What Are Prediction Markets in Crypto?

Prediction markets have garnered significant attention recently due to their uncanny ability to forecast global events with remarkable accuracy, often outperforming traditional bookmakers and even polling results.

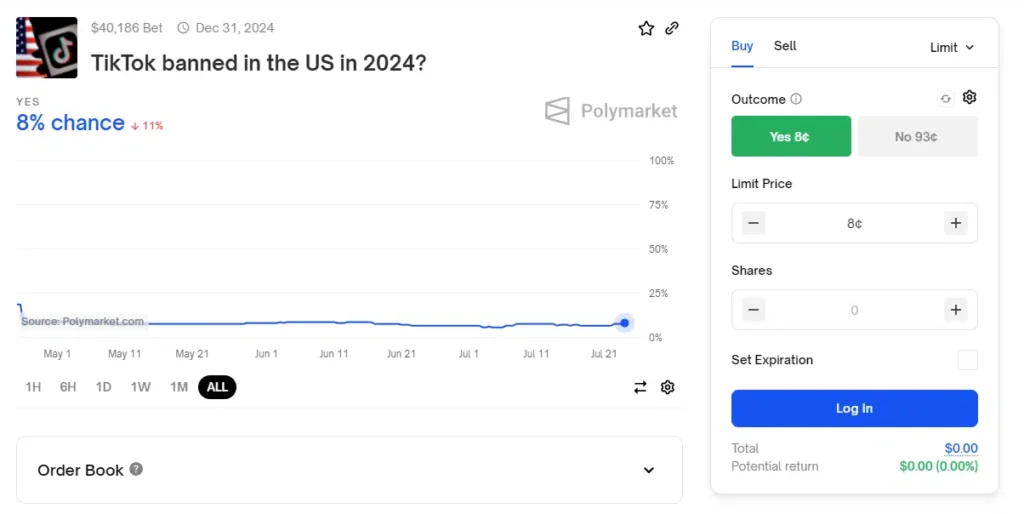

For instance, leading prediction platform Polymarket accurately predicted that Joe Biden would withdraw from the U.S. presidential race before it happened, sparking widespread interest in the concept of the “wisdom of the crowd” and the potential applications of these markets.

What Is a Prediction Market?

A prediction market is a financial platform where participants speculate on the outcomes of various events by buying and selling shares tied to specific scenarios.

For example, on Polymarket, users can trade contracts on events ranging from political elections and sports outcomes to cryptocurrency price milestones or entertainment award winners. Participants stake their money on what they believe will occur, creating a dynamic environment that reflects public sentiment and collective intelligence.

These markets attract skilled, methodical analysts who have financial incentives to share their true opinions, potentially making prediction markets a reliable tool for gauging public sentiment and even accurately forecasting outcomes in some cases.

A Brief History of Prediction Markets

While prediction markets may seem like a modern innovation, their roots stretch back centuries. Early examples include speculation on papal elections in the 1500s and political betting on Wall Street in the 1800s. Evidence also exists of such markets operating in Canada and Britain during this era.

In recent years, prediction markets have evolved into highly sophisticated platforms, leveraging advanced technology and decentralized finance (DeFi) tools to operate on a global scale.

How Do Prediction Markets Work?

Prediction markets function by allowing users to trade contracts tied to the outcome of a specific event. These markets typically involve:

- Two or More Outcomes: For instance, an election market might involve contracts for two candidates, starting with equal prices (e.g., $0.50 each).

- Fluctuating Prices: As trading occurs, the contract prices shift based on market sentiment, effectively serving as a live indicator of what the crowd predicts.

- Trading Flexibility: Unlike traditional bookmakers, prediction markets allow users to trade contracts dynamically, taking profits or minimizing losses throughout the event’s lifecycle.

In the crypto space, prediction markets often operate through a hybrid-decentralized model. While the platform might control event selection, the community provides liquidity and profits from market activity.

Types of Predictions Markets

In 2024, prediction markets can generally be categorized into four types:

- Fixed Odds Betting:

A familiar model where odds are set by bookmakers. Users cannot trade or sell contracts, and payouts depend on the timing of the bet placement. - Continuous Double Auction (CDA):

CDA markets, like Polymarket, allow participants to buy and sell contracts anytime, enabling arbitrage opportunities and dynamic trading. - Automated Market Makers (AMM):

Platforms like Augur and Gnosis use algorithms to provide liquidity and automatically adjust prices based on supply and demand. These systems are more decentralized than hybrid models like Polymarket. - Parimutuel Markets:

These markets, such as the Hollywood Stock Exchange, pool bets and distribute payouts based on the proportion of bets across different outcomes.

Types of Contracts in Prediction Markets

Prediction markets support various contract types, including:

- Binary Markets: Simple yes/no outcomes, such as predicting whether Bitcoin will surpass $50,000 by year-end.

- Categorical Markets: Multiple outcomes, offering a wider range of choices, such as predicting the winner of a music award.

- Scalar Markets: Continuous outcomes within a defined range. For example, predicting Bitcoin’s price within a range of $20,000 to $100,000, with contract value tied to proximity to the correct answer.

Leading Crypto Prediction Markets in 2024

Although crypto prediction markets are still in their infancy, several platforms have emerged as leaders in this niche:

- Polymarket:

Built on Ethereum and Polygon, Polymarket allows users to trade contracts in USDC. It is the leading crypto prediction market by trading volume. - Augur:

A fully decentralized platform on Ethereum, Augur leverages smart contracts and oracles to autonomously resolve events and pay out winners. - Zeitgeist:

Operating on the Kusama network, Zeitgeist offers diverse betting models and uses real-time oracles for live data feeds.

The Future of Crypto Prediction Markets: Priced In?

Prediction markets have remained under the radar for years, with only niche communities benefiting from the “wisdom of the crowd.” However, recent successes, such as Polymarket’s political insights, have brought them into the spotlight, attracting mainstream interest and higher trading volumes.

One looming question is whether prediction markets will become “priced in.” As they grow in influence, their predictions could affect actual outcomes, potentially creating a feedback loop that undermines their accuracy.

Regardless, the proven accuracy of prediction markets is remarkable. As they continue to evolve, these platforms may become essential tools for strategists, investors, and analysts worldwide.

Leave a comment