Ether Sets New All-Time High: Is Rally Just Starting?

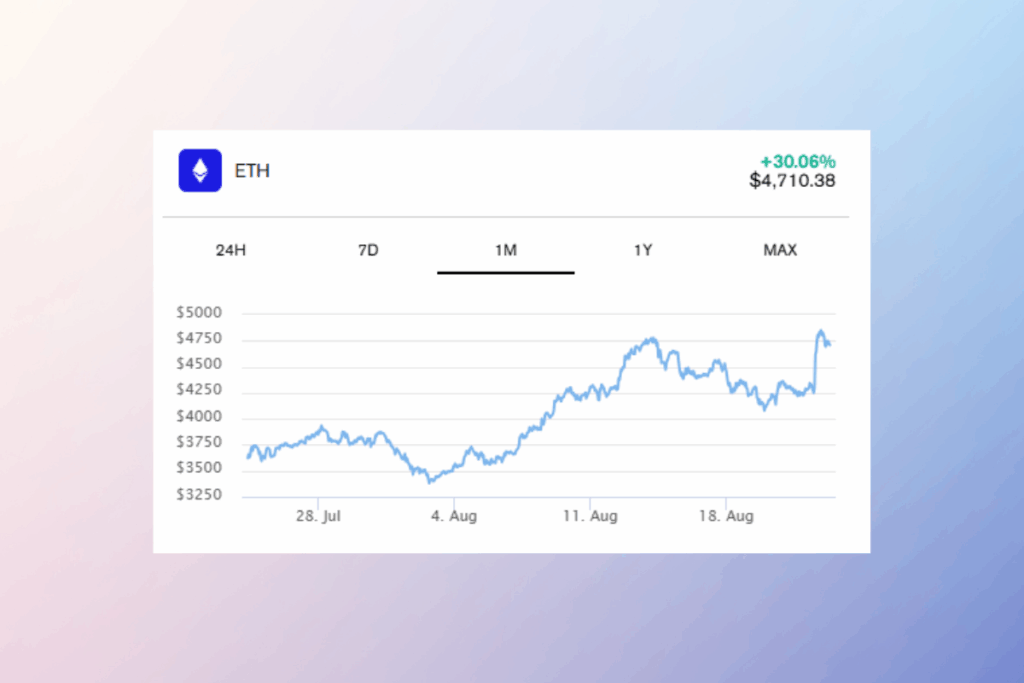

On Friday, Ethereum broke a nearly four-year record and reached a new all-time high. According to CoinMarketCap data, the second-largest cryptocurrency by market capitalization is up 15% in the last day to $4,884, breaking its previous record of $4,878 established in November 2021. Growing interest from established banking businesses, a more favorable regulatory environment, and swelling ETH treasuries all contributed to this spike.

Ethereum Outpaces Bitcoin: Is a New All-Time High Next?

As investors pour money into the exchange-traded funds, the price of ETH has more than doubled in the past two months, surpassing even Bitcoin. The price of ETH fell with the rest of the market, falling to less than $4,100 earlier this week after nearly hitting a new record on August 14. However, Friday saw a general spike in cryptocurrency values in response to remarks made by Federal Reserve Chair Jerome Powell that seemed to hint at the possibility of an impending interest rate cut. Within an hour of the remarks, Ethereum surged by around 8%, and it kept rising after that.

It’s finally ETH’s moment to shine: record ETH ETF inflows and the launch of large ETH digital asset treasuries, coupled with broader ecosystem success—Circle and Bullish IPOs, and Trump’s executive order allowing digital assets in 401(k)s. Jerome Powell’s dovish speech today hinting a rate cuts was the final push ETH needed. Sentiment in the trenches for ETH is strong as well. Layer-2s like Base continue to grow, and ETH still bodes the most DeFi liquidity by a factor of 9x above the second, Solana. We’re still in the early innings here for ETH, the world’s global settlement layer.

Brian Huang, co-founder of Glider

Ethereum ETFs See Record $1B Inflows as Institutional Demand Surges

Growing demand for ETFs has contributed to the recent Ethereum bubble. For the first time since their launch in July 2024, U.S. spot Ethereum ETFs had inflows of more than $1 billion in a single day last week. Additionally, Ethereum funds have been outperforming Bitcoin ETFs in terms of gains; however, they have also declined more quickly on days when prices have fallen.

The profits have coincided with the growth of businesses that have made Ethereum their top priority. BitMine Immersion, a Bitcoin miner, has increased its assets to over $7 billion in recent weeks, while SharpLink Gaming, which switched from online marketing, has amassed over $3.5 billion in Bitcoin. These firms are imitating the Bitcoin treasury company Strategy, which began purchasing the biggest cryptocurrency by market capitalization in 2020 in order to boost its stock price. Dozens of followers have been influenced by the move and have begun investing in additional assets such as Ethereum, Solana, and BNB.

There are a lot of tailwinds behind ETH at moment. Record ETH ETF inflows and aggressive buying from treasury companies are offering tangible demand. On top of this, Ethereum is at the center of several key themes that are garnering the attention of traditional financial institutions. These include tokenization of traditional assets and stablecoins. These are major economic themes, and Ethereum is emerging as a strong candidate to host this new influx of capital and interest.

Strahinja Savic, head of data and analytics at FRNT Financial

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.