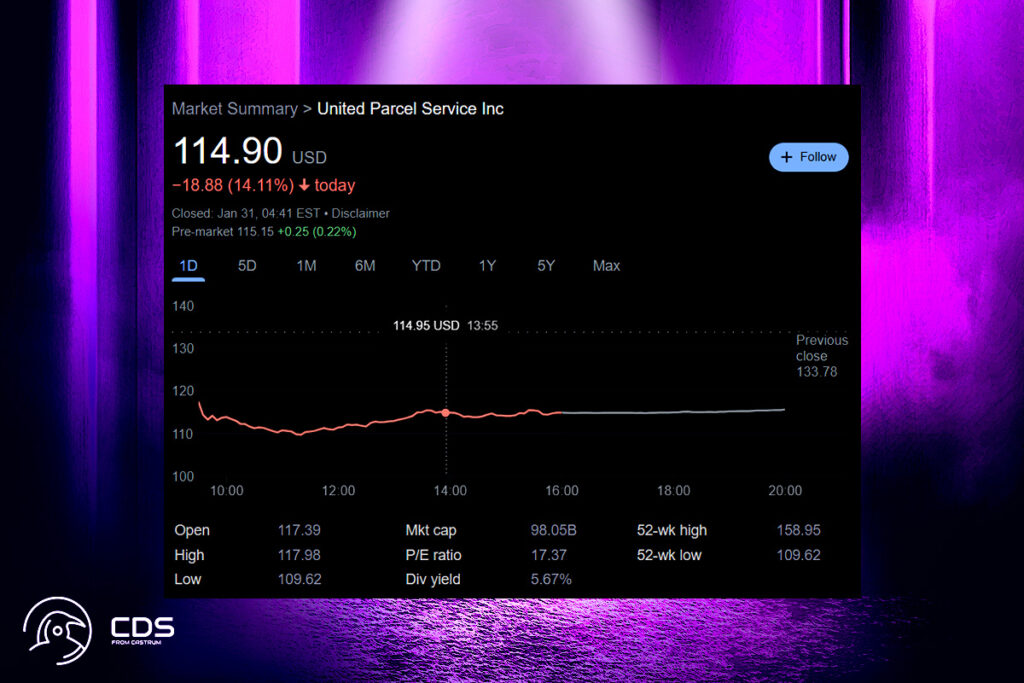

UPS Shares Plunge as Amazon Reduces Volume Agreement by Over 50%

After the package transportation giant UPS released poor fourth-quarter statistics and full-year revenue guidance that fell well short of expectations, its shares dropped 17.6% in the morning session. Concerns were raised when UPS revealed a deal with Amazon, its biggest client, to reduce volume by more than 50% by the second half of 2026. This might potentially hinder UPS’s ability to develop in the future. However, the fact that United Parcel Service exceeded analysts’ EPS projections this quarter was positive.

UPS Experiences Unusual Volatility as Investors React to Weak Projections

The shares of United Parcel Service are not very erratic. In the past year, there have only been three swings of more than 5%. This kind of action is uncommon for United Parcel Service, and it shows that the market’s opinion of the company was greatly affected by the news. The largest change in the past year occurred six months ago when the stock fell 13.5% in response to the company’s second-quarter earnings announcement. Its sales were below Wall Street’s projections, and its EPS was missed.

Given that the company somewhat reduced its full-year revenue projection, the picture was not promising. Additionally, it significantly reduced the full-year operating margin projection. All things considered, United Parcel Service had a disappointing quarter.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment