Featured News Headlines

The Meme Coin Economy: Who Really Profits?

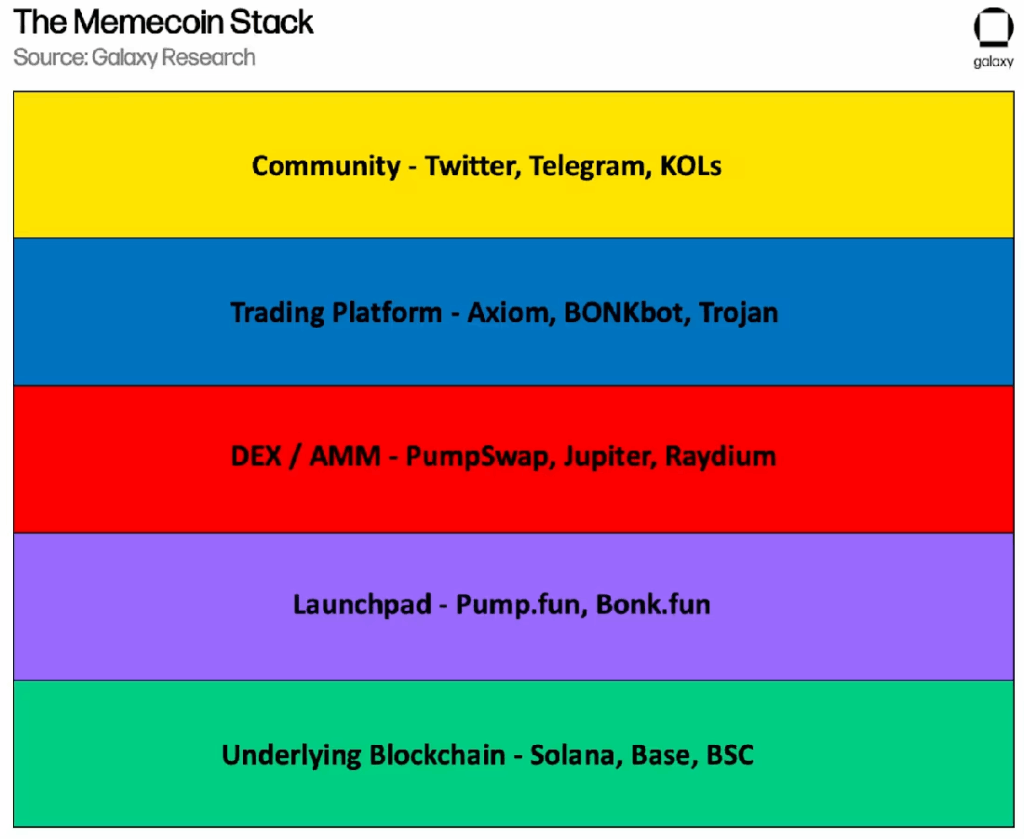

While meme coins attract millions of retail traders seeking fast profits, the underlying infrastructure—launchpads, DEXs, bots, and influencers—captures the majority of financial gains. As new tokens flood the market, the gap between hype and profitability continues to widen.

Platforms that facilitate meme coin creation and trading—such as decentralized exchanges (DEXs), launchpads, and automated bots—generate consistent revenue. Meanwhile, most individual participants incur losses, often engaging in what analysts call a “zero-sum game with negative expected value.”

In its latest report, Galaxy Digital noted that meme coin trading is rarely based on fundamentals. Instead, it revolves around attention cycles and timing.

“Trading them is less about fundamentals and more about what can be described as ‘cultural arbitrage’,” the report stated, describing it as “just plain gambling” for most participants.

Solana Leads the Meme Coin Explosion

At the base of this rapidly growing ecosystem is the Solana blockchain, now hosting over 32 million tokens—a 300%+ increase since early 2024. Solana accounts for 56% of all meme coins across major blockchains, including Ethereum, BNB Chain, and Base. Its low fees and high throughput make it ideal for rapid deployment, though meme coins now represent 20–30% of its DEX volume, down from 60% in January.

Ethereum, by contrast, hosts fewer but more established meme coins, with what Galaxy Digital describes as a “less cutthroat culture.”

Launchpads Like Pump.fun Industrialize Token Creation

Launchpads play a crucial role in mass token deployment. Pump.fun, launched in early 2024, has created 12.9 million tokens, or over 40% of all meme coins on Solana. It uses bonding curves to provide instant liquidity with minimal friction. Despite the high volume, most tokens have little value.

“Out of nearly 12.9 million tokens launched on the platform, just 12 account for more than half of all fully diluted market cap,” noted analyst Will Owens.

Those 12 tokens alone represent $2.69 billion, or 56% of the $4.8 billion total FDMC on Pump.fun.

Pump.fun briefly lost momentum to competitors like LetsBonk, but regained dominance through innovations like Project Ascend, which introduced dynamic fee models and integrated token launches with streamers and creators.

DEXs and Bots Capture Post-Launch Trading Revenue

Beyond launchpads, DEXs and aggregators such as Jupiter, Raydium, Orca, and PumpSwap benefit from high-volume meme coin trading. They handle the volatile post-launch period, monetizing liquidity and slippage.

Meanwhile, trading bots like Axiom, BONKbot, and Trojan enable sniping and fast execution.

“Axiom, for example, has broken $200 million in cumulative revenue with a team of less than 10 individuals,” the report stated.

These tools contribute to an aggressive player-vs-player (PvP) environment, where only the fastest and most informed profit.

Comments are closed.