Buybacks, Partnerships, and Market Sentiment Strengthen HYPE’s Outlook

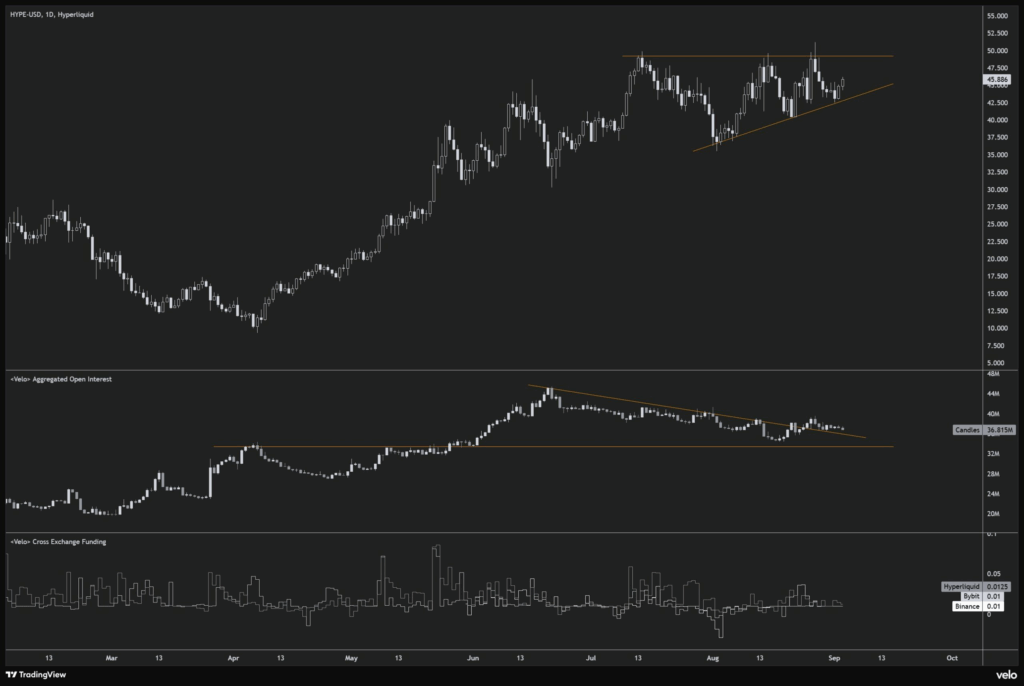

Hyperliquid’s native token HYPE has been trading in a tight consolidation range between $36 and $50 for more than two months, following its impressive 400% rally in the first half of 2025. However, mounting bullish catalysts may soon drive a decisive breakout above the $50 resistance.

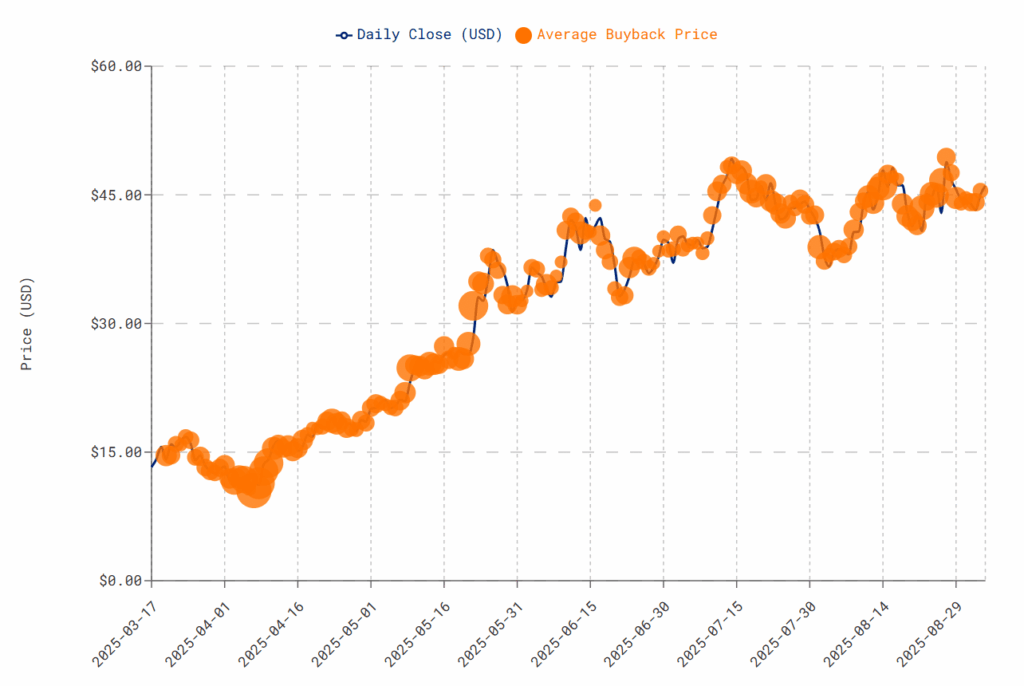

One such catalyst is Hyperliquid’s ongoing token buyback program. In a recent Bloomberg interview, David Schamis, VC partner at Atlas Merchant Capital, emphasized the impact of supply contraction, noting that over 30 million HYPE tokens have been repurchased so far. On September 3, the exchange bought back 50,000 HYPE, worth over $2 million, accounting for nearly 99% of the platform’s daily revenue.

Ecosystem Expansion Supports Bullish Sentiment

Partnerships with major wallet providers such as Phantom and Rabby have expanded access to Hyperliquid’s decentralized derivatives trading. This push aligns with the platform’s vision of becoming an “everything exchange,” similar to Coinbase, according to market analysts.

Popular crypto trader Byzantine General suggested HYPE is at a strong accumulation zone, adding that “it would fly” if bulls manage to push it past $50.

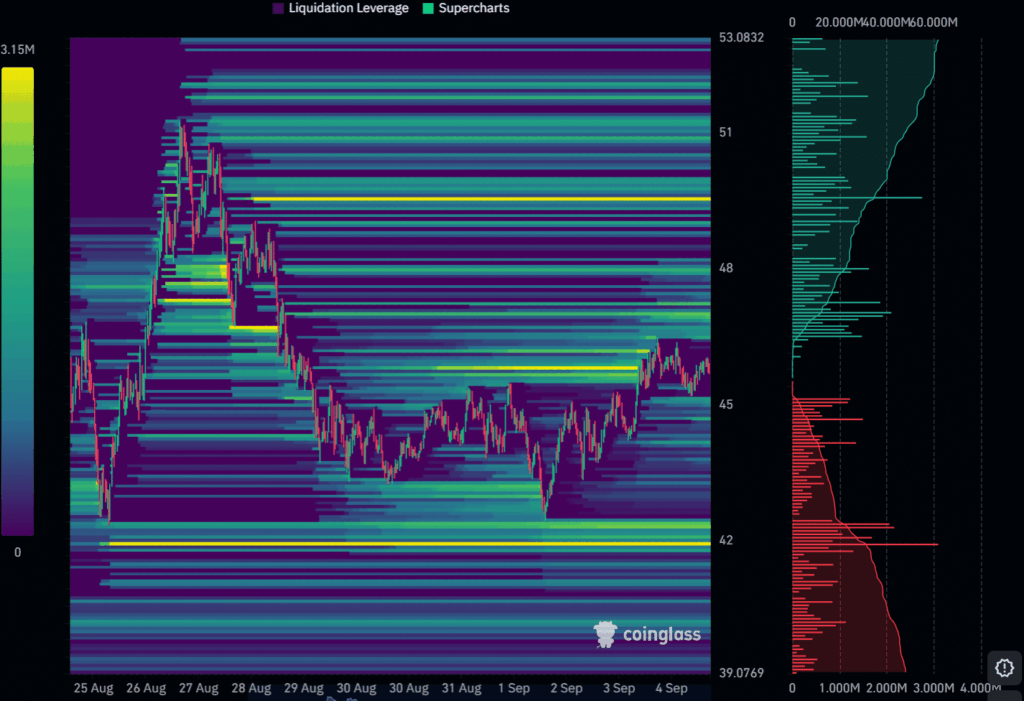

Currently, the token is holding above $40 after a modest 10% pullback from its recent peak. According to Coinglass, the net outflows from exchanges during this dip signal accumulation, supporting a “buy-the-dip” trend among holders.

Meanwhile, liquidity clusters at $41.8 and $49.6 mark key levels to watch in the lead-up to a potential Fed rate cut later this month.

Comments are closed.