Breaking Crypto News – What is the Purpose of the Uniswap Foundation Fee Mechanism Proposal?

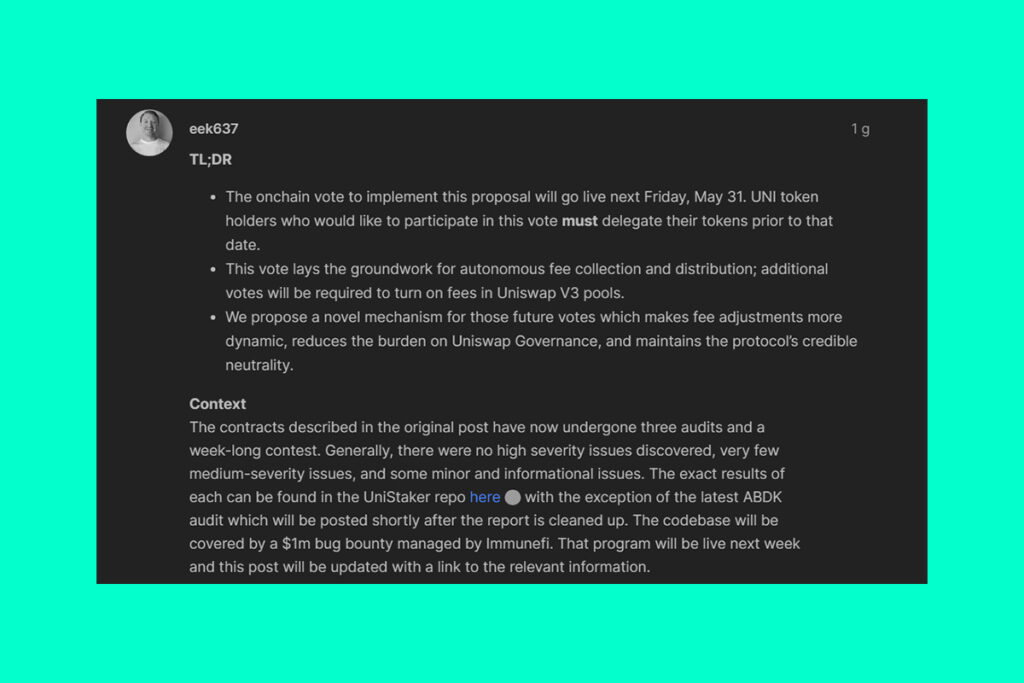

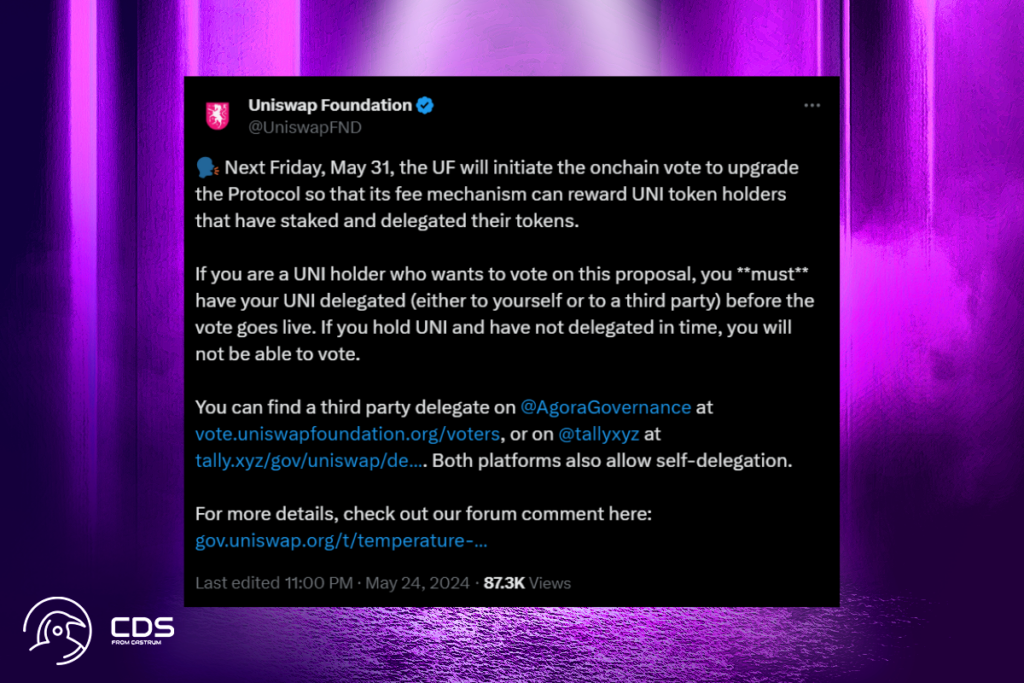

Breaking Crypto News – The Uniswap Foundation declared that by May 31, there will be on-chain voting for a proposal to create a new fee mechanism. The network’s native token, UNI, has gained more than 20% in value as a result of this statement. In order to establish autonomous charge collection and distribution in Uniswap V3 pools, the Uniswap Foundation delineated a critical step.

If passed, this proposal would transfer ownership of the mainnet UniswapV3Factory to a newly deployed instance of V3FactoryOwner. This vote will not turn on fees; that will be accomplished in a future proposal,

the Foundation

The Proposal is Expected to Increase Participation in the Ecosystem

To encourage more people to participate in governance, the Uniswap Foundation suggested in February a fee reward system for holders of UNI tokens. Though the US Securities and Exchange Commission (SEC) may file legal objections against the DeFi protocol, initial answers indicated a substantial level of support for the concept.

Liquidity providers (LPs), which provided assets to the platform, received all fees earned by Uniswap in the past. Stakeholders of delegated and staked UNI tokens will split protocol fees according to the new model. Thus, the proposal encourages involvement within its ecosystem.

FAQ

What is the Uniswap v3 Pool?

With the introduction of concentrated liquidity by Uniswap V3, liquidity providers (LPs) can focus their funds within particular price ranges. By using this capability, LPs can reduce capital inefficiencies by offering more focused liquidity.

What are Liquidity Providers?

Providers of liquidity play a crucial role in the market by promoting price stability, reducing volatility, lowering spreads, and lowering trading costs. The provision of liquidity to various segments of the financial markets is facilitated by banks, financial institutions, and trading organizations.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment