Featured News Headlines

PancakeSwap Token Surges Amid Liquidity Inflow

PancakeSwap’s native token CAKE has posted an 11% daily gain, fueled by a sharp rise in market liquidity and trading volume. According to DeFiLlama, CAKE reached $2.3 billion in daily trading volume, significantly outpacing competitors like Hyperliquid (HYPE), which recorded $773 million.

This uptick aligns with rising capital inflows into the BNB ecosystem, which analysts suggest could be entering a new phase of altcoin accumulation.

BNB Ecosystem Fuels Demand for CAKE

Market analyst Joao Wedson described the trend as the onset of a new cycle, stating:

“Altcoins connected to the Binance Smart Chain will start to attract attention soon.”

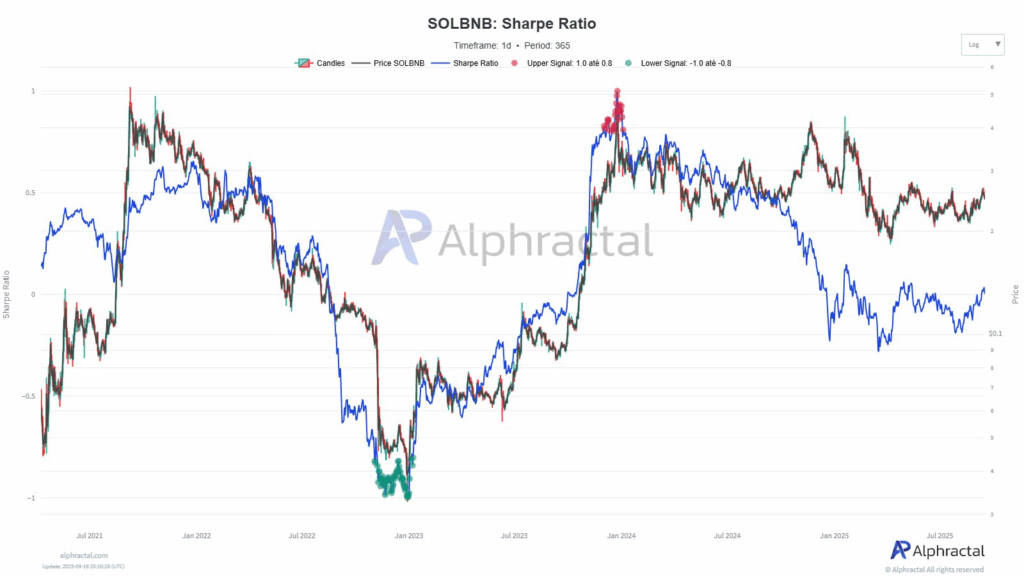

His analysis uses the SOL/BNB Sharpe Ratio as a gauge, which has historically signaled capital rotation when trending downward. As liquidity shifts toward BNB-related assets, CAKE is benefiting not just in price but in trading activity.

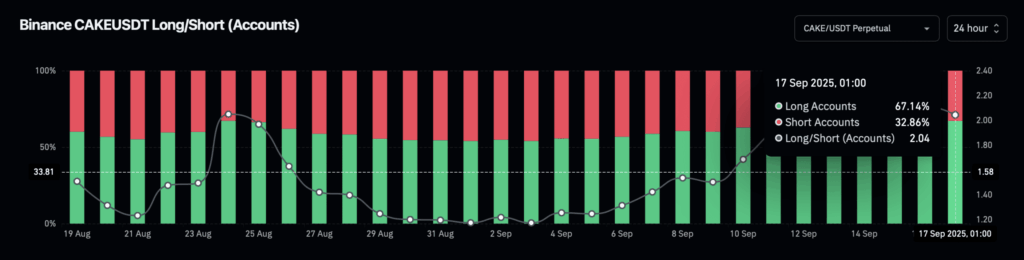

Derivatives Data Signals Strong Buying Pressure

Data from CoinGlass shows Binance traders are leading CAKE derivatives activity, with a Taker Buy-Sell Ratio of 2.04, suggesting aggressive buying behavior. Spot market activity, while smaller, also reflects bullish sentiment. Over the past week, spot purchases have totaled $1.47 million, with $260,000 bought in a single day.

This buying momentum highlights growing interest from both retail and institutional participants.

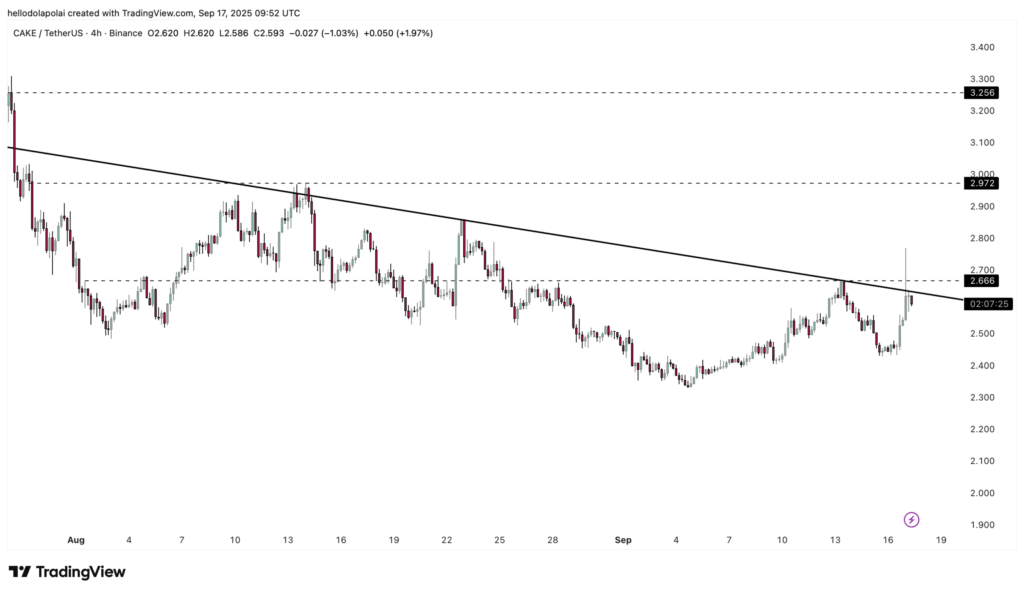

What’s Next for CAKE Price?

CAKE’s price is currently testing a descending resistance line. A breakout above this level could open the door to targets at $2.66, $2.97, and potentially $3.25.

If the token fails to break resistance, a period of consolidation may follow. However, market sentiment remains optimistic, with indicators leaning more toward a continued rally than a bearish reversal.

Comments are closed.