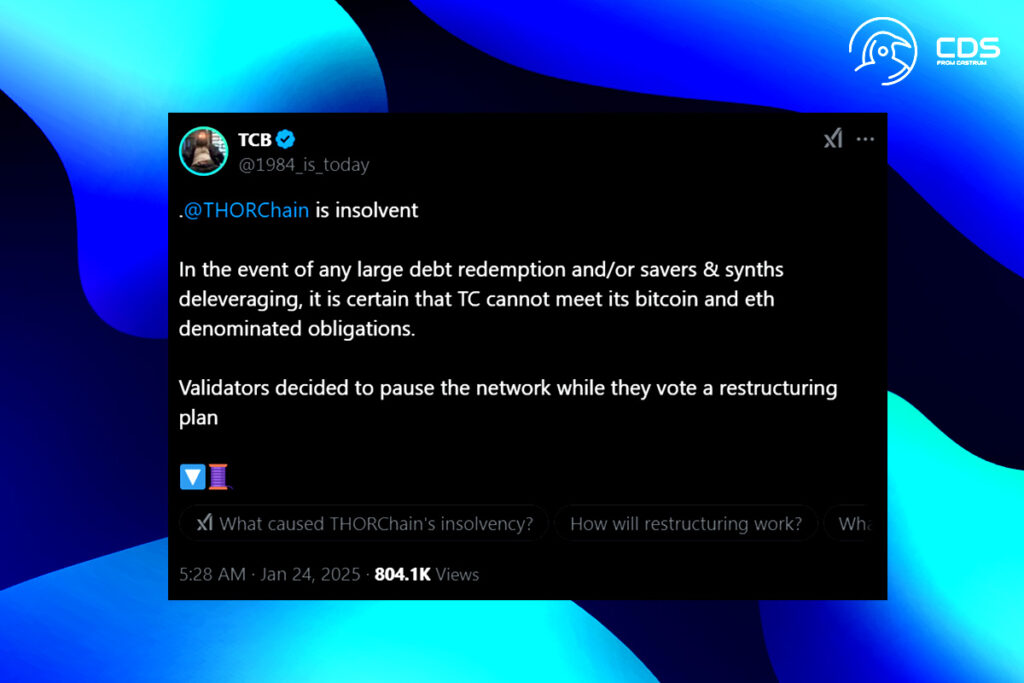

THORChain Pauses Key Withdrawals: 90-Day Pause to Mitigate Insolvency Risks

To reduce the danger of insolvency, the inter-blockchain settlements protocol THORChain suspended the withdrawal of bitcoin (BTC) and ether (ETH) from its lending and savers programs. According to postings from THORChain’s Telegram groups, network node operators suggested and carried out a 90-day stop in early Asian hours on Friday in order to devise a strategy for debt resolution. However, the primary function of THORChain, cross-chain exchanges, is unaffected. Users are still able to use liquidity pools and conduct swaps without any problems.

THORChain’s Loan Program Faces Insolvency Risk Amid RUNE Market Volatility

Although THORChain‘s saving vaults accept other assets, its loan program exclusively accepts Bitcoin and Ethereum. If all loans and savers’ positions were closed and returned at precisely the same time, and if market sentiment also contributed to a sharp drop in RUNE, this may potentially result in insolvency.

By minting RUNE and reselling it into liquidity pools, THORChain fulfills its lending commitments. As a result, a year ago, deposits were stopped because the community was growing more and more worried about the risk. Almost $200 million in liabilities are alleged by some community members. In the event of a panic, liquidity providers (LPs) or RUNE holders may withdraw or sell the approximately $107 million that is contained in liquidity pools.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment