28 March XRP Price Outlook: Is a Major Selloff on the Horizon?

The price of XRP is still below the overall cryptocurrency market this week, despite the fact that several altcoins had a positive turn as Bitcoin surged to $88,800. Over the last seven days, the cryptocurrency has dropped 4.88%, halting the 11% gain that occurred on March 19, the day when the Ripple SEC lawsuit ended and made headlines. Additionally, the trading volume of XRP has decreased from approximately $4 billion to $3.2 billion.

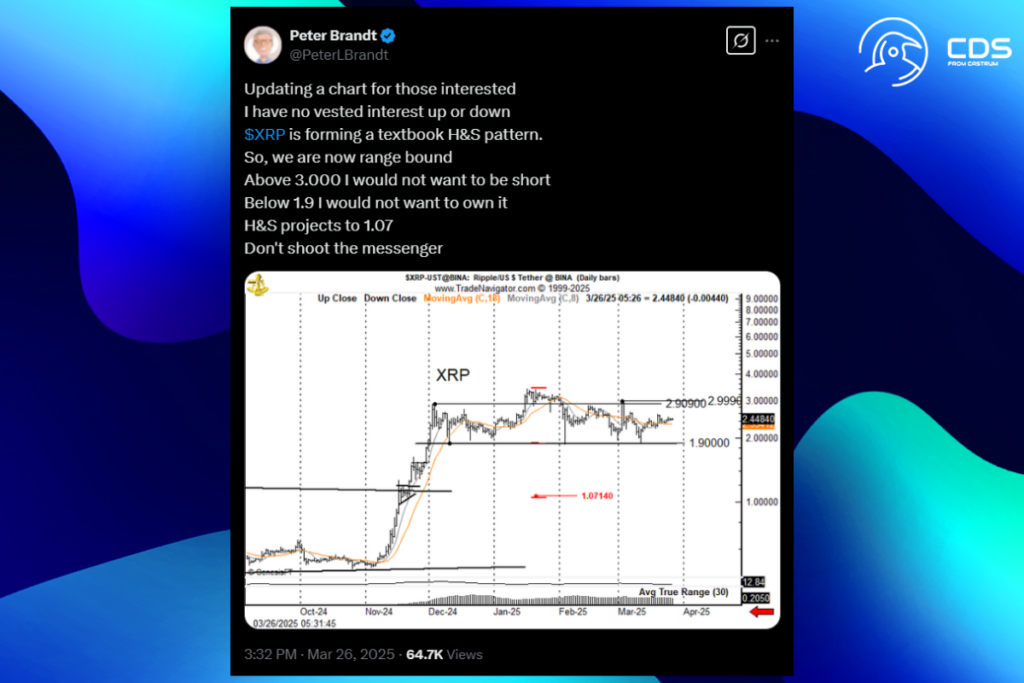

Veteran trader Peter Brandt stated in a recent X post that the existence of a textbook head-and-shoulders pattern (H&S) might cause the price of XRP to plunge as low as $1.07. A price surge above $3 might render the H&S pattern worthless, Brandt said. However, a 55% correction is possible if the price falls below $1.90.

Below $1.9, I would not want to own it. H&S projects to $1.07. Don’t shoot the messenger.

Brandt

XRP Price Poised for a Major Bull Run? Key Indicators Flash Green!

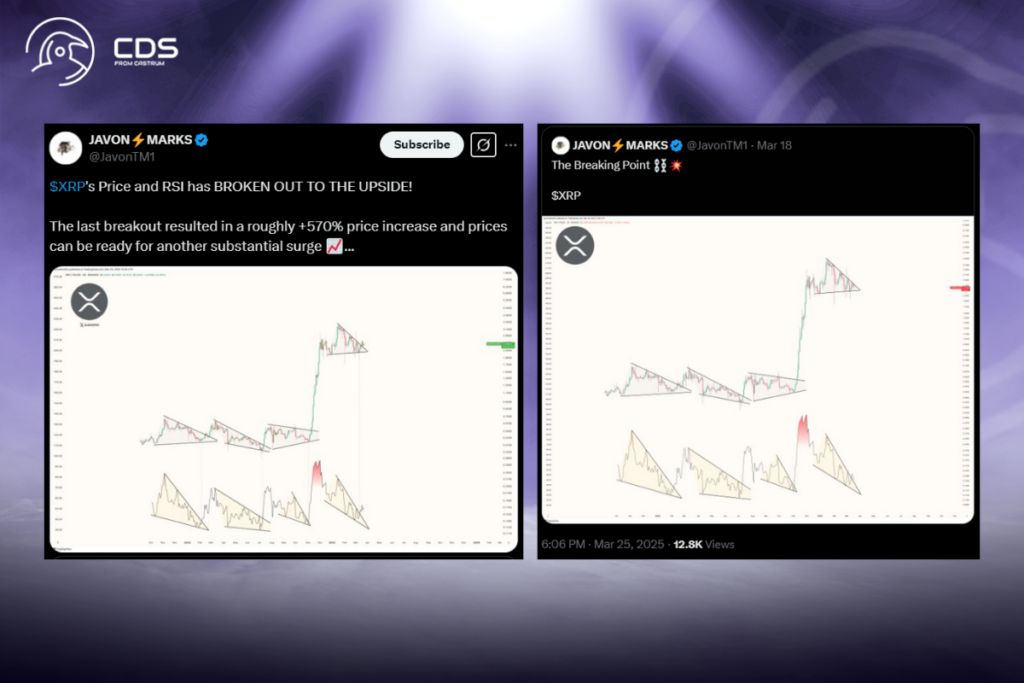

Conversely, Javon Marks pointed out a promising breakout for XRP. The relative strength index (RSI) and the price of XRP have both traded above their falling wedge formations, according to the cryptocurrency trader. In the past, this kind of arrangement has helped the altcoin generate a profit.

The last breakout resulted in a roughly +570% price increase and prices can be ready for another substantial surge.

Marks

Technically speaking, given XRP’s current market structure, it is a little early to anticipate a retest of the $1.07 level. The $1.90 barrier has only been tested three times since November 2024, despite the fact that XRP has been declining since the beginning of 2025. Investors may consider this area as a possible buy-back zone because XRP has not had a daily close below the $2 mark since it traded above it.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment