XRP Price Forecast: Can It Withstand Whale Selling and Rising Exchange Reserves?

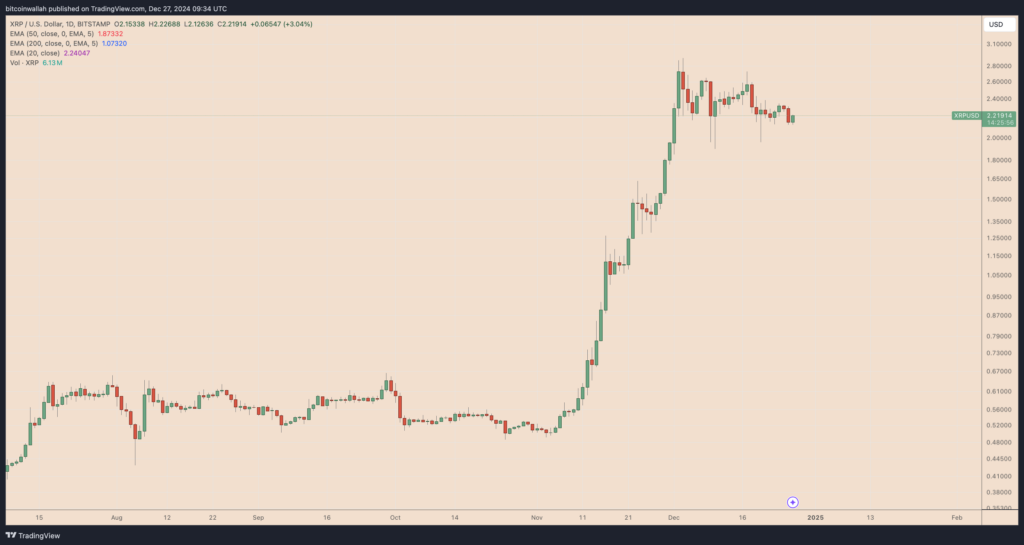

XRP Price Forecast – XRP’s impressive rally of over 300% in the past two months seems to be losing steam. Trading at $2.10 as of December 27, XRP now faces significant short-term downside risks. Despite the substantial gains, warning signs suggest that XRP/USD could erase at least 25% of those gains in the coming weeks.

XRP Approaches Critical Breakdown Point

XRP’s price is currently trading within a descending triangle pattern, a classic bearish formation that typically signals further declines. This pattern is characterized by a series of lower highs forming the triangle’s descending trendline, while the $2.10 level is acting as horizontal support. If XRP fails to hold this support, a decisive breakdown could trigger a deeper correction.

Technical analysis suggests that the potential downside target for XRP could be around $1.64 in January 2025, marking a 25% drop from its current price. The breakdown could open the door for further declines as the descending triangle suggests continued bearish momentum. Traders are watching closely to see if the $2.10 support holds, as any breakdown below this level could exacerbate the downward pressure.

Whale Selling Intensifies, Adding to Bearish Outlook

On-chain data further supports the bearish outlook for XRP. Whale addresses, or large investors holding over 1 million XRP, have been actively reducing their positions. Since the beginning of December, the supply held by these whales has declined by a staggering 180 million XRP. Similarly, entities holding 100,000 XRP or more have reduced their supply by 170 million XRP.

This large-scale selling by whales adds downward pressure to the price of XRP, as it increases the supply of tokens circulating in the market. The combined effect of the price decline and the whale sell-off suggests that demand is not keeping pace with the increase in supply. As a result, XRP’s price may struggle to maintain upward momentum.

XRP Reserves on Binance Increasing, Signaling Profit-Taking

Adding to the bearish narrative, XRP reserves on Binance, the largest cryptocurrency exchange by volume, have been steadily increasing since mid-December. Typically, a rise in exchange reserves signals that investors are preparing to sell their holdings, which often precedes price corrections. As traders take profits at local highs, the additional supply on exchanges may further suppress XRP’s price.

Unless this trend reverses, XRP’s price could face a 25% downside risk as more supply enters the market and large holders continue to sell during rallies. The growing XRP reserves on exchanges are adding to the bearish pressure, making it difficult for the coin to sustain its recent gains.

Conclusion: XRP’s Short-Term Outlook Remains Bearish

Despite its impressive rise over the past two months, XRP’s short-term outlook is facing significant challenges. The descending triangle pattern, coupled with whale selling and rising XRP reserves on Binance, suggests that the price may continue to face downward pressure. Unless these trends reverse, XRP could see a 25% decline, bringing its price down to around $1.64 by early 2025. Investors should remain cautious as the market dynamics shift, and closely monitor any potential breakdowns or reversals in the coming weeks.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment