Solana Faces Heavy Selling Pressure: Liquidations Spike and Buyer Confidence Wanes

As the spread of its long-term holdings (LTH) expands, Solana is coming under more selling pressure. This circumstance suggests a drop in trust in the altcoin’s immediate future. The increase in lengthy liquidations throughout the SOL futures market has further depressed sentiment and turned off buyers who would normally hold SOL for longer than three months. These patterns suggest that the coin’s short-term recovery will be difficult.

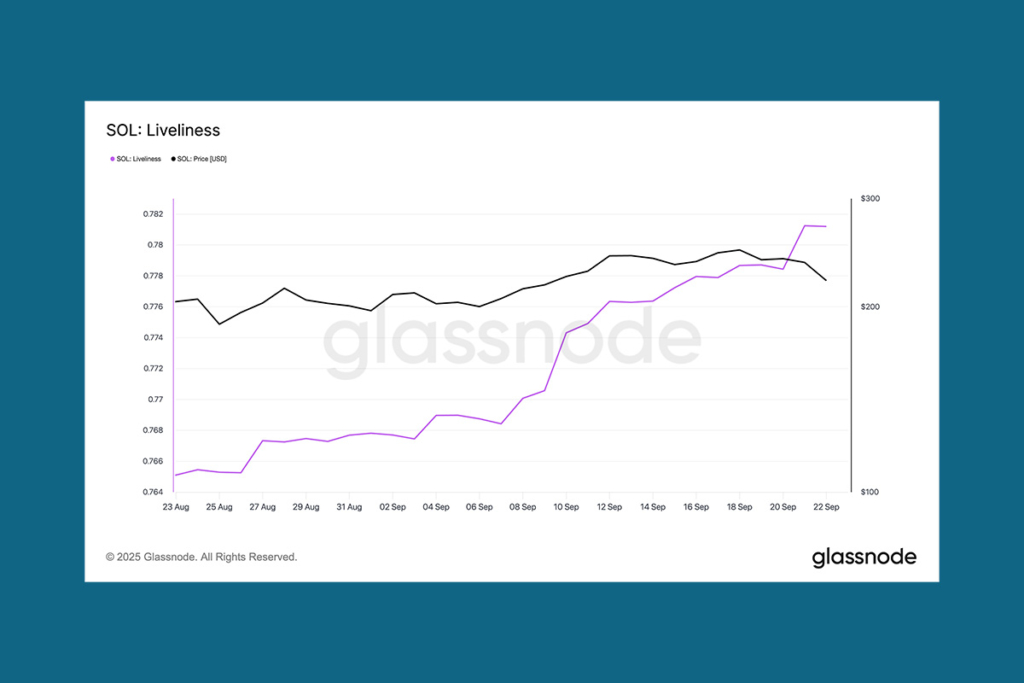

SOL Liveliness Spike Indicates Growing Sell Pressure from Long-Term Investors

SOL‘s Liveliness has been steadily increasing over the last several weeks, according to Glassnode data. On September 21, the statistic reached a 30-day high, indicating a surge of previously inactive token movement. Liveliness provides information about whether LTHs are spending or holding onto their coins by monitoring the ratio of coin days destroyed to total coin days accumulated. Similar to SOL, an increase in this indicator indicates that more long-held tokens are being sold or transferred, indicating profit-taking and a decline in long-term investors’ conviction.

This pessimistic view is further supported by SOL’s Hodler Net Position Change negative results. Since August 27, this measure has continuously reported negative values and trended downward, according to Glassnode. This indicator shows whether investors are expanding or decreasing their exposure by tracking the net position of long-term holders over a certain time period. More coins are being moved into hodler wallets when the reading is positive.

Solana Price Could Plunge Below $200 Following Record Liquidations

Solana‘s long-term holders’ declining confidence has a plausible explanation. Due to the bearish cloud looming over the entire market, SOL’s value has declined, causing many bullish traders to suffer significant losses. 97% of all positions in the coin’s derivatives market were wiped out as long liquidations on Solana futures spiked to a year-to-date high yesterday. Participants who had placed bets on the coin’s upward trend typically lose faith in such liquidations, which may make selloffs worse. In such a scenario, the price of the altcoin may drop below $200 once more and go toward $195.55.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.