WIF Price Soars 30%—Will Bitcoin’s Surge Push It Higher?

On January 29, the dogwifhat (WIF) increased to $1.31 thanks to the Fed’s rate decision. Even if inflation failed to reach the 2% objective, Fed head Jerome Powell reaffirmed that the institution was willing to lower interest rates. After the upgrade, Bitcoin surged to $105K, propelling WIF and other altcoins and meme coins. Still, it’s hard to be sure if this move is enough to bring WIF to $2.

WIF Faces Resistance at $2 Despite Strong Trading Volume—Breakout Soon?

Significant trade volume was indicated by the OBV’s jump on the daily price chart. On January 29, WIF observed a huge $326 million in daily trading volume, which was significantly larger than the bid volumes recorded in March 2024. Unfortunately, as of this writing, the OBV has not reached a higher high to indicate additional traction. In order to support sustained purchasing pressure, the daily RSI also partially recovered from the oversold area but remained below neutral.

Although the U.S. inflation statistics may cause this bearish technical chart reading to shift, the current reading did not indicate a big WIF leap to $2 (overhead resistance zone, red). WIF’s rise to $2 or higher, however, might be accelerated by weak U.S. inflation data (the PCE index).

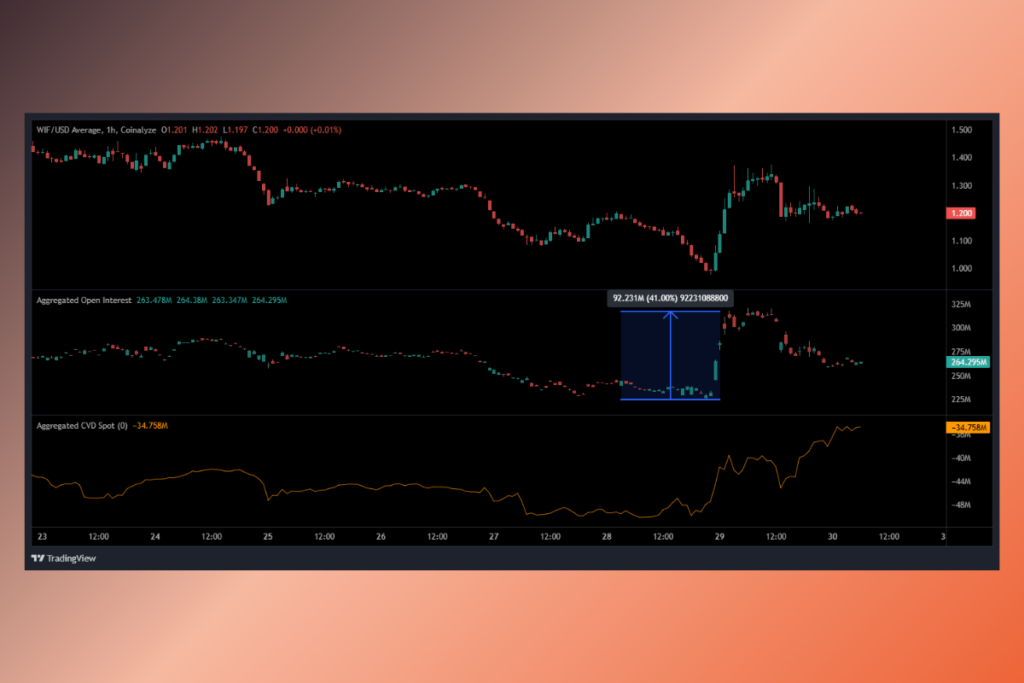

WIF’s Open Interest Drops But Spot CVD Signals Sustained Buying

Data from Coinalyze indicates that the spot and futures markets demonstrated robust demand during this surge. An increase in cumulative volume delta (CVD) and open interest (OI) rates demonstrated this. OI increased by more than 40% during the rally, indicating that the spike was partially driven by enormous leveraged trading. Nevertheless, the CVD spot increased while the OI subsequently decreased. This indicated that despite declining futures interest, spot market demand stayed consistent, which might be advantageous for WIF if the pattern holds.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment