What Are Crypto Narratives?

Crypto narratives are the driving stories, trends, or themes that influence how cryptocurrencies are perceived, valued, and adopted. These narratives can significantly shape investor sentiment, market behavior, and technological innovation within the blockchain ecosystem.

Market participants often rely on narratives to interpret ongoing developments, predict future trends, and strategize investments. For instance, Elon Musk’s tweets have historically impacted DOGE’s price, while Bitcoin halving cycles are often seen as triggers for market bull runs. By understanding these narratives, investors and developers can navigate market dynamics more effectively.

For example, the idea of cryptocurrencies as a “store of value” has drawn investors seeking an economic hedge. Similarly, the concept of blockchain as a disruptive technology has spurred innovation, with entrepreneurs creating new decentralized applications.

Why Are Crypto Narratives Important?

Crypto narratives arise from a mix of technological potential, societal events, and industry actors’ beliefs. Mainstream media, social media, online forums, influencers, and market conditions all contribute to these narratives.

In 2024, key narratives like Decentralized Physical Infrastructure Networks (DePIN) and memecoins have captured the market’s attention. These themes make the crypto space more accessible to a broader audience by reducing the complexity often associated with blockchain technologies.

Narratives shape public perception, guide investment flows, and influence the broader trajectory of the cryptocurrency industry. However, they can also be misleading, fueled by hype or misinformation. Evaluating narratives critically and basing decisions on solid research is essential for avoiding pitfalls.

Below, we explore the top crypto narratives gaining momentum in 2024 and beyond.

Top Crypto Narratives for 2025

1. Memecoins

Memecoins remain one of the most profitable narratives, with expectations for a potential “memecoin supercycle”. Tokens like SPX6900 and Gigachad led the list of top gainers in Q3 2024. For instance, GOAT, the first token launched on Pump.fun, achieved a $1 billion market cap.

Memecoins are community-driven and thrive on virality. They often lack utility at launch but attract attention due to their affordability and entertainment value. In 2024, platforms like Pump.fun on Solana simplified the process of creating memecoins, democratizing token launches for non-technical users.

At the time of writing, Solana and Base are the leading chains for memecoin activity.

2. Prediction Markets

Prediction markets allow users to bet on event outcomes using crypto by purchasing “yes” or “no” shares. Popular platforms like Polymarket have seen significant growth, with high-profile categories such as the U.S. Presidential Election 2024 driving over $732 million in volume.

3. Liquid Restaking Tokens

Restaking enhances capital efficiency by enabling staked tokens to secure multiple protocols simultaneously. Pioneered by EigenLayer, restaking allows users to earn additional rewards by staking assets like stETH, rETH, and cbETH. At present, EigenLayer’s TVL exceeds 3.5 million ETH.

4. Liquid Staking Derivatives (LSDs)

LSDs unlock liquidity for staked assets while generating yield. These derivatives allow stakers to use locked tokens for DeFi activities, solving capital inefficiency issues. Major players in this space include platforms like Lido and Rocket Pool. LSDs enhance accessibility, security, and network stability.

5. Blockchain Modularity

Modular blockchains break down functionality into distinct layers (execution, settlement, consensus, and data availability), enabling scalability and flexibility. Examples include Layer 2 solutions like Optimism and Arbitrum, which batch transactions before settlement on Ethereum. Layer 1 networks like Celestia focus on specific modular components, optimizing scalability and performance.

6. Layer 1 Blockchains

Layer 1s remain critical for on-chain transactions and decentralized applications. New L1 networks are addressing issues like scalability and high fees. Notable examples include:

- Solana: Dominates the memecoin narrative with low fees and high speed.

- Sui: Focuses on scalability and cost-effectiveness for dynamic applications.

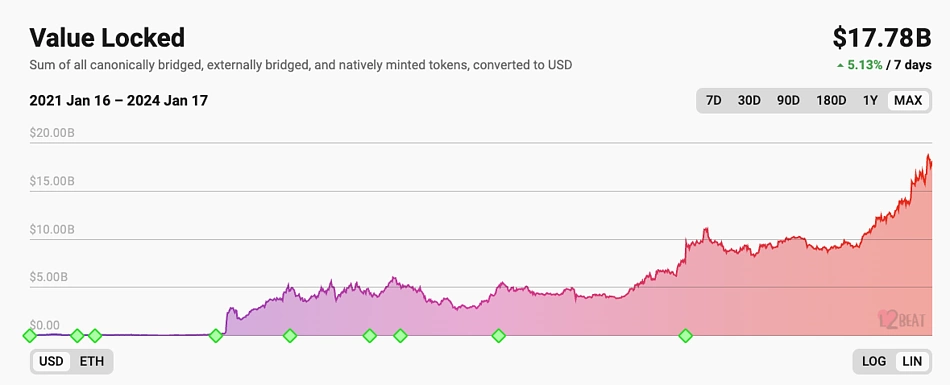

7. Layer 2 Scaling Solutions

Layer 2s enhance scalability for Layer 1 blockchains by processing transactions off-chain.

- Optimistic Rollups: Solutions like Optimism and Arbitrum reduce fees and improve throughput.

- ZK Rollups: Zero-knowledge proofs offer privacy and scalability. Platforms like zkSync Era and Polygon zkEVM are at the forefront of this technology.

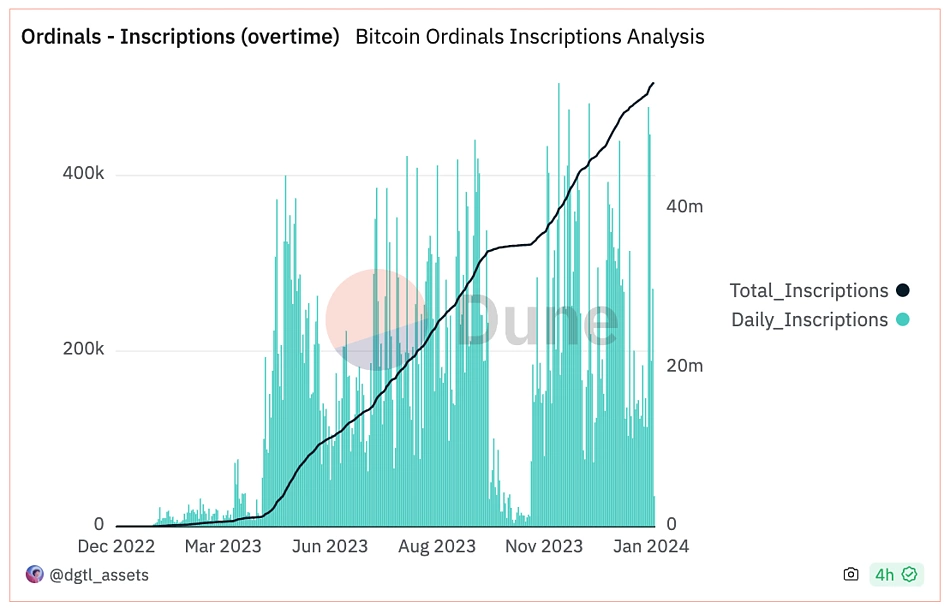

8. Bitcoin Innovations

Bitcoin narratives include:

- Ordinals and NFTs: Taproot-enabled NFTs inscribed directly on-chain.

- BRC-20 Tokens: Mimic ERC-20 functionality on Bitcoin, with growing interest in fungible token applications.

- Layer 2 Projects: The Lightning Network and Rollups like Merlin are scaling Bitcoin for broader utility.

9. Decentralized Physical Infrastructure Networks (DePIN)

DePIN uses blockchain incentives to build real-world infrastructure across industries like wireless connectivity and energy. These networks provide cost-efficient alternatives to centralized systems while rewarding participants for resource contributions.

10. Real World Assets (RWAs)

RWAs bridge traditional finance and DeFi by tokenizing physical assets like real estate and commodities. Platforms like MakerDAO and Ondo Finance showcase how RWAs can generate sustainable yields and align DeFi with traditional markets.

11. Telegram Trading Bots

Telegram bots streamline crypto trading by automating wallet interactions and enabling features like liquidity sniping. These tools have gained popularity for their convenience and efficiency, with several bots dominating niche trading ecosystems.

Conclusion

In 2023, narratives like AI, decentralized social media, and Chinese tokens gained traction. As we move into 2024 and beyond, emerging trends like restaking, DePIN, modular blockchains, and real-world assets will shape the crypto landscape. Understanding and critically evaluating these narratives can help market participants navigate the evolving ecosystem with confidence.

Leave a comment