From Euphoria to Doubt: XRP Faces Dramatic Sentiment Shift

We are about to leave behind a week in which the balance for XRP shifted from start to finish. Last week, it surpassed the $3.65 threshold, which had not been seen in eight years. With things finally looking up for XRP, what has changed?

The probability of XRP hitting $4 was 66% last week, according to users on Myriad, a prediction market. Today, the odds have fallen: 49% for the doom outcome of $2 and 51% for the moon scenario of $4. Compared to yesterday, when bears effectively turned the tide and put the $2 scenario at 61%, those odds are marginally better. However, in any case, it’s a rather striking sentimental reversal.

XRP Faces Key Technical Test: $3 Resistance vs. $2 Downside Risk

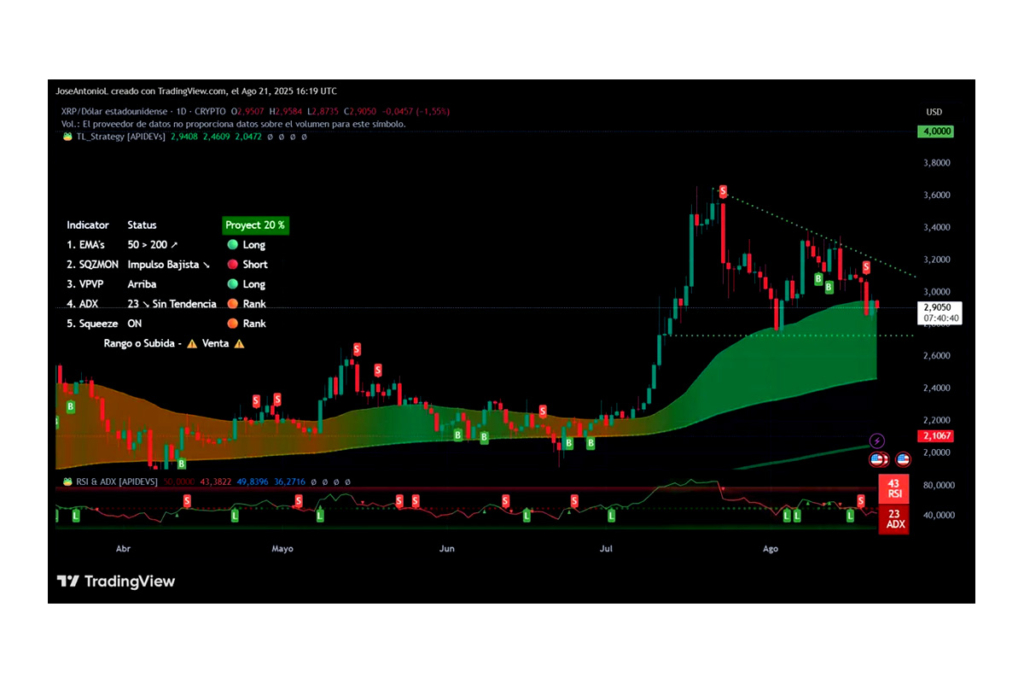

After opening at $2.95 and attempting to surpass the psychologically critical $3 mark, the coin violently rolled over to reach lows of $2.85. Since then, it has leveled off at about $2.84. However, the price of XRP has done something that many traders would find concerning, according to the daily chart. It has broken below the average price of the previous 50 days. Even though it might not be sufficient to drop below the 50-day EMA in order to initiate algorithmic sells, Myriad users should take this into account.

Bulls may find it more challenging to break over the $3.00 price mark and hit the $4 moon target if the XRP market begins to see the 50-day EMA as resistance, even in an otherwise bullish trend. However, $2 remains below the 200-day EMA, so significant bearish momentum would be required for XRP to reach that level.

XRP Loses Strength: RSI and ADX Flash Bearish Warnings

The Relative Strength Index (RSI) for XRP has fallen to 43, far below the neutral 50 level. This represents a significant decline below 50. Real bearish momentum is building at 43. An RSI below 45 could be interpreted by traders as a signal of further declines unless buyers intervene forcefully, given other factors.

The Average Directional Index, or ADX, for XRP is currently at 23, below the critical 25 level. This implies that XRP has lost its upward momentum and moved into a risk area where the permabulls aren’t powerful enough to sustain price pumping. Technical indicators are generally displaying conflicting signals, necessitating cautious examination for individuals who wish to place wagers.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.