Insane ETH Trade: Small ETH Bet Into Millions of Dollars!

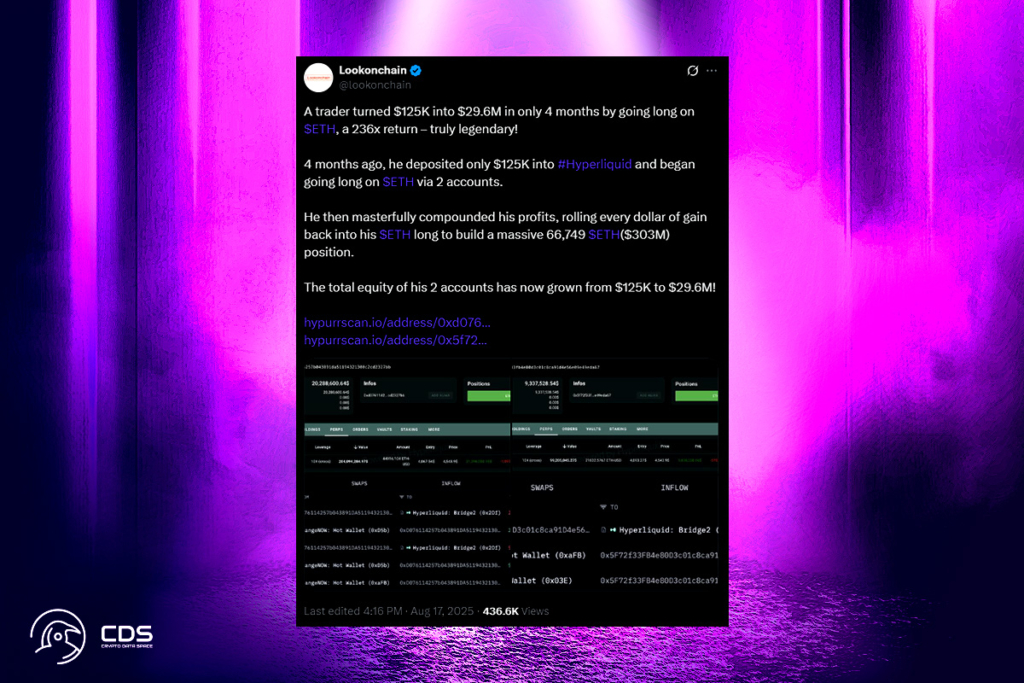

Even as whales started locking in gains during the recent boom, a cryptocurrency investor traded Ether on a decentralized exchange and made a multimillion-dollar profit from a $125,000 bet. Before the most recent market slump damaged his Ether long position, the astute trader had made an initial investment grow to a peak of almost $43 million in just four months.

Despite Crash, Ethereum Trader Secures Massive 55x Profit

According to blockchain data platform Lookonchain, the astute trader liquidated all of his positions despite the market decline, locking in a net profit of $6.86 million on Monday, producing an astounding 55-fold return on his initial investment. He compounded every profit into his $ETH long, ultimately accumulating a huge $303 million position, according to Lookonchain’s Sunday post article. To determine short-term momentum, traders frequently track the transaction patterns of whales, or large investors. These investors have the ability to hold market-moving sums of money in the cryptocurrency that underlies it. The information provided by Lookonchain is crucial because of this.

Ethereum’s Rally Stalls as Whales Cash Out Millions

According to statistics from Farside Investors, US spot Ether ETFs experienced withdrawals of $59 million on Friday, breaking eight days of net positive inflows before last weekend. More Ether whales have begun locking in profits in preparation for a possible fall during the remaining August break period, following Friday’s ETF outflows.

According to Nansen statistics, the wallet with the code “0x806,” which is among the top 100 Ether traders it tracks, sold more than $9.7 million worth of Ether on Monday. This was the second-largest Ether sale in the previous 24 hours. Wallet “0x34f,” another top 100 Ether trader, also sold $1.29 million worth of Ether, and many other whales sold millions of the second-largest cryptocurrency in the world.

Ethereum’s strong run has invited some profit-taking, which may limit immediate upside momentum and instead set the stage for consolidation,

Ryan Lee, chief analyst at Bitget exchange

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.