Ondo Finance Gains Momentum Tied to BlackRock’s Blockchain ETF Plans

This week, the token of the digital company and decentralized finance-focused asset manager Ondo Finance is continuing to rise in tandem with the cryptocurrency market. Momentum is also being fueled by recent stories about BlackRock, the biggest asset manager in the world. Bloomberg said Wednesday that the emergence of the tokens also aligns with BlackRock’s intentions to add exchange-traded funds to public blockchains.

Why Is Ondo’s Price Soaring?

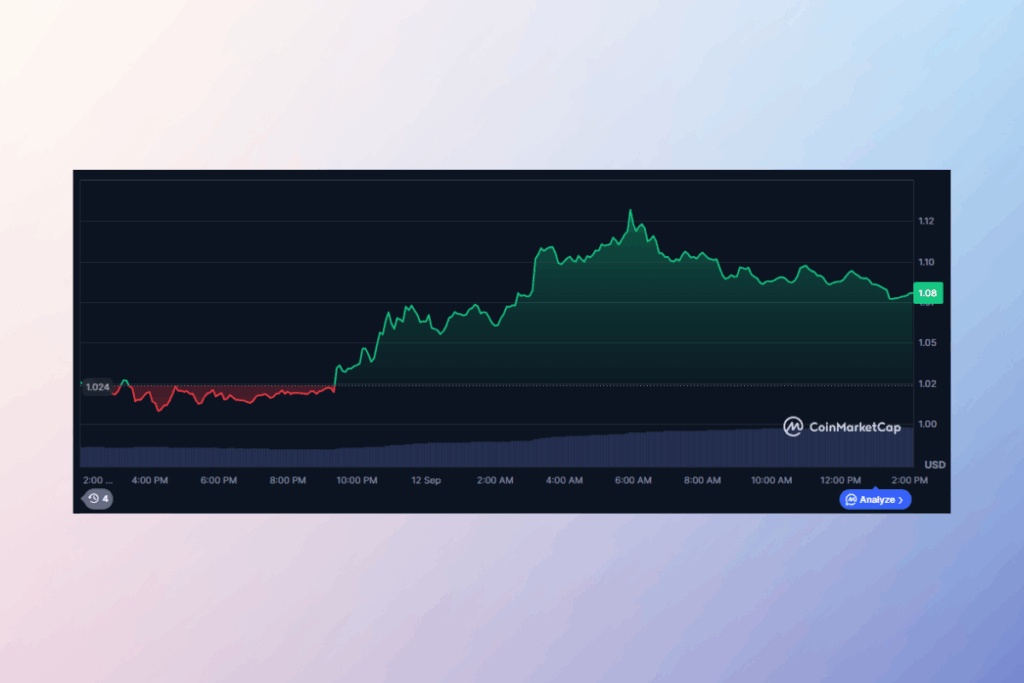

After recording gains of over 21% this week, Ondo is up about 10% on the day to $1.10, according to CoinGecko data. Ondo’s price increase is probably being driven by enthusiasm for tokenized stocks, according to Lai Yuen, an investment analyst at Fischer8 Capital. Over the course of nine days, Ondo’s Global Markets has grown by $160 million in TVL due to onboarded partners and advisers, such as WisdomTree. Yuen stated that this essentially highlights the project’s high early traction.

Yuen: Ondo Finance’s Growth and Moat Make It Hard to Beat

According to DefiLlama data, Ondo Finance‘s total value locked has increased from $611 million to $1.57 billion, nearly tripling since the beginning of 2025. According to Yuen, the long-term view is still optimistic. He believes that even if the project only gains 10% of the stock market, it would still provide a sizable amount of revenue for holders of Ondo tokens.

The project’s regulatory moat, bolstered by its advisory board, provides a durable long-term advantage that will be difficult for competitors to replicate

Yuen

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.