Bitcoin Hits $100K, But Whale Sell-Off Casts a Shadow on Rally

Once again, Bitcoin whales are selling the cryptocurrency in huge amounts. Concerns regarding Bitcoin’s capacity to sustain this crucial milestone are raised by the selling pressure spike that occurs in tandem with the cryptocurrency’s return to $100,000. Should this occur, it may postpone the many forecasts that Bitcoin will get close to $125,000.

BTC Net Flow Drops to -3,960 BTC: What’s Next for Bitcoin’s Price?

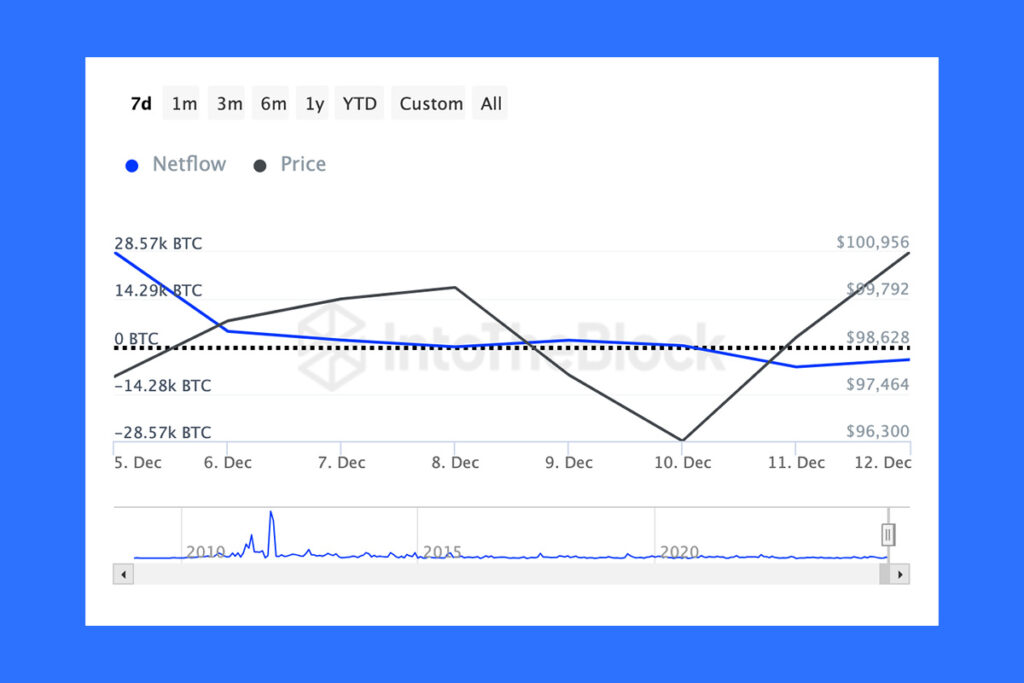

Bitcoin‘s large holders’ net flow, which measures the net purchasing or selling by addresses that control more than 1% of the circulating supply, has changed significantly over the previous week, according to data from IntoTheBlock. When Bitcoin was worth $97,885 a week ago, the net flow was 28,570 BTC.

But now, things are different. The net flow is currently down to -3,960 BTC. At the current price of $101,537 for Bitcoin, this negative net flow corresponds to whale sales of about $400 million. This implies that major Bitcoin holders are under a great deal more pressure to sell. This might cause the price of Bitcoin to decline in the days ahead if it persists.

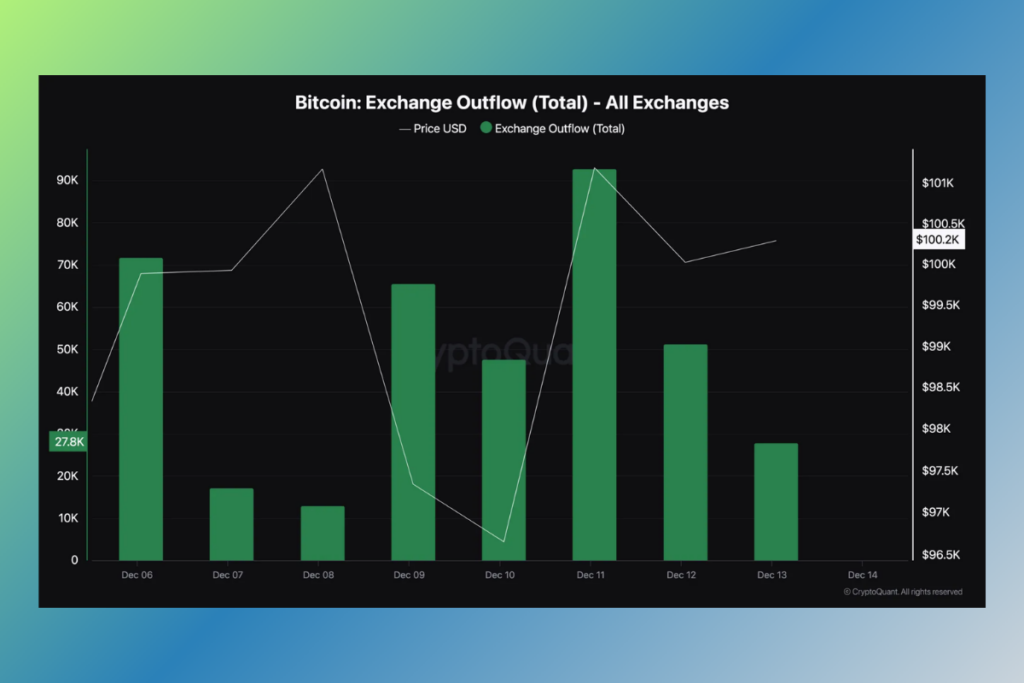

This theory is supported by the overall Bitcoin exchange outflow. The quantity of coins transferred from centralized platforms to external self-custody wallets is known as exchange outflow. The majority of holders do not intend to sell when the metric increases. On the other hand, a decline suggests that HODLing has decreased, which can have a negative impact on the price. The outflow from the Bitcoin exchange has slowed since its peak on December 11, according to CryptoQuant. The price of Bitcoin may be in danger of falling below $100,000 once more if this trend keeps up.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment