May — has added further inflationary pressure, undermining the token’s ability to maintain value. Combined with community distrust and lack of clear project direction, this has left PI in a prolonged bearish phase.

Unless the Pi Network team openly addresses the concerns and re-engages with its user base, the project may continue to drift without meaningful recovery in price or confidence.

Comments are closed.