TRX Price Action Stalls: Tron Slides Back to $0.22–$0.27 Range After Holiday Sell-Off

AMBCrypto’s analysis indicates that Tron (TRX) has retracted the majority of its Q4 2024 gains. It rose to $0.44 after topping a 180% rise in early December. The holiday sell-off wiped out the majority of TRX’s gains, and as of the time of writing, it has not shown a strong recovery. Swing traders can profit from the range of lows and highs because TRX has been trapped in the $0.22–$0.27 price range since January 2025.

Given the probable cautious sentiment ahead of the FOMC meeting next week, the sideways pattern may continue to expand over the coming days. Technically speaking, TRX might continue to be limited in a volatile market due to the mixed CMF readings, which showed modest capital inflows, and the flat RSI, which indicated muted demand.

USDD 2.0 Fuels Investor Trust as Tron Adds Millions of Active Addresses

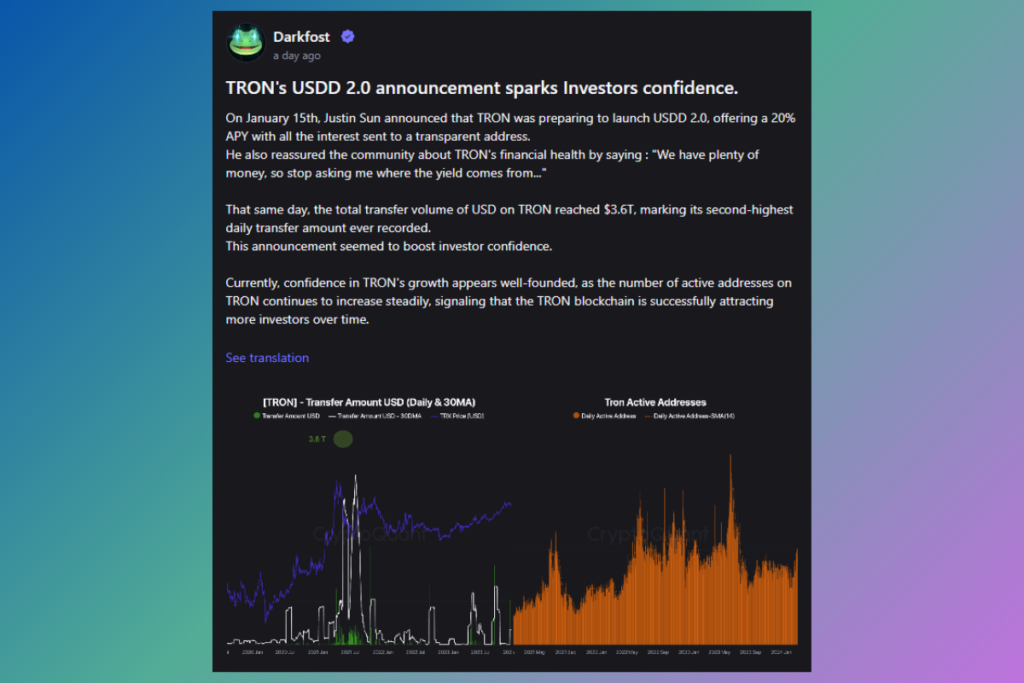

Over 2 million people have joined Tron’s network, a move that CryptoQuant analyst DarkFost attributes to heightened investor trust in the chain, particularly with the introduction of its high-yield stablecoin USDD 2.0. The expert went on to say that on January 15, Tron witnessed a $3.6 trillion transfer, highlighting the chain’s robust network expansion.

Currently, confidence in TRON’s growth appears well-founded, as the number of active addresses on TRON continues to increase steadily, signaling that the TRON blockchain is successfully attracting more investors over time.

DarkFost

All things considered, a tight consolidation seems to be the short-term price prognosis. The almost similar liquidity levels between $0.22 and $0.26 further supported this. Both sides of the price action may have an impact on Tron‘s movements in the event of a liquidity sweep.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment