Tether CEO Unveils Stablecoin Multiverse: Are Governments About to Embrace Stablecoins?

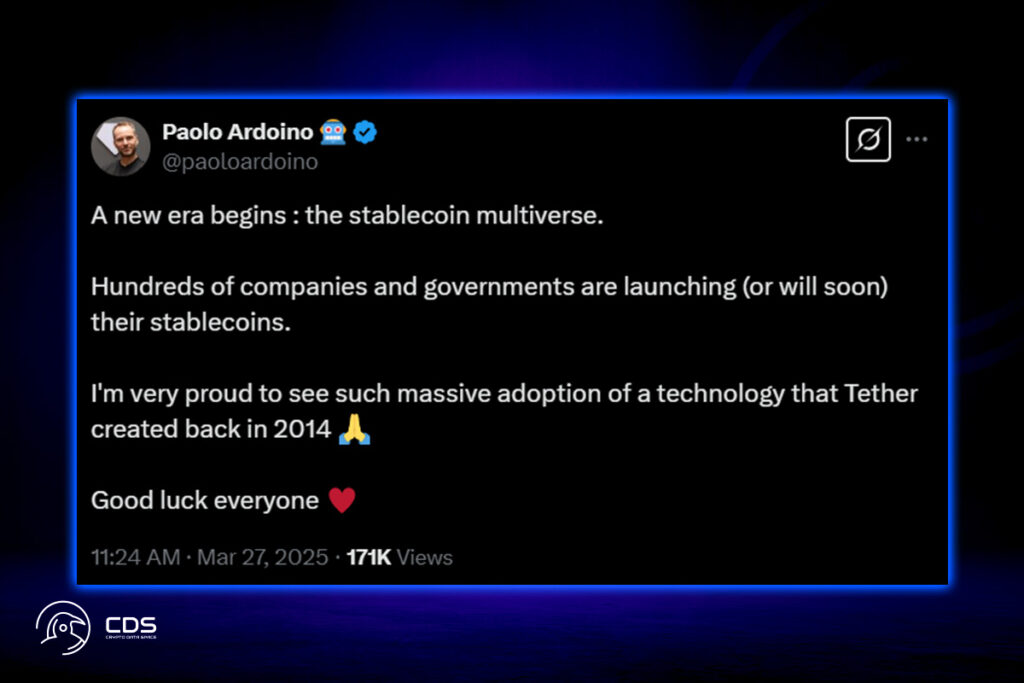

Amid the overall market collapse, Tether CEO Paolo Ardoino revealed a bold vision for the future of digital assets called the stablecoin multiverse. Ardoino has predicted the widespread adoption of stablecoins by both governmental and private entities, highlighting their increasing importance in the global financial system.

A new era begins: the stablecoin multiverse. Hundreds of companies and governments are launching (or will soon) their stablecoins. I’m very proud to see such massive adoption of a technology that Tether created back in 2014. Good luck everyone.

Ardonio

Tether CEO Declares ‘We’re Unstoppable’ as Fidelity Enters Stablecoins

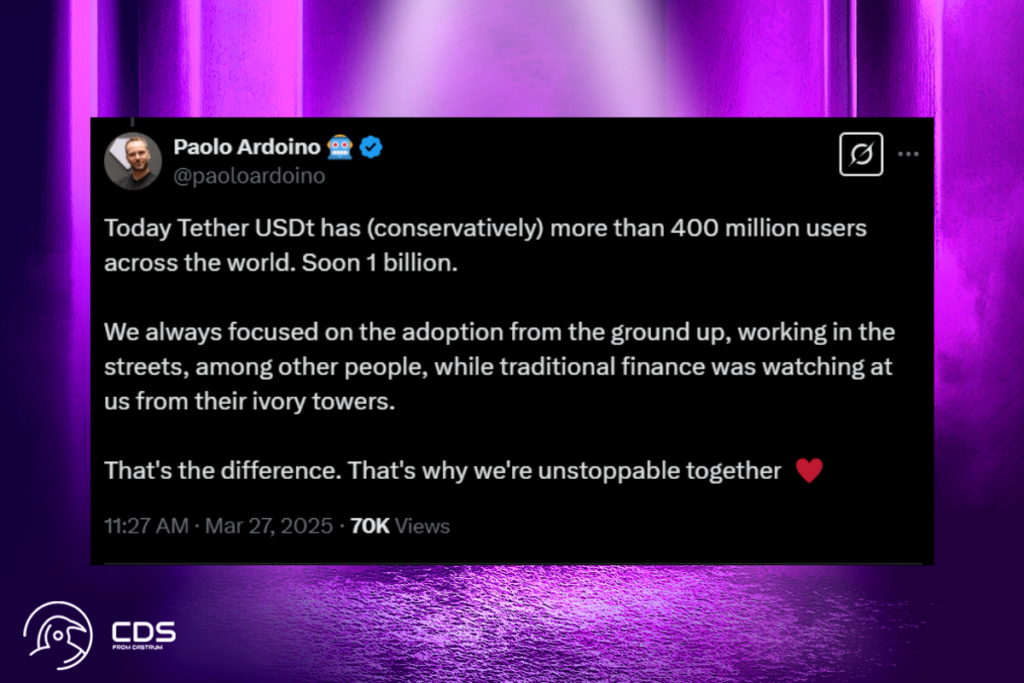

This remark came after Fidelity Investments’ most recent one. When the company announced its foray into the stablecoin market, it garnered media attention. It indicates that big banks are becoming more interested in this quickly growing industry. Leading the effort is the company’s digital assets division, which now provides execution and custody services for Litecoin, Ethereum, and Bitcoin. However, in another tweet, Ardoino added:

Today Tether USDt has (conservatively) more than 400 million users across the world. Soon 1 billion. We always focused on the adoption from the ground up, working in the streets, among other people, while traditional finance was watching at us from their ivory towers. That’s the difference. That’s why we’re unstoppable together.

USDC Hits Record $60.2B Market Cap: Is It Catching Up to USDT?

Regarding the market, Circle’s USDC has been gaining momentum quickly, most recently exceeding its previous top of $55 billion in 2022 to reach a record market cap of $60.2 billion. In the last three months, USDC has grown at a substantially faster rate than Tether’s USDT, increasing its supply by $16.6 billion as opposed to USDT‘s $4.7 billion.

Even though USDT is the market leader because of its extensive use and high liquidity, USDC is a significant rival due to its institutional alliances, fully backed reserves, and strong regulatory compliance. Nonetheless, Tether continues to lead the stablecoin market, according to Visa on-chain analytics for March 2025. Earlier today, USDT registered a transaction volume of $357.35 billion, which was a huge increase over USDC’s $207.80 billion.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment