Institutional Ethereum Holdings Soar: Could This Be the Next Big Bull Catalyst?

Ethereum is attracting the interest of many organizations. In this regard, StrategicETHReserve’s data shows that 4.1 million is the entire value of ETH holdings in treasuries. These holdings, which total more than 100 ETH across 69 entities, are dispersed. About 3.39% of the entire supply of ETH was represented by that.

The increasing institutional confidence in Ethereum as a long-term asset is demonstrated by this degree of accumulation. According to analysts, these concentrated holdings may be crucial in lowering market volatility and fortifying ETH’s floor price. Ethereum is anticipated to play a bigger part in Web3 innovation and decentralized finance (DeFi) as more treasuries embrace it.

Top Ethereum Holders: BitMine, SharpLink, and More

BitMine Immersion Technologies is the owner of the most ETH of all of them, with approximately 1.5 million ETH worth nearly $6.6 billion. Its business focus has changed from mining Bitcoin to accumulating Ether. On the other hand, in terms of ETH holdings, SharpLink Gaming comes in second with over 740,800 ETH in its treasury, which is valued at roughly $3.2 billion. About 345,400 ETH are held by the Ether Machine, whereas 231,600 ETH are held by the Ethereum Foundation.

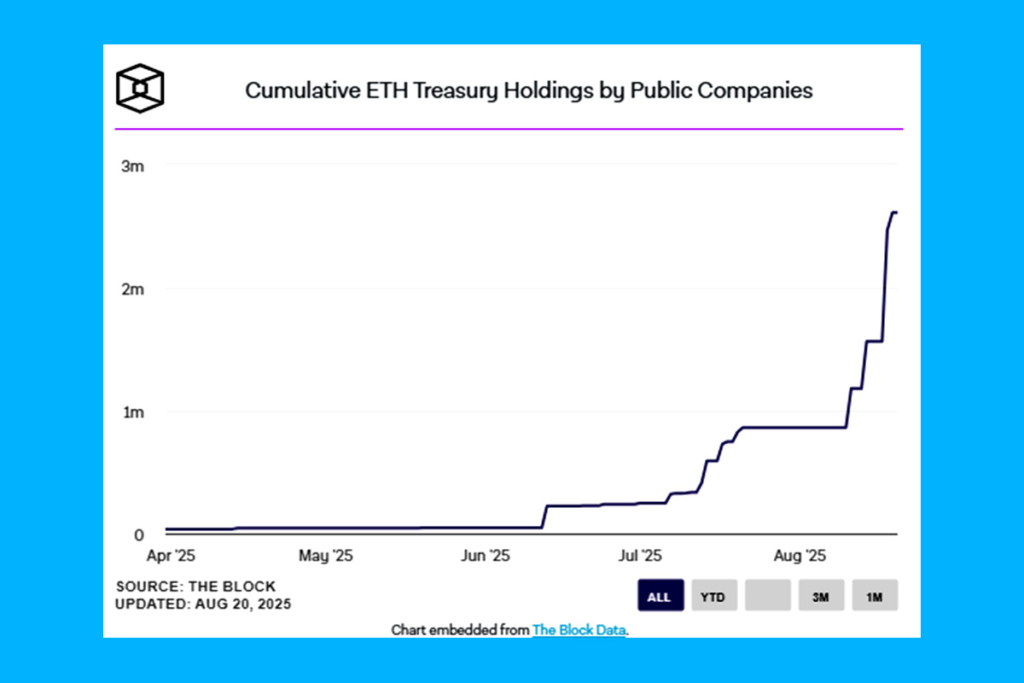

Institutional Ethereum Holdings Reach Record Highs

With Ethereum treasuries emerging as a key topic in the cryptocurrency sector, digital asset treasuries, or DATs, have gained popularity. Notably, The Block’s dashboard shows that as of Wednesday, public firms’ total ETH treasury holdings stood at 2.6 million ETH, or roughly $10.9 billion. This increase demonstrates the growing institutional belief in Ethereum as a fundamental layer for decentralized applications and as a store of value. The widespread corporate integration into the digital asset system may be accelerated by treasury acceptance, given Ethereum’s crucial position in DeFi, NFTs, and Web3 infrastructure.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.