XRP Price Outlook: Consolidation Phase Could Lead to Significant Losses

XRP Price Prediction for 2025 – XRP, the cryptocurrency that has seen immense attention in recent years, has found itself stuck in a prolonged consolidation phase, hindering its ability to reach the $3.00 mark in 2024. With January 2025 rapidly approaching, the prospects for XRP achieving this milestone in the short term appear slim. Market conditions, along with technical indicators, suggest that XRP’s rally is delayed, leaving many investors wondering when the altcoin will regain momentum.

XRP Faces Strong Resistance and Technical Setbacks

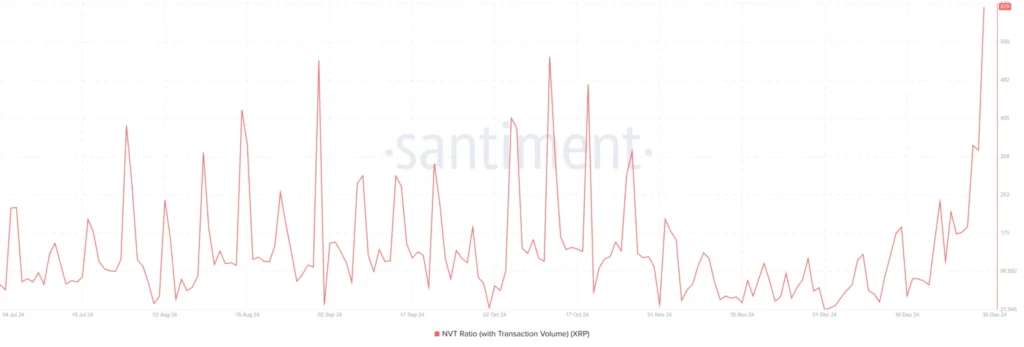

The NVT (Network Value to Transaction) ratio is one of the primary indicators pointing to XRP’s struggles. The NVT ratio suggests that XRP’s network value is growing faster than its transactional activity, which historically has been a precursor to market corrections. When the network value gets inflated without corresponding transaction volume, it often leads to sharp declines in price, putting investors at risk. This pattern indicates that without an increase in transactional activity, XRP’s network value could be unsupported, leading to stagnation or even further downward movement.

MACD Indicator Shows No Signs of Recovery

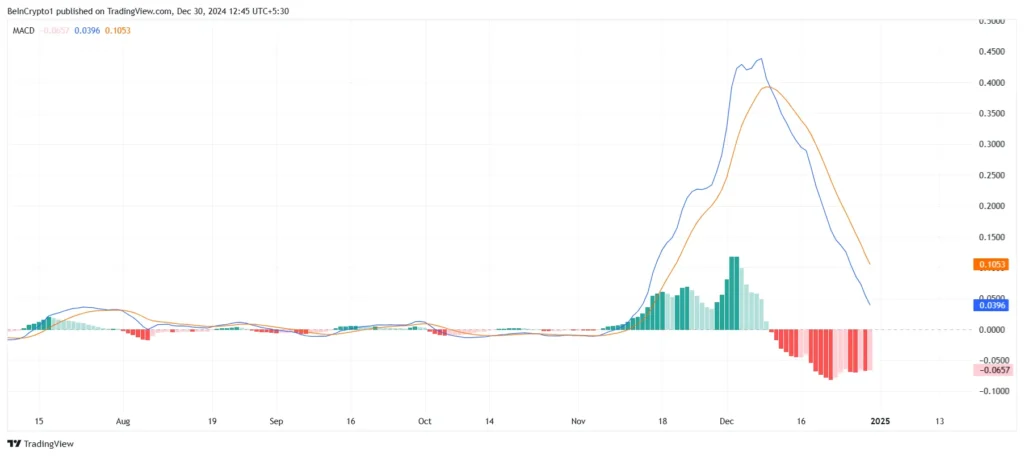

The MACD (Moving Average Convergence Divergence) indicator, a key technical metric used to track price trends, adds to the negative outlook for XRP. The absence of a bullish crossover on the MACD suggests that the altcoin is likely to face further downward pressure in the near future. The bearish crossover currently in place reflects broader negative market signals, and the situation is unlikely to change as 2025 approaches. Until the trend reverses, XRP will likely remain trapped in its current consolidation range with a strong resistance around $2.73.

XRP Price Prediction: A Long Road to $3.00

XRP has been consolidating within a narrow price range for the past month, lingering just below the $2.73 resistance level while maintaining a support at $2.00. This consolidation pattern is reminiscent of the period earlier this year, where XRP remained stagnant for over three months before experiencing a surge in November 2024. If history repeats itself, XRP may not reach $3.00 until the end of February 2025, as the altcoin could continue its sideways movement during the early part of the year.

However, this extended consolidation phase presents a risk of significant selling pressure. If selling activity intensifies, XRP could dip as low as $1.28, compounding losses for investors already feeling the weight of its stagnation. The question remains: will XRP manage to break free from this bearish trend?

A Shift in Market Sentiment Could Change XRP’s Trajectory

Despite the current bearish outlook, a shift in market sentiment could potentially reverse XRP’s fortunes. If XRP manages to break the $2.73 resistance level, it could quickly surge toward $3.00, invalidating the current negative forecasts. Such a move would signal a renewed bullish phase for the altcoin and may even propel it to a new all-time high, surpassing its previous peak of $3.31. This scenario, however, requires strong support from the broader cryptocurrency market, alongside increased transactional activity and improved investor sentiment.

Conclusion: XRP’s 2025 Prospects Hang in the Balance

XRP’s current price action is marked by extended consolidation and bearish technical indicators, making it difficult for the altcoin to achieve the $3.00 milestone in the short term. With the MACD showing no signs of a reversal and the NVT ratio suggesting a misalignment between network value and transaction volume, XRP faces significant downward pressure as 2025 approaches.

Yet, despite these hurdles, market sentiment and a potential breakthrough of key resistance levels could ignite a rally, pushing XRP toward new heights. Investors should closely monitor market dynamics, as XRP’s future price movements will depend heavily on changes in both market sentiment and transactional volume in the coming months. As the year unfolds, the cryptocurrency’s trajectory remains uncertain, with both bullish and bearish scenarios in play.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment