Ethereum Growth Story: What’s the Reason for the Rally?

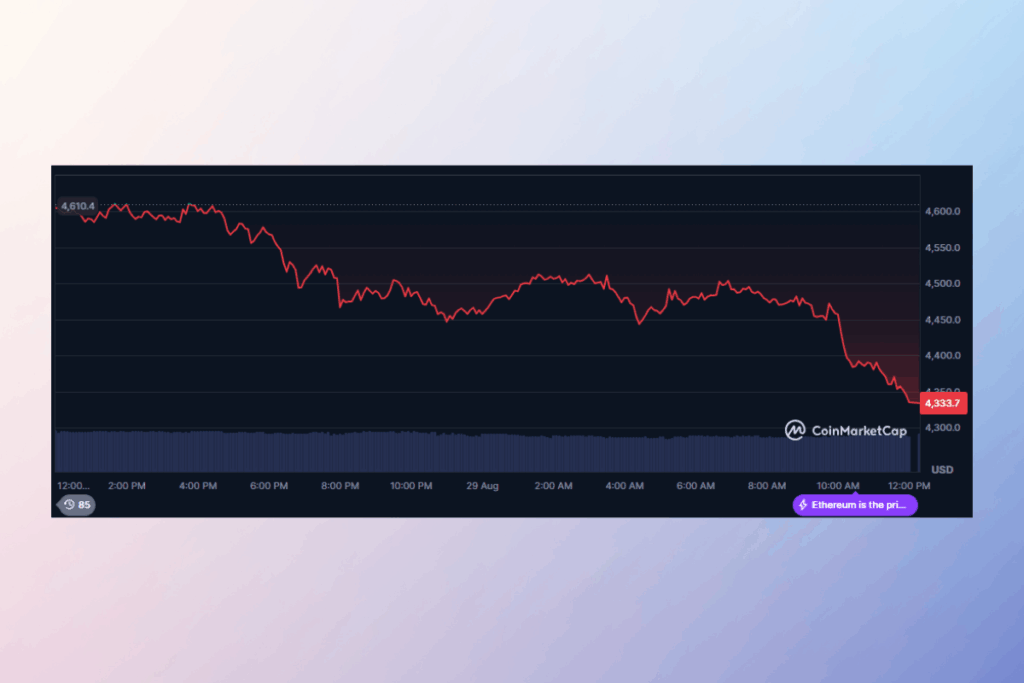

Ethereum’s capacity to attract institutional interest and funding is supporting market sentiment, despite the late-summer trade drifts in the larger cryptocurrency market. In contrast to Bitcoin’s 5.5% negative return over the last 30 days, the second-largest cryptocurrency has increased by more than 17%, according to CoinGecko data. It comes after a record-breaking run earlier this week, when Ethereum reached its highest price ever on Sunday at $4,945.

Ethereum offers a dynamic growth story,

Xu Han, director of Liquid Fund at HashKey Capital

Record Ethereum Staking Levels Highlight Institutional Confidence

The data analysis tool Beaconchain reports that this year has seen a steady rise in the quantity of Ethereum used for staking activity. A record high of 35,750 ETH, or around $169 million, was reached on August 2. Even while that number has essentially leveled off in recent weeks, Han stated that institutional inflows into Ethereum ETFs are still driven by structural advantages. He went on to say that Ethereum’s function as the framework for DeFi and tokenization makes this allure even stronger.

BlackRock Eyes Approval as Ethereum ETF Demand Skyrockets

As of August, the Securities and Exchange Commission has not yet authorized any Ethereum staking ETFs in the United States. Some, like BlackRock, a digital asset manager, are hopeful that things will improve shortly. Nonetheless, spot-based products continue to receive the most attention. After a $237.7 million outflow between August 15 and August 20, Ethereum ETFs recovered. According to data from SoSoValue, Ethereum ETFs have received inflows totaling more than $1.2 billion as of this Thursday.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.