SPX6900 Breaks Key Levels Amid Whale Activity

The memecoin sector reignited crypto market enthusiasm, with a 4.64% jump in total market cap and an 84.43% spike in trading volume in the past 24 hours, according to CoinMarketCap.

Leading this charge, SPX6900 (SPX) delivered sharp gains, fueled by whale accumulation, technical breakouts, and a surge in liquidations. Alongside SPX, Pudgy Penguins (PENGU) also posted double-digit weekly gains and notable intraday spikes.

SPX’s breakout above the $1.30 resistance—previously a strong rejection zone—was driven by a high-volume rally that formed a price gap. At press time, SPX hovered around $1.34, with daily volume exceeding $42 million.

Technical Shift Fuels Rally

SPX recently broke above both its 100 and 200-day moving averages, signaling a structural shift on higher timeframes. On the 4-hour chart, the token breached the $1.05–$1.20 consolidation range, confirming short-term bullish momentum.

The current target appears to be $1.50, but price action around the $1.40 resistance could trigger another pause or pullback, particularly if buying volume slows.

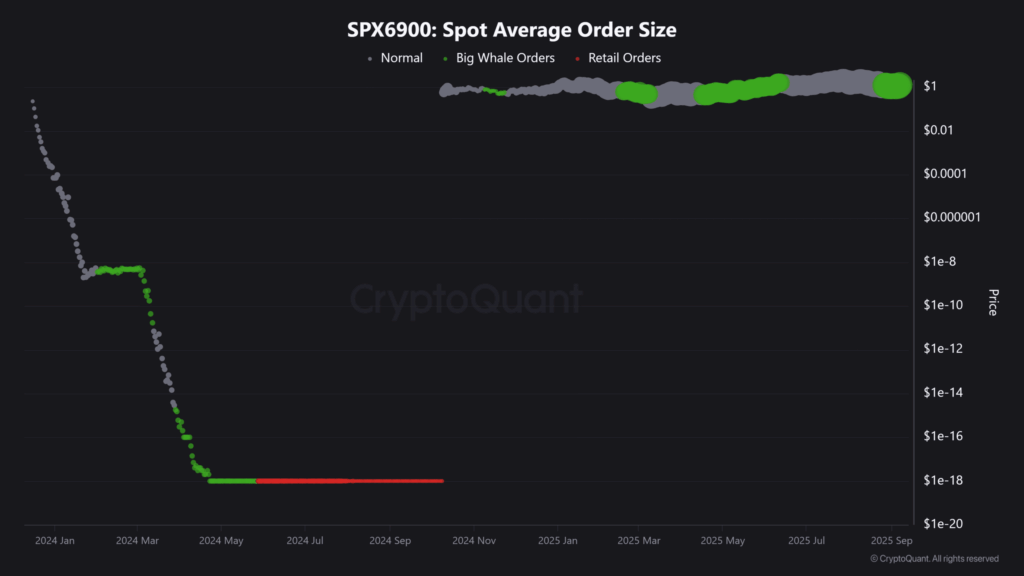

On-chain metrics from CryptoQuant show a rise in Spot Average Order Size, highlighting large players as the primary market movers. SPX has consistently attracted whale interest since holding above the $1 mark.

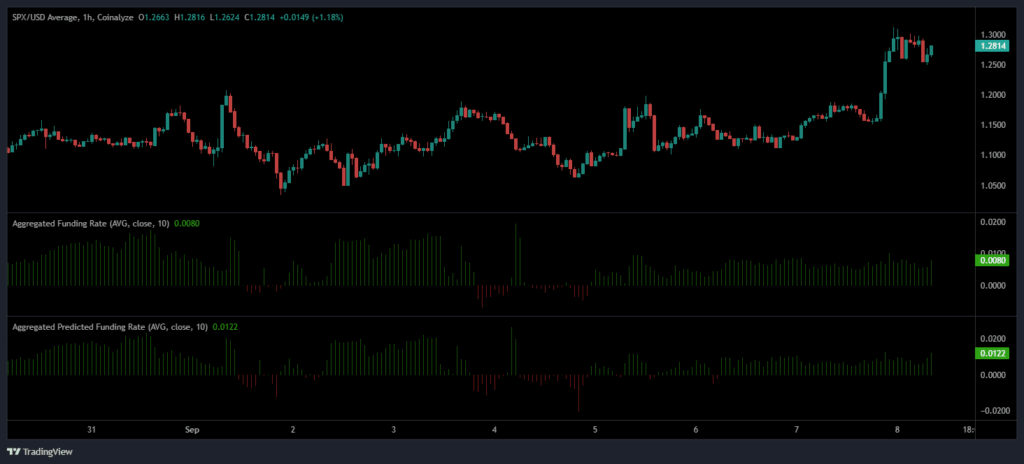

Meanwhile, Open Interest (OI) across major exchanges like Binance and OKX surged to $101 million, marking a 20% increase within a day. Coinalyze data revealed a Long/Short Ratio of 1.15 and positive funding rates (0.0122), suggesting bulls remain slightly dominant.

Short Squeeze Accelerates Momentum

A short squeeze above $1.30 cleared out sellers and reduced resistance pressure, allowing SPX to spike beyond $1.35. This event added to bullish momentum and may open the door to higher targets — provided whale support and funding conditions remain favorable.

Comments are closed.