XRP Price Faces Critical Test Below $2.50 Resistance

XRP Price– XRP’s recent rally attempt was halted just below the critical $2.50 resistance zone, suggesting a potential shift in market dynamics. As the price struggles to maintain upward momentum, both derivatives and spot markets are showing signs that bearish pressure could be increasing.

Currently trading around $2.37, XRP has been rejected near the $2.50 mark for the third time in just two weeks. This resistance aligns with a dense supply zone visible on the price chart. XRP is holding above its 50-day moving average of $2.37, but still remains below the 200-day moving average at $2.52. This mixed technical setup indicates indecision in the market, and the Relative Strength Index (RSI) is at 48.48, suggesting neutral momentum with a slight bearish bias.

Potential Risks: A Break Below the 50-Day Moving Average

If XRP fails to maintain the 50-day moving average and breaks below this level, the token could face downside risks toward the $2.00 psychological support zone. The technical outlook shows uncertainty, with a lack of strong momentum behind the recent price action.

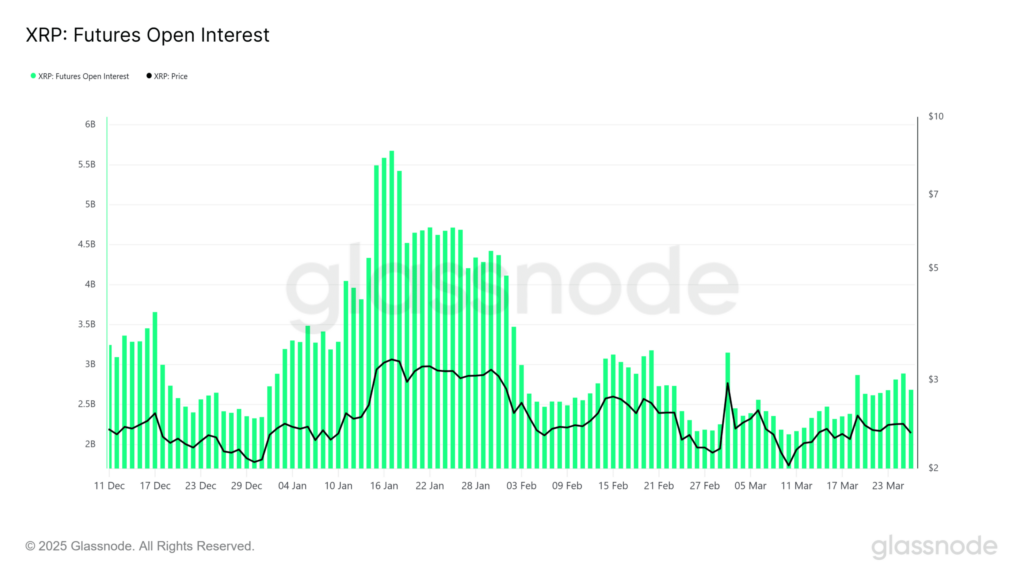

XRP futures market data also paints a cautious picture. After peaking in mid-January at nearly $5.8 billion, Open Interest in XRP futures has steadily declined to around $2.8 billion. This drop in speculative positioning suggests that traders are not yet confident in a strong bullish breakout. Volume trends remain stagnant, further implying that recent price movements are largely driven by spot market traders rather than leveraged positions.

Outlook: What’s Next for XRP?

If XRP fails to hold the $2.35 support level, a decline toward the $2.00 mark may follow. On the upside, a daily close above $2.50, accompanied by volume confirmation, could invalidate the bearish setup and signal a potential rally toward the $2.75-$3.00 range. However, this would require renewed buying pressure, which is currently lacking.

With both technical resistance and a weakening derivatives market, bearish sentiment may dominate in the short term. However, a shift in market sentiment or a significant catalyst could quickly reverse this trend.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment