ETF Progress Sparks Price Rally

The U.S. Securities and Exchange Commission (SEC) has officially acknowledged the Cboe BZX Exchange’s filing to list and trade the Canary Staked Sei (SEI) ETF. This regulatory milestone triggered bullish sentiment, pushing SEI’s price up by 8% and fueling a surge in trading volume.

At press time, SEI traded at $0.317, supported by a 120% jump in daily volume, signaling renewed investor interest.

Breakout Confirms Bullish Shift

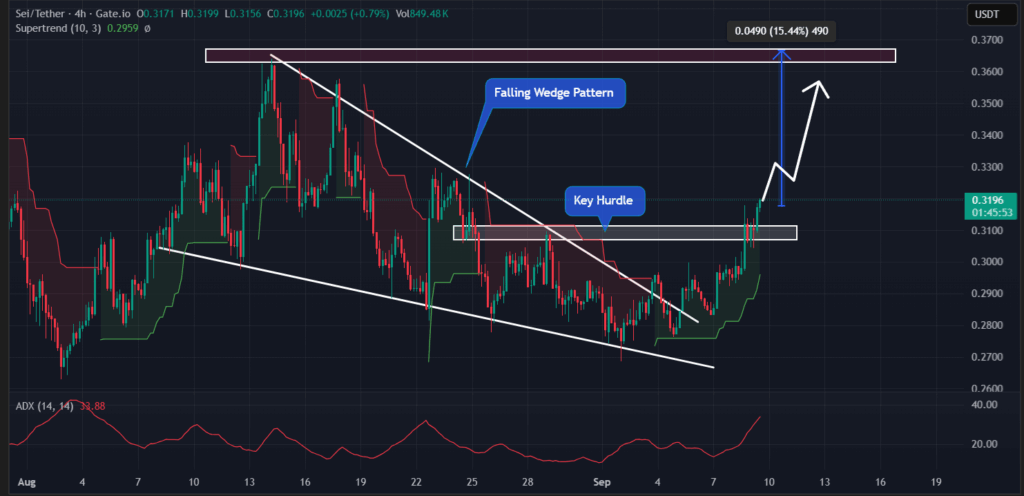

SEI recently broke out of a Falling Wedge pattern, a technical setup typically seen as a bullish reversal signal. The token also cleared a key resistance zone around $0.31, opening the door for further upside.

On the 4-hour chart, technical indicators suggested minimal resistance overhead. If SEI holds above the $0.303 support, analysts at AMBCrypto noted the possibility of a 15% rally, potentially targeting the $0.36 level.

Supporting this outlook, the Average Directional Index (ADX) stood at 33.78, above the bullish threshold of 25. In addition, the Supertrend indicator flipped green and is currently trailing below the price, reinforcing upside momentum.

On-Chain Data Backs Bullish Outlook

Investor activity also aligns with the bullish technical setup. According to CoinGlass, over $2.2 million worth of SEI tokens exited exchanges in the past 24 hours — often interpreted as a sign of accumulation and reduced sell pressure.

Meanwhile, short sellers may face risk, as approximately $1.81 million in short positions sit vulnerable near the $0.319 mark. A move above this level could trigger liquidations, potentially accelerating the rally.