Strong Revenue Growth Propels The AI Leader Palantir to New Heights

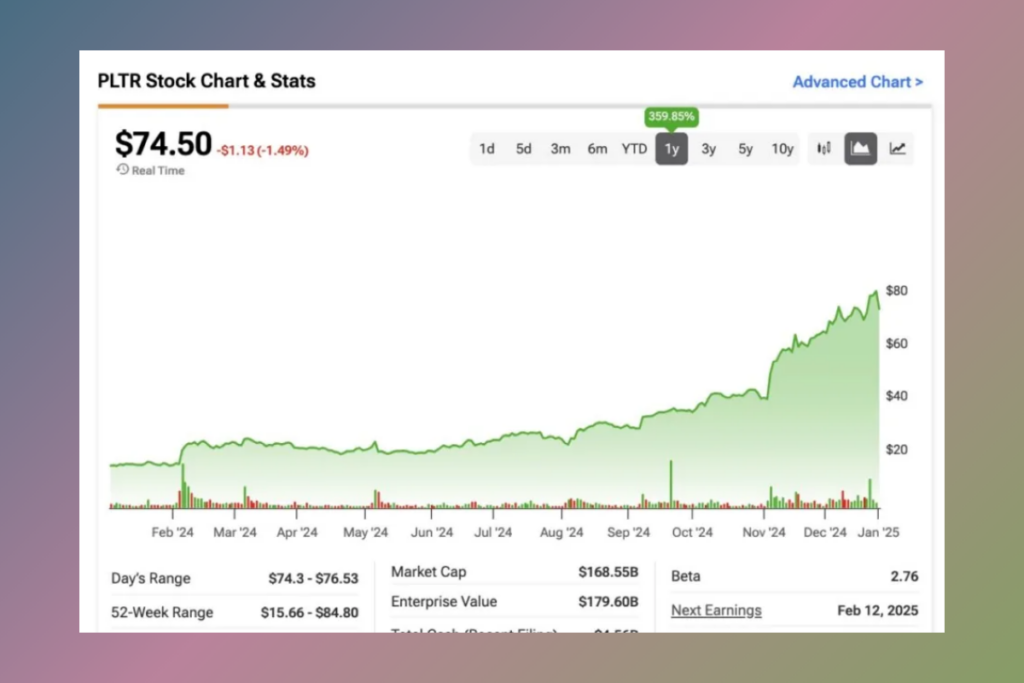

Over the past 12 months, the stock price of Palantir (PLTR) has increased by almost 360%, making it one of the most anticipated companies. Analysts think there are still compelling reasons to remain bullish despite this sharp rise. These include Palantir’s strong trend of upward guidance revisions, remarkable revenue and margin expansion, and its standing as the purest AI player in the software sector.

The AI Revolution: Why Palantir Stands Out as a Leader in Data Analysis?

The first reason I’m optimistic about Palantir in 2025 is that the business, under the leadership of CEO Alex Karp, maybe the purest AI player in the software sector. For instance, Palantir’s products are split between its commercial arm, Foundry, and its government division, Gotham. Additionally, Palantir’s Artificial Intelligence Platform (AIP) is utilized by businesses. These products are all based on data analysis powered by AI.

To put it plainly, Palantir‘s commercial business and its capacity to manage and evaluate vast amounts of intricate, frequently unstructured data from a range of sources are its main strengths. Palantir’s commercial division had a 54% year-over-year and 13% quarter-over-quarter increase in commercial revenue in Q3 due to these significant competitive advantages. Therefore, they are actual growth numbers that indicate actual demand rather than conjecture about AI’s potential at a time when it has been the most disruptive technology of the past ten years at the very least.

For more up-to-date crypto news, you can follow Crypto Data Space.

1 Comment