VeChain Treasury Drops on Heavy Losses in VET, ETH, and BTC

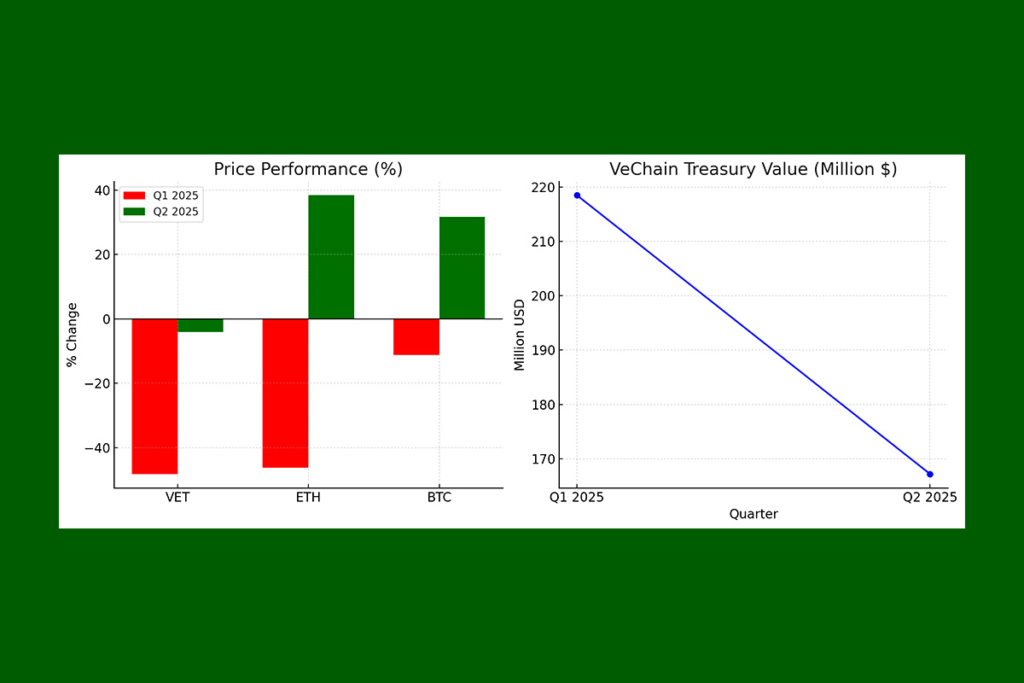

In just one month, VeChain’s treasury dropped 23.5% to $167 million at the end of Q2 2025. In the meantime, the price of VET has fallen 91.49% from its peak. This decline emphasizes how much pressure the project is under. Nonetheless, it is anticipated that the enhancements in tokenomics will assist VeChain in regaining its growing pace.

VET Price Drop Leads to Treasury Decline

Examining the Foundation in greater detail shows a sharp difference between the first two quarters of 2025. Its investing approach and the extremely volatile market environment are partially to blame for this. At the end of Q1 2025, VeChain’s treasury, which includes stablecoins and holdings of BTC, ETH, and VET, was valued at $218.5 million, according to the report. This signaled a sharp decline compared to the end of the fourth quarter of 2024. The main reason for this decline was unfavorable market conditions, such as VET losing 48.16%, ETH losing 46.19%, and BTC losing 11.13% in value.

The volatility is reflective of both our strategic investment in Renaissance protocol upgrades and ecosystem expansion initiatives, combined with broader cryptocurrency market conditions experienced during the quarter,

the report

VeChain’s Dual-Token Model Faces a Major Transition

VeChain made changes to its tokenomics during the quarter. Staking and ecosystem activities are now the only ways that VTHO coins are created. This is intended to promote increased community involvement and lessen inflationary pressure. In order to facilitate the onboarding of new customers into Web3 and NFT services, the project also proceeded to expand VeWorld’s Web3 super app. The Foundation’s possibilities for future growth are strengthened by this expansion.

According to many observers, Q2 is a transitional moment when the ecosystem is under pressure to increase income while also laying the foundation for significant improvements. These modifications aim to make the dual-token system more equitable and possibly deflationary by controlling supply flows. The mechanisms of VTHO’s issuance and consumption are specifically highlighted.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.