Featured News Headlines

Ethereum Back in Focus as Whale Reshapes the Market

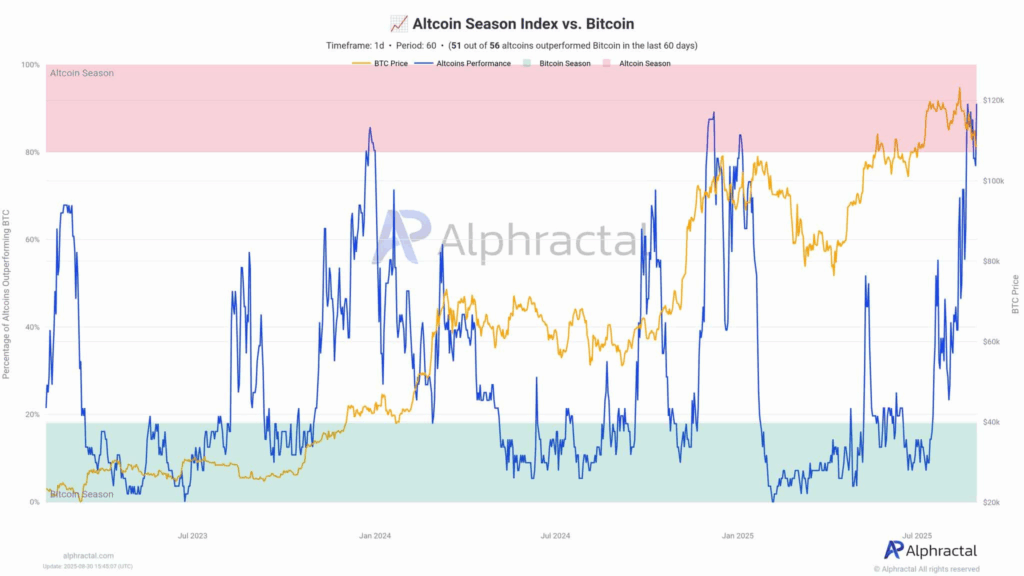

Ethereum [ETH] is back in the spotlight after a high-profile Bitcoin whale redirected billions into the smart contract giant. The shift, occurring amid shaky macro conditions and fading altcoin momentum, has reignited speculation about Ethereum’s next breakout.

$3B Already In, $650M Still Waiting

A whale previously holding nearly $6 billion in Bitcoin has quietly funneled over $3 billion into Ethereum, according to on-chain data. Most of the ETH purchased has been staked, further reducing circulating supply. The move began with a $1.1 billion wallet transfer, followed by a $434.7 million ETH buy via decentralized exchange HyperUnit.

Still, the whale has approximately $650 million reserved—reportedly aimed at ETH—which could further tilt market momentum if deployed.

$4.8K Resistance Level in Sight

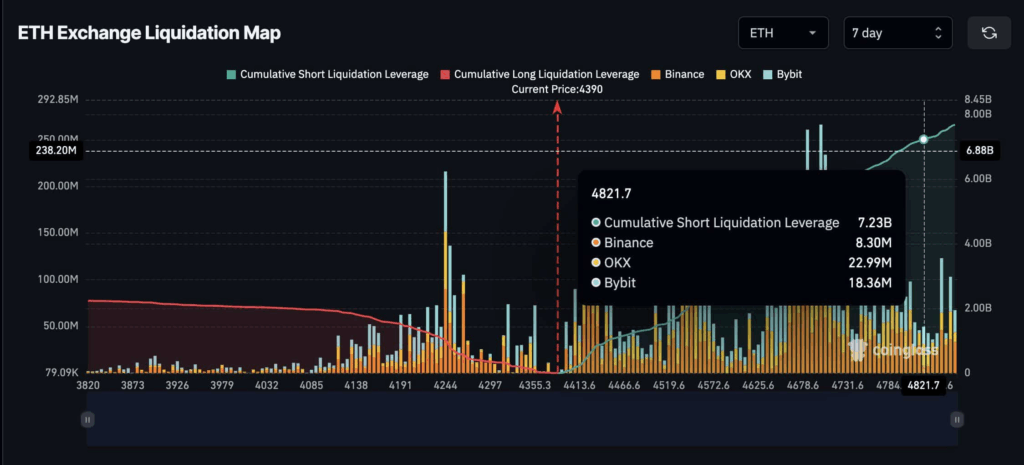

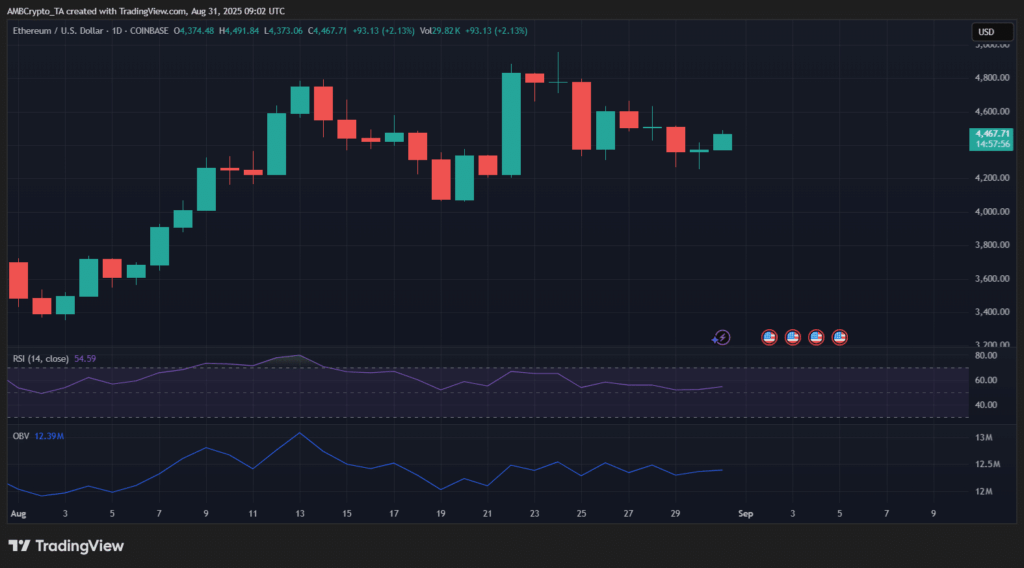

At the time of writing, Ethereum is trading around $4,467, consolidating just above the key $4.4K support zone. Market watchers are eyeing $4,800 closely, where more than $7.23 billion in short positions are currently stacked.

Analyst TedPillows noted on X,

“This doesn’t happen during market strength,”

commenting on the retracement after the Jackson Hole speech. Still, he remains long-term bullish, calling $10K ETH a likely target this cycle.

If ETH can break past $4.8K cleanly, it could trigger a short squeeze, potentially flipping bearish sentiment into a full-blown rally.

Ethereum Leads in Sector Strength

Despite weakness in other areas like gaming, staking, and AI tokens, Ethereum has outperformed in late Q3. AMBCrypto reported a sector dominance score of 0.20, placing ETH ahead of Layer 2 and DeFi competitors.

For now, with a neutral RSI (54.59) and steady OBV (12.39M), ETH continues to hold its ground—waiting for the next major move.