Why is Solana price up today?

Solana is outpacing many of its leading cryptocurrency competitors today, fueled by reports that David Sacks has been named as Donald Trump’s artificial intelligence and cryptocurrency czar.

Sacks’ Pro-Solana Stance Drives Optimism

The price of Solana (SOL) surged by as much as 5.42%, reaching $247 on December 6, following the announcement of Sacks’ new role as the chief policy strategist for AI and crypto under Trump’s administration.

Sacks has a notable history of supporting Solana as an investor. In a 2022 episode of the All-In Podcast, he openly confirmed owning Solana tokens during a discussion with other venture capitalists about their cryptocurrency portfolios.

Reports further suggest that Sacks was among the early adopters of SOL tokens, strengthening his reputation as a Solana advocate. His involvement in Trump’s administration has sparked excitement among traders and analysts, with some predicting it could pave the way for the approval of a spot Solana exchange-traded fund (ETF) by 2025.

Memecoin Mania Propels Solana Activity

Solana’s rise today coincides with a strong performance from its native memecoins. Tokens such as Dogwifhat (WIF), Bonk (BONK), and Peanut the Squirrel (PNUT) have posted gains ranging between 4.5% and 7.5% over the past 24 hours.

Additionally, Gigachad (GIGA), a Solana-based memecoin recently added to Coinbase’s listing roadmap, climbed by 2.6% during the same period.

This memecoin trading frenzy has significantly increased on-chain activity, driving demand for SOL as the gas token facilitating transactions on the Solana blockchain.

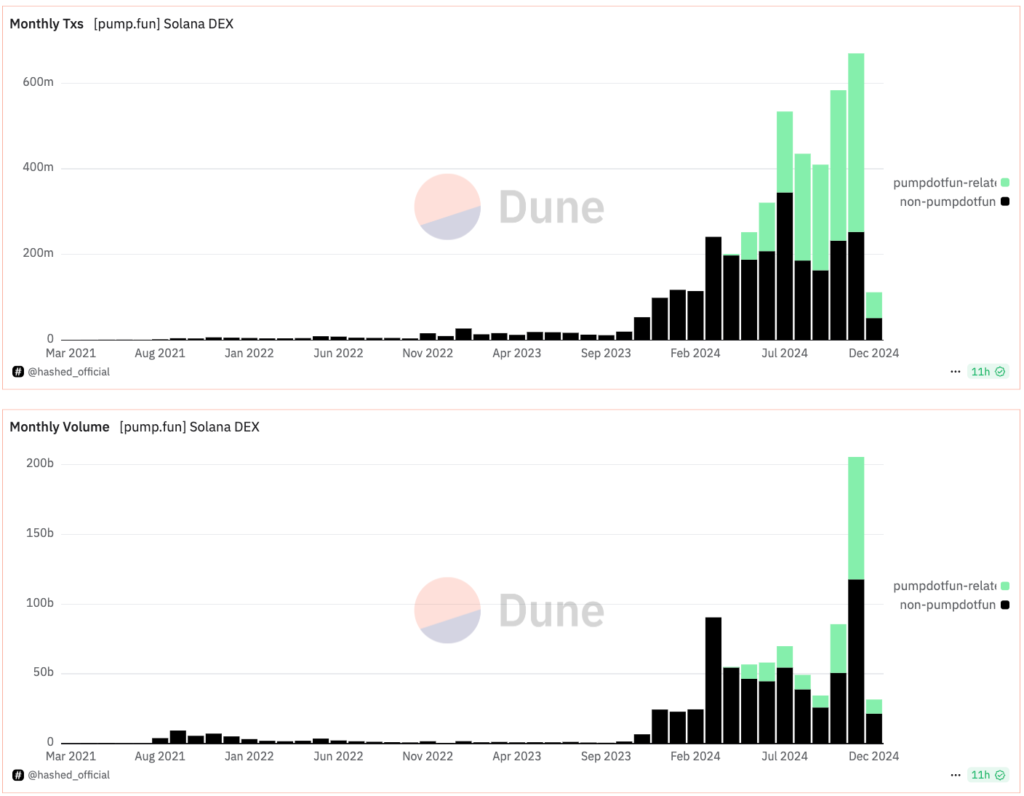

According to Dune Analytics, the Solana network has seen over 4.32 million memecoin project launches on the pump.fun platform, generating approximately 1.61 million SOL in revenue—equivalent to about $383 million.

November marked a high point for memecoin activity on Solana, with record transaction volumes and trading activity. This surge led to a 4.5 million SOL increase in total value locked (TVL) on the network and a corresponding 40% rally in SOL price.

Today’s memecoin boom appears to mirror this pattern, further underscoring the growing demand for SOL as the ecosystem’s primary utility token.

Technical Patterns Hint at Solana Rally to $300

Solana’s recent price movement suggests a potential rally toward the $300 mark, driven by a rebound from the lower trendline support within its ascending triangle pattern.

Ascending triangles are continuation patterns in uptrends, often indicating a pause before the next leg of the rally. These patterns typically resolve with a breakout above the upper trendline, with the price climbing by a height equivalent to the triangle’s maximum distance.

In Solana’s case, the triangle’s height measures roughly $65. A decisive breakout above the $250 resistance level could propel SOL toward the $300–$310 range by the end of December.

Conversely, failure to breach the upper trendline may lead to extended consolidation or a potential retest of the lower support zones.

As market sentiment builds around both David Sacks’ appointment and Solana’s technical strength, traders and investors are closely watching for the next breakout in this rapidly evolving ecosystem.

Leave a comment