BNB Price Holds Strong After Technical Milestones

Technical upgrades, rising on-chain activity, and strong price structure put BNB in a potentially breakout-ready position.

BNB Chain is making headlines again — and not just for price action. A recent wave of technical improvements and strategic updates is strengthening its market positioning.

Validators have proposed reducing the minimum gas price to 0.05 Gwei and shortening block intervals to 450 milliseconds. These changes aim to enhance scalability and minimize transaction costs. Meanwhile, Binance founder CZ pushed for even deeper cuts, suggesting on X: “Let’s reduce fees by another 50% on #BNB Chain?” He previously noted that gas fees could already be reduced by up to 10x.

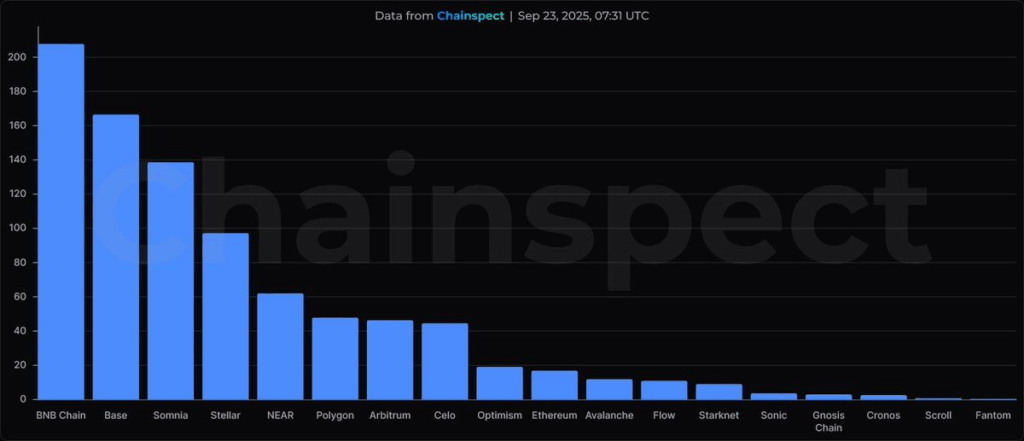

These adjustments have made BNB Chain one of the most cost-efficient networks, appealing particularly to high-frequency use cases like DeFi, decentralized exchanges, and on-chain derivatives. Community metrics now show that BNB Chain leads all Layer-1 and Layer-2 networks with over 200 transactions per second.

Still, ultra-low fees can present challenges—like increased spam risk or validator revenue pressure. Whether BNB Chain can balance cost-efficiency with sustainability remains to be seen.

On-Chain Metrics Signal Growing Strength

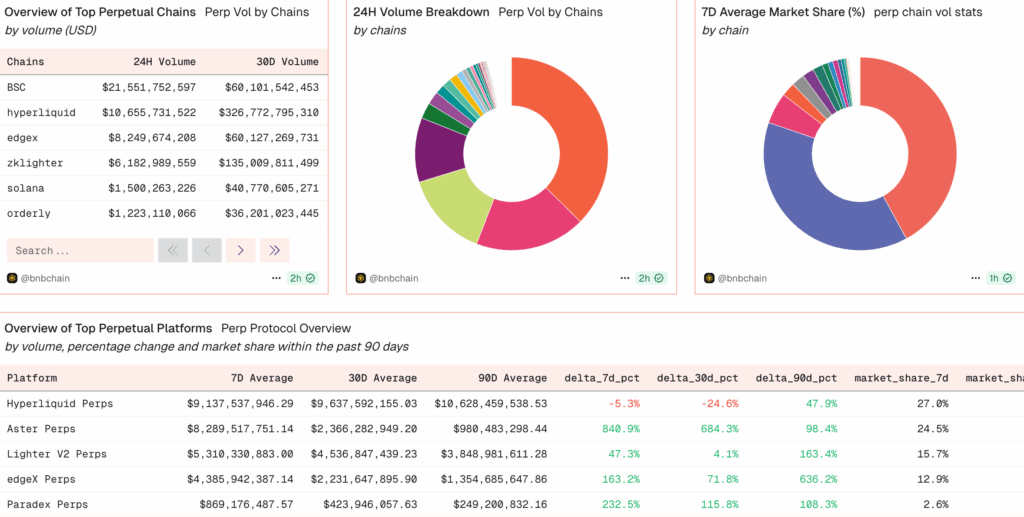

According to Dune Analytics, total perpetual trading volume reached $51.3 billion recently, with $21.5 billion of that on BNB Chain—largely driven by a spike in usage on Aster perp DEX. Santiment data also ranks BNB Chain at the top for developer activity in the last month, while stablecoin flow data confirms its central role in fast settlements.

Currently, BNB is pulling back to retest support around the 20-day EMA after breaking $1,000. If this level holds, analysts believe the uptrend may resume, backed by strong fundamentals.

Comments are closed.