In the dynamic world of cryptocurrencies, “alt-season” marks an exhilarating period when alternative cryptocurrencies (altcoins) take center stage, often stealing the limelight from Bitcoin. These phases typically emerge following Bitcoin’s dramatic price rallies, as investors seek promising assets with the potential for explosive growth.

As 2024 draws to a close, all signs suggest that the next alt-season is upon us. From growing institutional interest to advancements in blockchain technology and increasing real-world use cases for altcoins, the conditions appear ripe for a new wave of opportunity. For savvy investors, this could be the moment to ride the next big wave in crypto history.

A Historical Glimpse at Alt-Seasons

Studying previous alt-seasons can provide valuable insights into the factors driving these phenomena. By analyzing the events of 2017–2018 and 2021, clear patterns and lessons emerge that can help anticipate future trends.

The 2017–2018 Alt-Season

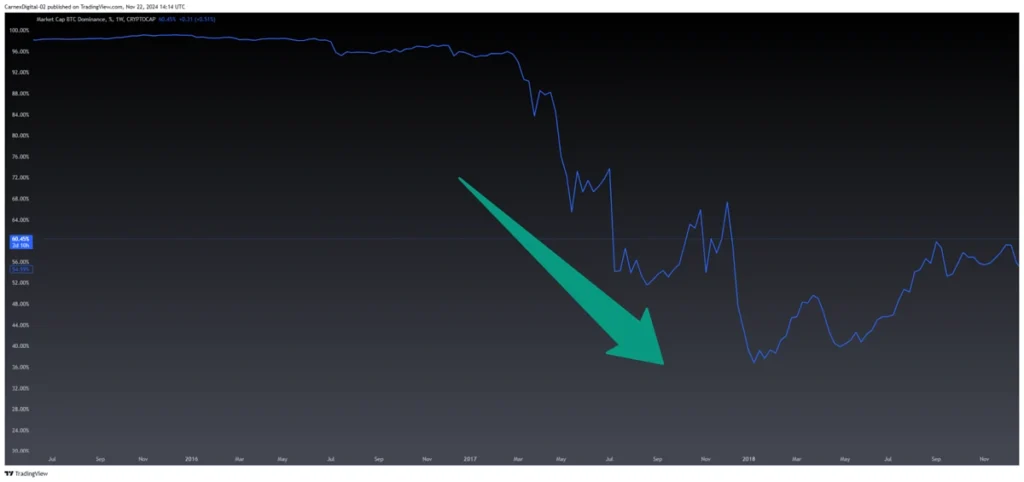

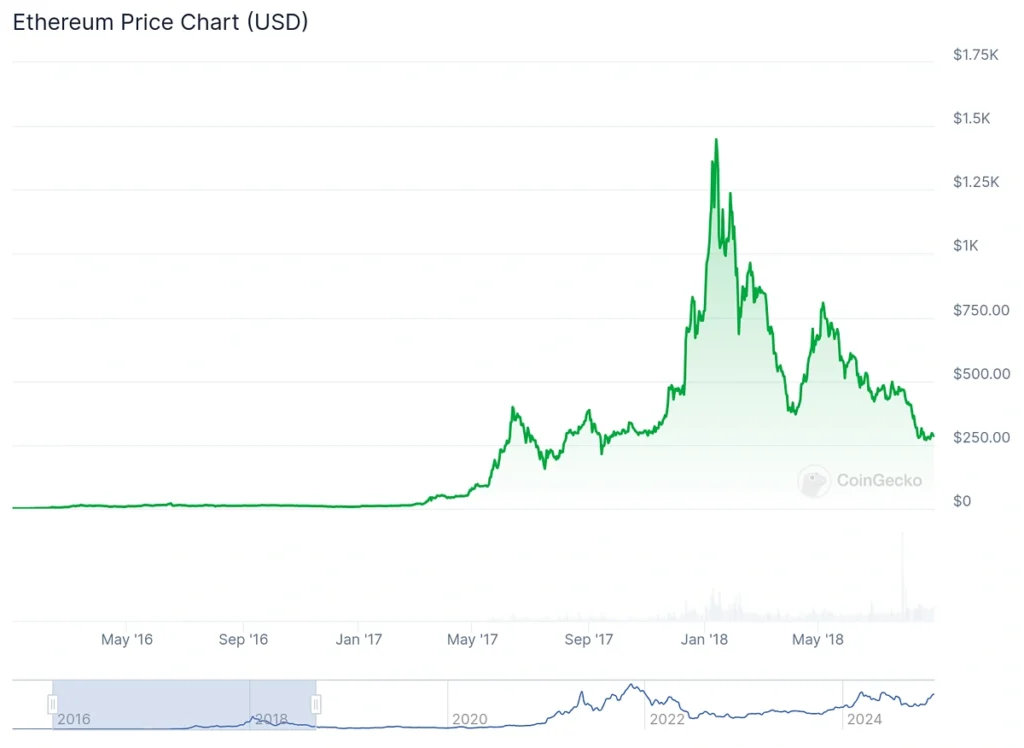

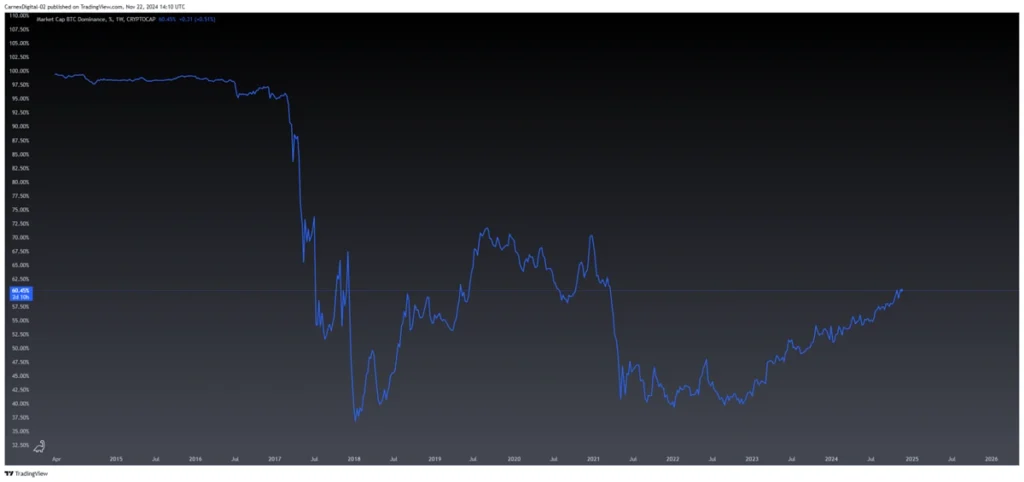

This cycle was dominated by the ICO (Initial Coin Offering) craze, as numerous blockchain projects launched tokens to raise capital. During this period, Bitcoin’s dominance plummeted from approximately 86% in late 2017 to just 39% by early 2018. This decline coincided with an altcoin market capitalization surge from around $30 billion in early 2017 to over $600 billion by January 2018.

- Ethereum (ETH): The go-to platform for ICOs, Ethereum soared from $8 in January 2017 to over $1,400 by early 2018. Its smart contract capabilities were a major driver of this growth.

- Ripple (XRP): XRP surged from $0.006 to over $3 in the same period, bolstered by partnerships with major financial institutions focused on cross-border payments.

- Litecoin (LTC): Often considered the “silver to Bitcoin’s gold,” Litecoin rose from $4 to nearly $350 by the end of 2017.

While enthusiasm for blockchain technology drove the market to unprecedented heights, it also led to an oversaturation of ICOs, many of which lacked viable use cases. The resulting market correction in early 2018 served as a cautionary tale about speculative excess.

The 2021 Alt-Season

In 2021, alt-season was characterized by rapid gains in DeFi platforms and NFTs. Bitcoin’s dominance once again fell, as investors flocked to altcoins offering innovative financial solutions and digital collectibles.

- Solana (SOL): The standout performer, Solana, grew from $1.60 to over $250 within the year, driven by its scalability and low transaction costs.

- Avalanche (AVAX) and Polygon (MATIC): These projects saw exponential growth as investors sought Layer 1 and Layer 2 scalability solutions.

- Utility-Based Tokens: Unlike the speculative frenzy of 2017–2018, this cycle saw projects like Uniswap (UNI) and Aave (AAVE) thrive, reflecting a maturing market that prioritized real-world use cases.

These alt-seasons highlight the importance of technological innovation and investor enthusiasm in driving market dynamics, but they also underscore the risks of speculative bubbles.

Signs of a New Alt-Season

As November 2024 winds down, several indicators suggest that a new alt-season is on the horizon:

- Bitcoin Dominance Drops: Bitcoin’s market share has declined from 55% in early November to around 50%, signaling a shift toward altcoins.

- Trading Volume Surges: Exchanges like Binance and Coinbase report sharp increases in altcoin transaction volumes.

- Macroeconomic Support: Central banks’ dovish stances and falling inflation have created a favorable environment for risk assets, including cryptocurrencies. The recent 50-basis-point rate cut by the Federal Reserve has injected liquidity into global markets, further boosting interest in speculative assets.

- Regulatory Clarity: Frameworks like the EU’s MiCA regulation have reduced uncertainty, encouraging institutional participation.

Social media platforms, including X (formerly Twitter) and Reddit, have also amplified the buzz, with the hashtag #AltSeason2024 trending globally. Mid-cap altcoins have seen trading volumes increase by 28% in just two weeks, signaling growing retail and institutional interest.

Emerging Trends Shaping This Alt-Season

Unlike past cycles driven by speculation, the 2024–2025 alt-season seems poised to focus on utility and innovation:

- Layer 2 Solutions: Projects like Arbitrum (ARB) and Optimism (OP) are gaining traction as they address Ethereum’s scalability challenges.

- AI-Driven Tokens: Platforms like Fetch.ai (FET) are blending artificial intelligence with blockchain, unlocking new possibilities in data monetization and predictive analytics.

- Cross-Chain Technologies: Polkadot (DOT) and Cosmos (ATOM) are tackling interoperability issues, paving the way for a more connected blockchain ecosystem.

- Decentralized Identity: Solutions like Worldcoin and Civic (CVC) aim to revolutionize digital identity management.

- Decentralized Storage: Filecoin (FIL) and Arweave (AR) are challenging traditional cloud storage providers, offering decentralized alternatives.

The Memecoin Resurgence

Memecoins are also making a comeback, fueled by strong community engagement and viral marketing campaigns:

- Dogecoin (DOGE): Once a joke, DOGE continues to capture attention, recently bolstered by Elon Musk’s ongoing influence.

- Shiba Inu (SHIB): With the launch of ShibaSwap and the Shibarium network, SHIB has enhanced its transactional efficiency and scalability.

- Emerging Stars: New entrants like Brett (BRETT) and Yeti Ouro are gaining traction with innovative features like staking rewards and gamification.

Opportunities and Risks

While the opportunities in this alt-season are immense, so are the risks:

- Bullish Outlook: Institutional inflows, technological advancements, and favorable macroeconomic conditions could propel altcoins to new heights. Ethereum’s Proto-Danksharding upgrade, for instance, could further drive DeFi adoption and Layer 2 solutions.

- Bearish Concerns: Regulatory overreach, speculative excess, or macroeconomic shocks could dampen growth.

Is Now the Time to Dive In?

The evidence suggests that a new altcoin season is underway, with numerous projects poised to capitalize on innovation and market demand. However, the volatile nature of cryptocurrencies necessitates a cautious approach.

Investors should focus on projects with strong fundamentals, avoid chasing hype, and stay informed about market developments. As always, never invest more than you can afford to lose. The cryptocurrency market remains a high-risk, high-reward arena—one that could redefine the future of finance.

Leave a comment