The Fate of Bitcoin Options: Key Levels & Market Sentiment You Need to Know!

On Friday, February 14, 21,300 contracts for Bitcoin options with a notional value of about $2 billion will expire. Despite the constant flow of positive news coming out of the US, the spot markets have been lackluster, and this week’s expiry event is a little smaller than last week’s, which had no effect.

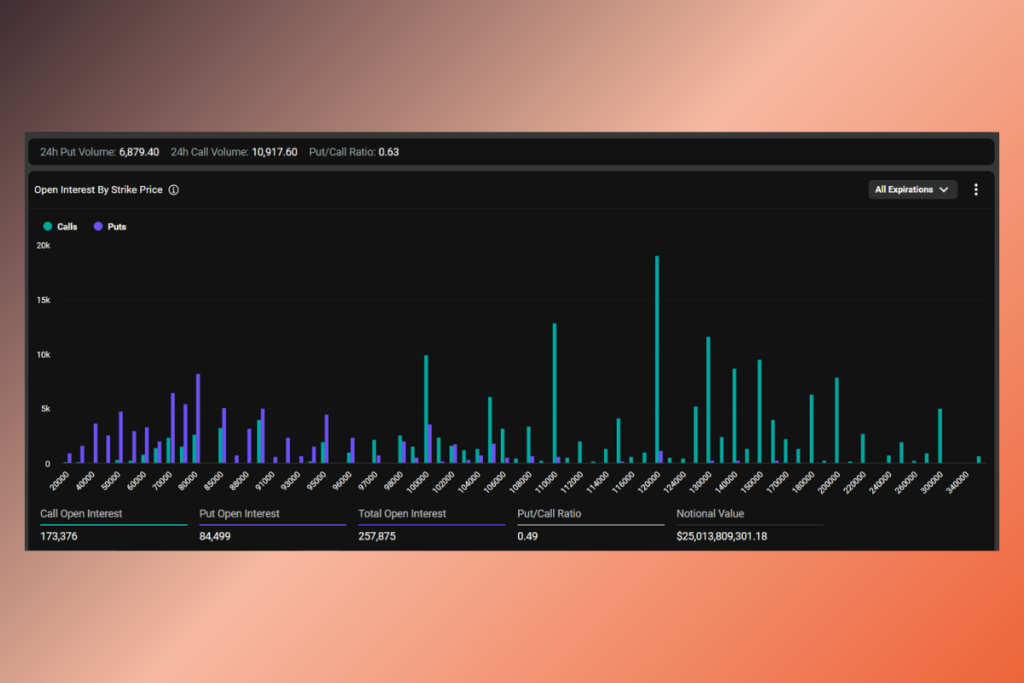

This week’s Bitcoin options contracts have a put/call ratio of 0.67, which indicates that there are marginally more call (long) contracts than puts (short). $98,000 is the maximum pain point, or the price at which the majority of losses will transpire. According to Deribit data, the strike price of $120,000 has the most open interest (OI) at $1.8 billion, followed by $110,000 at $1.2 billion. This implies that traders continue to place bets on Bitcoin’s price rising over time.

Greeks Live Warns of Weak Market Ahead as Crypto Options Expire

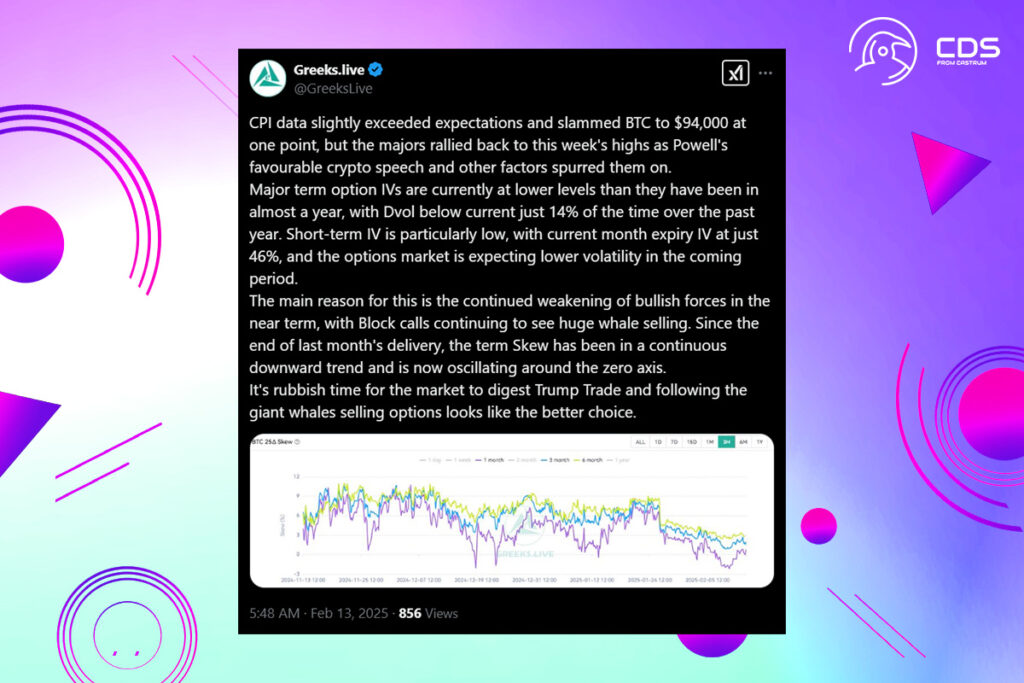

Greeks Live, a provider of cryptocurrency derivatives, stated earlier this week that a minor overabundance of this week’s CPI data caused a decline in the market.

Market sentiment maintained a weak consolidation this week, with Implied Volatility falling to its lowest level in almost a year, despite multiple positive news from the U.S. government side. Short-term IV is particularly low, with current month expiry IV at just 46%, and the options market is expecting lower volatility in the coming period. The main reason for this is the continued weakening of bullish forces in the near term,

Greeks

Approximately 176,000 Ethereum contracts with a notional value of $470 million, a put/call ratio of 0.64, and a maximum price of $2,765 are also expiring in addition to the Bitcoin options tranche today. This raises the total notional value of crypto options expiring on Friday to about $2.5 billion.

Institutions generally agree that February is going to be a junk time with no market, and indeed, the market looks like it is really lacking in hot spots and money,

Greeks

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment