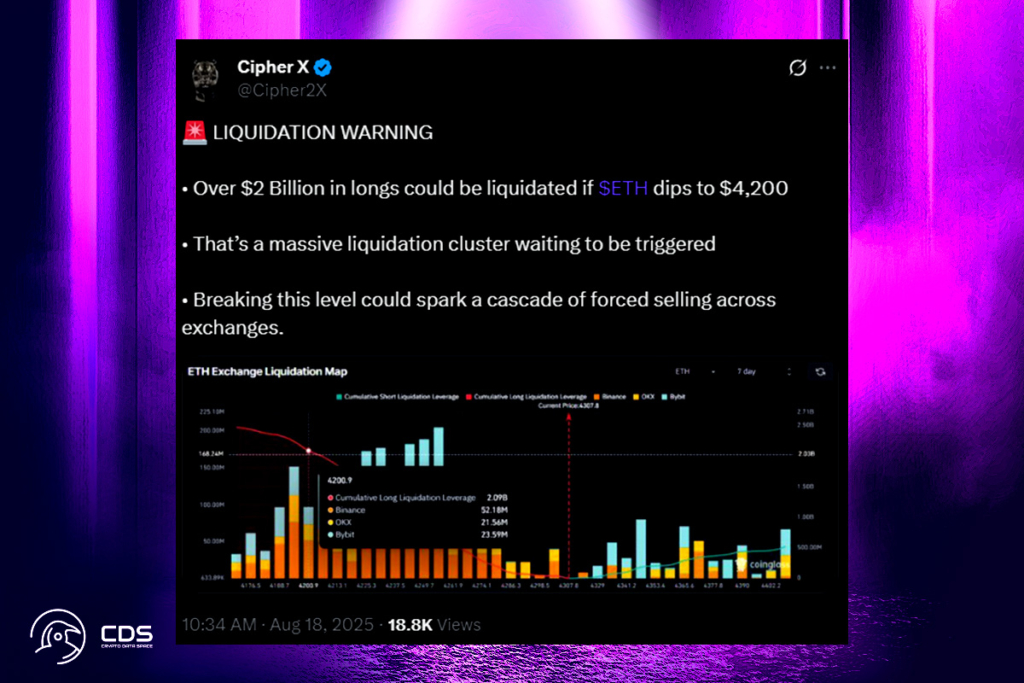

Ether Faces Liquidation Danger Zone: Traders Brace for $2B Shakeout

At the time of writing, Ethereum was down 4.61% in a day and somewhat over the week, trading at $4,328. According to Cipher X, analysts are keeping a careful eye on the $4,200 mark, where more than $2 billion in long bets may be vulnerable to liquidation. According to exchange data, the area right below the present price has the highest concentration of leverage. With further bets on OKX ($21.56M) and Bybit ($23.59M), Binance’s liquidation exposure is close to this level at $52.18M.

Breaking this level could spark a cascade of forced selling across exchanges,

Cipher X

$4,000 Retest Could Trigger $5,000 Surge

Recently, Ethereum closed a weekly candle above $4,000, which some analysts believe is a crucial level for trend structure. According to cryptocurrency analyst Lennaert Snyder, an upswing is still supported by any price action above $3,490.

Flipping $4,000 into support would be a very bullish retest,

Snyder

The current range of support levels is $4,240 to $4,190. The $4,550–$4,571 range is viewed as a potential breakout area, and resistance is higher. A clear advance above $4,780, which Snyder indicated as a range high, might pave the way for a test of $5,000.

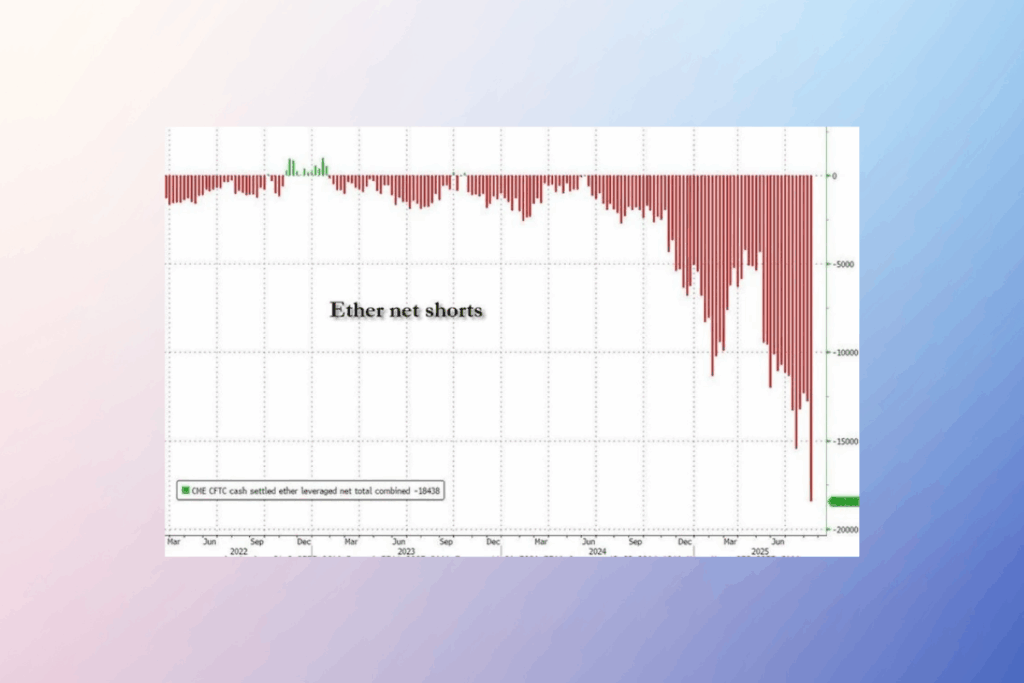

ETH Traders Brace for Volatility as Shorts and Spot Demand Collide

Ethereum has seen an increase in short interest at the same time. Based on data, institutional short exposure to CME futures just reached a record high number. There is now more friction between spot demand and futures positioning as a result of ETFs’ ongoing spot accumulation. A potential short squeeze is being watched by traders if Ethereum maintains its current levels and rises. As a result, some trades might have to settle quickly, which would increase price volatility in both directions.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.